By V and

Abu Dhabi’s main renewables company has diverted billions of dollars to AI projects instead of green hydrogen, due to a lack of buyers for the fuel once seen as key to the energy transition.

Get the Latest US Focused Energy News Delivered to You! It’s FREE:

Global demand for clean hydrogen products has fallen short of expectations while power needs from data centers have been surging, prompting Masdar to adjust course, Chief Executive Officer Mohamed Jameel Al Ramahi said in an interview.

“In my original plan, I was supposed to generate 6 gigawatts of renewables to produce around 350,000 tons of green ammonia,” said Al Ramahi, referring to a compound that includes green hydrogen. But power from the $6 billion solar project in the desert has been reallocated to feed data centers, he said.

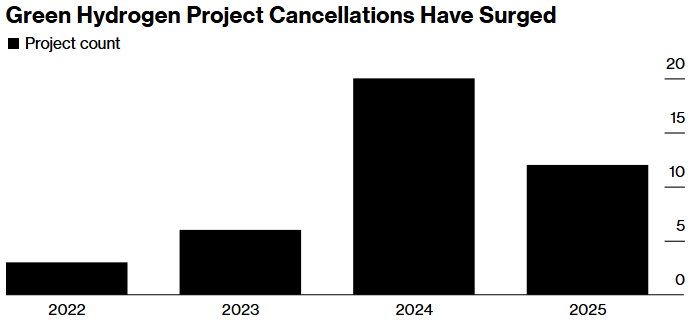

Masdar’s decision reflects the dilemma faced by developers that made a big push for green hydrogen when excitement around the fuel was at its peak. But weak demand resulting from high costs has forced companies to pull out of projects around the world, casting doubt over the future of the industry.

Read More:

“Today, green hydrogen is under pressure and the market is shrinking. A lot of people who went into this venture are out. We are not,” Al Ramahi said. “But we also need to respect global dynamics. Today, if I want to produce green ammonia, who’s going to be the offtaker?”

Source: BloombergNEF

Note: Data as of August 18, 2025.

Masdar is offsetting its sluggish green hydrogen plans against an expected boom in power consumption from energy-hungry data centers. The United Arab Emirates is embracing the latest technology by planning massive projects following US President Donald Trump’s trip to the Middle East earlier this year.

One of the world’s biggest such projects — a 5 gigawatt Stargate venture — is coming up in the UAE. Emirates Integrated Telecommunications Co PJSC, better known as Du, is planning a 2 billion-dirham ($545 million) facility of its own with Microsoft Corp.

According to Citi Research, powering the surge in the world’s data centers is expected to require over three times more energy by the end of this decade than it did in 2023. Masdar is gearing up to meet this requirement, Al Ramahi said.

“My basic business mandate isn’t hydrogen or aluminum or whatever. It is green electron capacity,” he added.

The push for green energy will contribute to Abu Dhabi’s aim to produce 60% of the emirate’s electricity from renewables and nuclear by 2035. Masdar, which has a target to reach 100 gigawatts of global renewable energy capacity by 2030, has already hit 51 gigawatts, Al Ramahi said.

Hydrogen Target

The UAE had also previously said it wanted to develop 1 million tons per year of green hydrogen by 2031 and Masdar’s decision puts that further out of its reach.

Masdar Green Hydrogen, an offshoot of Masdar, was set a target of developing 1 million tons per year of production capacity by 2030, but this has been eroded over time. The company is actively developing projects and some have been approved by its investment committee, Masdar said, without disclosing the identity of the projects.

Companies elsewhere have also struggled with green hydrogen. BP Plc decided to exit a $36 billion facility in Western Australia last month, while a developer has struggled to sell production from an under-construction facility at Neom in Saudi Arabia.

One of the few green hydrogen projects in the Middle East to enter the construction stage is being built by another Emirati state-controlled company, Fertiglobe Plc, in Egypt. In this instance, securing an offtake agreement through a mechanism backed by the German government was crucial.

Green hydrogen will only take off when its price matches so-called gray hydrogen — made from fossil fuels in a process that releases carbon dioxide into the atmosphere — Al Ramahi said. “We are working to try to produce green molecules at a competitive price,” he said. “That’s the only solution.”

(Updates with company comment in the 12th paragraph.)

Share This:

More News Articles