July 18 (Reuters) – Top oilfield services firm SLB (SLB.N) narrowly beat Wall Street expectations for second-quarter profit on Friday, as resilient demand in parts of its international business helped offset drilling slowdown in North America, Mexico and Saudi Arabia.

SLB, the first of the Big Three U.S. oilfield services provider to report quarterly results, had previously flagged weaker drilling activity in Saudi Arabia and Latin America, with rigs demobilized and short-cycle work slowing.

Get the Latest US Focused Energy News Delivered to You! It’s FREE:

“The market is navigating several dynamics — including fully supplied oil markets, OPEC+ supply releases, ongoing trade negotiations and geopolitical conflicts,” CEO Olivier Le Peuch said in a statement.

Crude prices averaged $66.83 per barrel in the April–June quarter, down more than 21% from a year earlier.

The decline has raised concerns about a broader pullback in exploration and production spending, weighing on demand for oilfield services.

“Customers have selectively adjusted activity, prioritizing key projects and planning cautiously, particularly in offshore deepwater markets,” Le Peuch added.

Shares of the company rose 1% to $34.99 in morning trade.

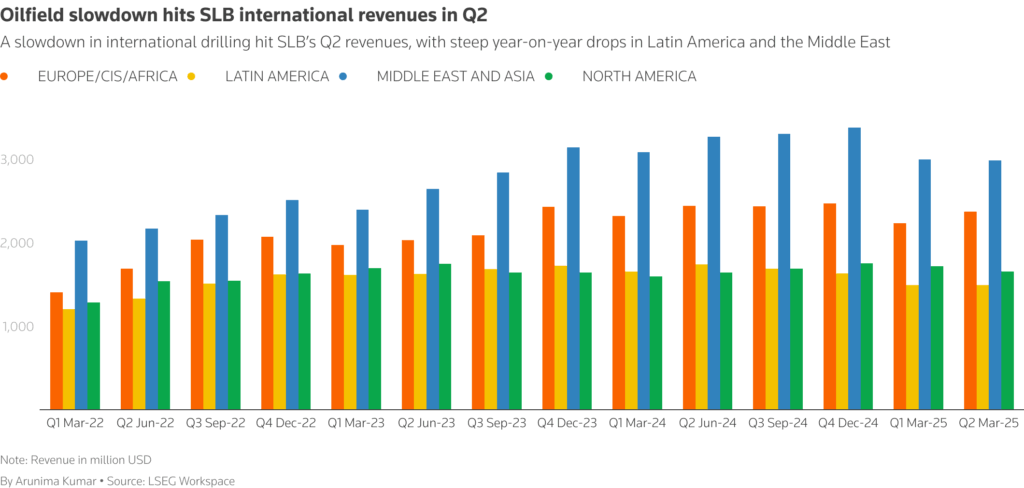

SLB said international revenue declined more than 8% in the quarter to $6.85 billion, from $7.45 billion a year ago.

That still beat analysts’ expectation of $6.77 billion, according to data compiled by LSEG.

Column chart showing SLB’s geographical revenue

The company got a boost from higher offshore activity and increased drilling demand in the UAE, Kuwait and Iraq.

Total revenue fell 6% to $8.55 billion, but beat expectation of $8.48 billion.

SLB said its second-quarter North America revenue rose 1% to $1.66 billion from last year, helped by gains in data-center infrastructure solutions.

The company posted earnings, excluding charges and credits, of 74 cents per share, for the three months ended June 30, compared with expectation of 73 cents.

Reporting by Arunima Kumar and Vallari Srivastava in Bengaluru; Editing by Sriraj Kalluvila

Share This:

More News Articles