SMA Solar Technology AG recorded consolidated sales of €684.9 million for the first half of 2025, compared to €759.3 million in the same period last year. In the Home & Business Solutions division, sales were €116.1 million—split between €54.0 million from Home Solutions and €62.1 million from Commercial & Industrial Solutions—down from €223.5 million in H1 2024 due to declining demand, competitive pressures, and price challenges.

The Large Scale & Project Solutions division posted sales of €568.8 million, up from €535.8 million in the prior year, in line with expectations.

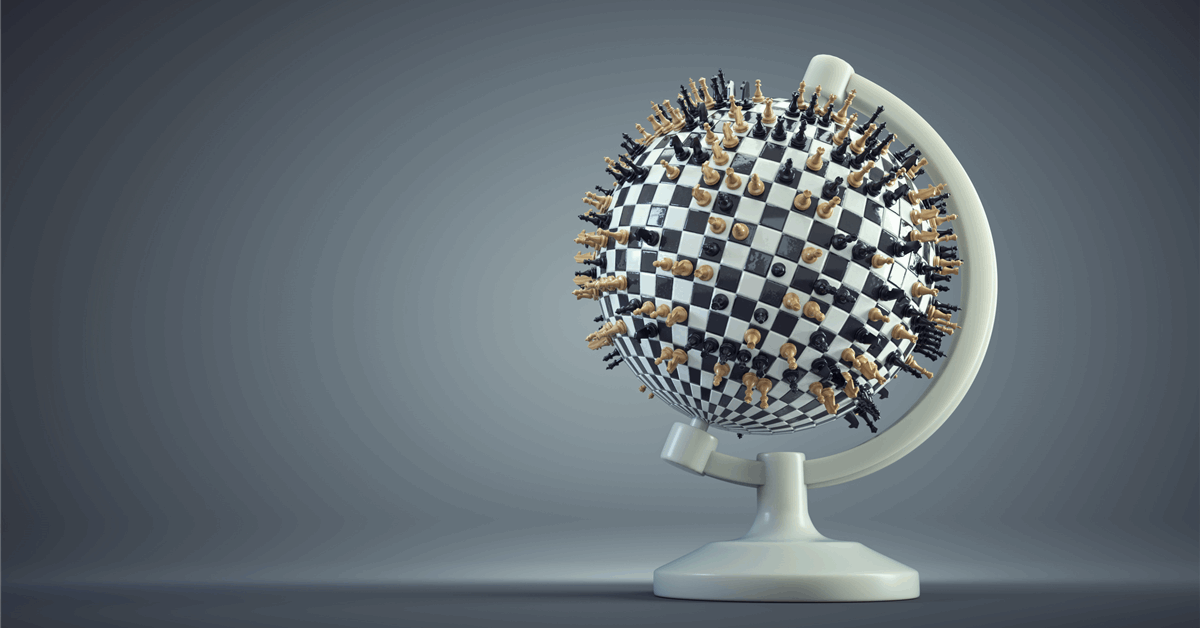

Group EBITDA was €55.1 million versus €80.6 million in H1 2024. Including one-time effects, EBITDA was €9.1 million, translating to an EBITDA margin of 1.3% (H1 2024: 10.6%). The drop was driven by lower sales in the Home & Business Solutions division and significant one-off impacts, including €50 million in inventory write-offs and purchase obligation provisions, plus €7.5 million in provisions for doubtful receivables. EBIT stood at −€19.0 million, compared to €56.2 million in H1 2024, reflecting an EBIT margin of −2.8% (H1 2024: 7.4%).

Profitability improved year-on-year in the Large Scale & Project Solutions division, with EBIT rising to €113.4 million (H1 2024: €100.5 million), supported by higher sales and productivity gains. In contrast, the Home & Business Solutions division saw EBIT decline to −€129.2 million (H1 2024: −€66.8 million), impacted by reduced sales, inventory write-offs, and purchase obligation provisions.

Subscribe to get the latest posts sent to your email.