By

- Chinese low prices thwarted efforts to shake its dominance

- Industry elsewhere has long campaigned for alternative pricing

- Sole domestic US rare earth miner aims for commercial magnet production late this year

LONDON, July 14 (Reuters) – U.S. efforts to break China’s dominance of the rare earths market and to drive investment in its own industry have moved up a gear with a Washington-backed plan to create a separate, higher pricing system.

Get the Latest US Focused Energy News Delivered to You! It’s FREE:

The West has struggled to weaken China’s grip on 90% of the supply of rare earths, in part because low prices set in China have removed the incentive for investment elsewhere.

Miners in the West have long called for a separate pricing system to help them compete in supplying the rare earths group of 17 metals needed to make super-strong magnets of strategic importance. They are used in military applications such as drone and fighter jets, as well as to power motors in EVs and wind turbines.

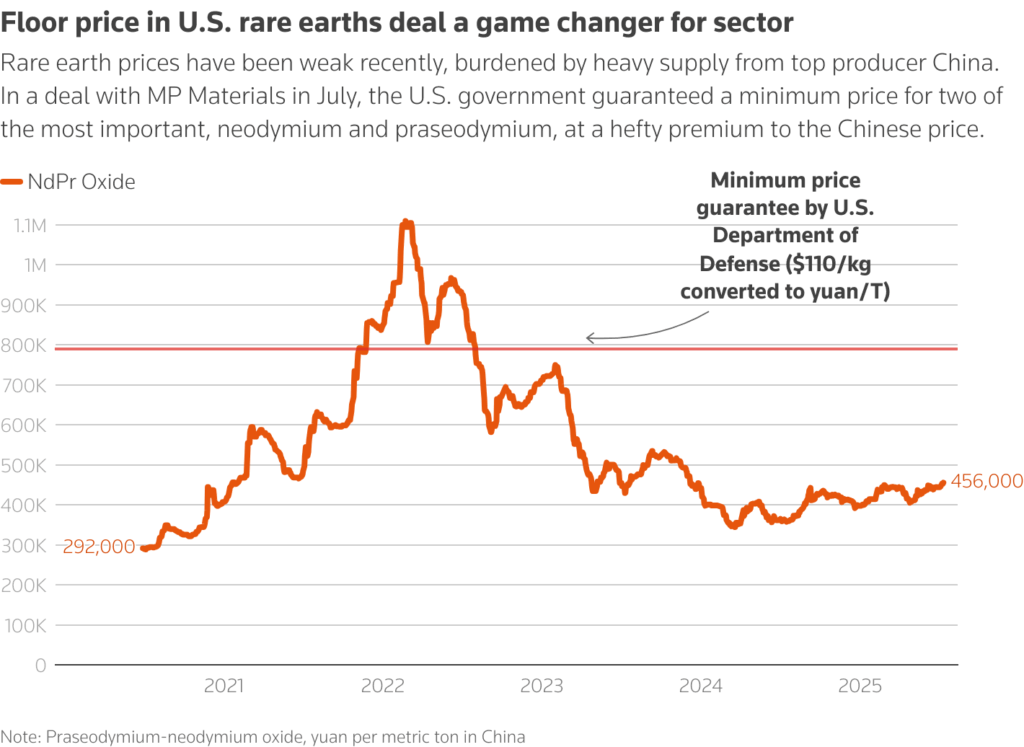

Under a deal made public last week, the U.S. Department of Defense will guarantee a minimum price for its sole domestic rare earth miner MP Materials (MP.N), at nearly twice the current market level.

Las Vegas-based MP already produces mined and processed rare earths and said it expects to start commercial magnet production at its Texas facility around the end of this year.

Analysts say the pricing deal, which takes effect immediately, should have global implications – positive for producers, but may increase costs for consumers, such as automakers and in turn their customers.

“This benchmark is now a new centre of gravity in the industry that will pull prices up,” said Ryan Castilloux, managing director of consultancy Adamas Intelligence.

The DoD will pay MP the difference between $110 per kilogram for the two most-popular rare earths and the market price, currently set by China, but if the price rises above $110, the DoD will get 30% of additional profits.

Castilloux said other indirect beneficiaries of the pricing system may include companies, such as Belgian chemicals group Solvay (SOLB.BR), which launched an expansion in April.

“It will give Solvay and others the impetus to command a similar price level. It will give them a floor to stand on, you could say,” Castilloux added.

While Solvay declined to comment, other rare earth miners, developers and their shareholders welcomed the news.

Aclara Resources (ARA.TO) is developing rare earths mines in Chile and Brazil, as well as planning a separation plant in the United States. Alvaro Castellon, the company’s strategy and development manager, told Reuters the deal added “new strategic paths” for the company.

MP’S GRADUAL OUTPUT INCREASE

MP Materials, which suffered a net loss of $65.4 million last year largely because of China’s low pricing, will build up magnet production at its Texas plant initially to 1,000 metric tons a year, later expanding to 3,000 tons a year.

Under last Thursday’s deal, the DoD will become its largest shareholder with a 15% stake and MP will construct a second rare earth magnet manufacturing facility in the U.S., eventually adding 7,000 tons per year. In total, production would be 10,000 tons a year – equalling U.S. consumption of magnets in 2024.

That does not include, however, the 30,000 tons imported by the United States already installed in assembled products, Adamas consultancy said.

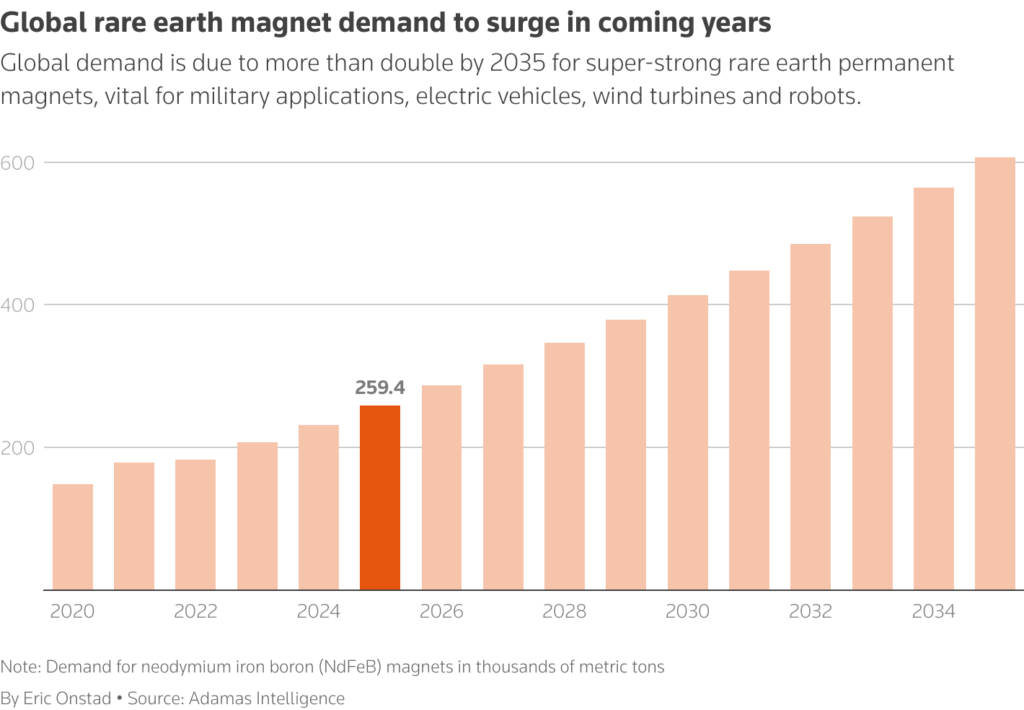

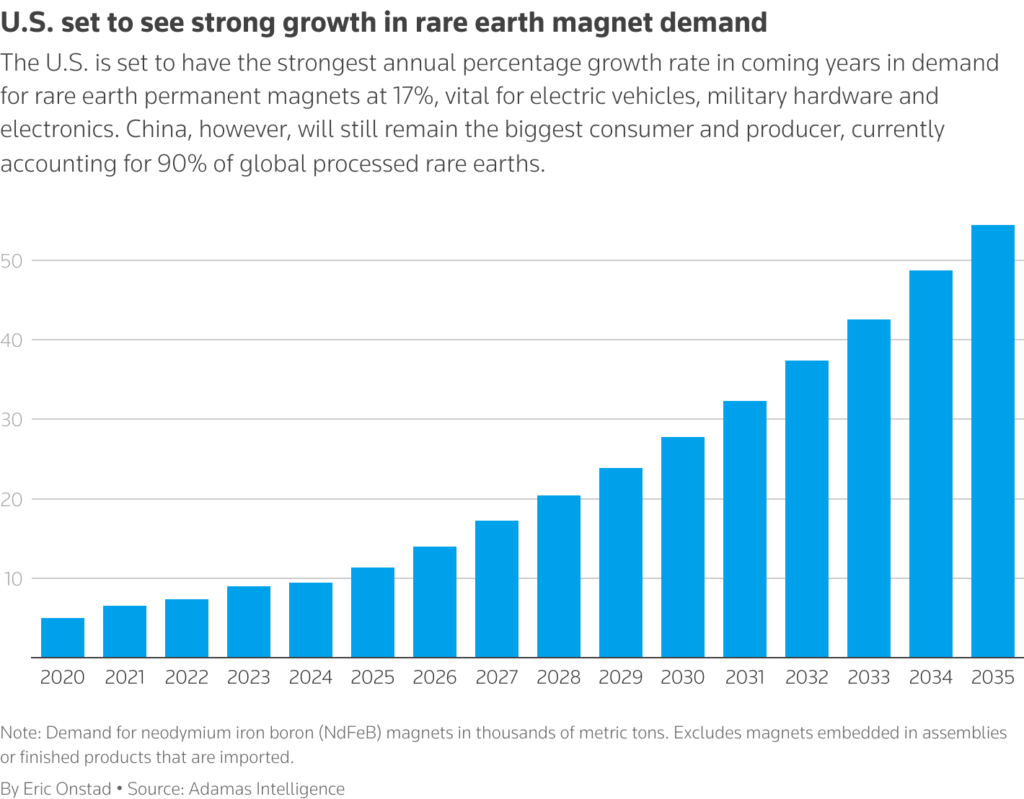

It predicts global demand for rare earth permanent magnets will more than double over the next decade to about 607,000 tons, with the U.S. seeing the strongest percentage annual growth rate in coming years at 17%.

Global demand is due to more than double by 2035 for super-strong rare earth permanent magnets

The U.S. is set to have the strongest percentage growth rate in coming years in demand for rare earth permanent magnets

The world’s reliance upon China for much of this demand was brought into focus by China’s curbs on its exports as trade negotiations continue between the United States and China.

So far Western governments have had little success in trying to help their own industries to compete.

Attempts to agree stronger pricing have been confined to piecemeal deals that set premiums for magnets.

Dominic Raab, a former deputy prime minister and former foreign secretary for the United Kingdom, said he was not surprised the Trump administration had concluded that tax breaks alone would not create the level of investment required.

“The next step is, can they scale it up?” asked Raab, now head of global affairs at Appian Capital Advisory, a private equity firm that invests in mining projects.

The $110 level for neodymium and praseodymium, or NdPr, guaranteed by the DoD is slightly above a $75-to-$105 per kg range that consultancy Project Blue reckons would be needed to support enough production to meet demand in coming years. It compares to a current level of about $63.

Many rare earth prices have been weak in recent years, burdened by heavy supply from top producer China.

David Merriman of Project Blue said it was unclear how commercial industrial consumers would respond to higher prices and whether it would make them invest in rare earths as they have more diverse supply sources.

“Major non-government backed consumers are less likely to follow this same investment pattern, however, as they are not so clearly aligned to a particular regional supply route,” he said.

A spokesperson for German auto giant Volkswagen (VOWG.DE) declined to comment on pricing when asked about the DoD floor level but said: “We welcome all efforts to strengthen long-term stability and diversification in global supply chains for critical materials.”

Reporting by Eric Onstad; additional reporting by Daina Beth Solomon in Santiago and Ernest Scheyder in Houston; Editing by Veronica Brown and Barbara Lewis

Share This:

More News Articles