Oil extended a rally that has brought it to the highest in more than two months as shrinking US crude stockpiles and a risk-on tone in broader markets overshadowed signs of a misfiring Chinese economy.

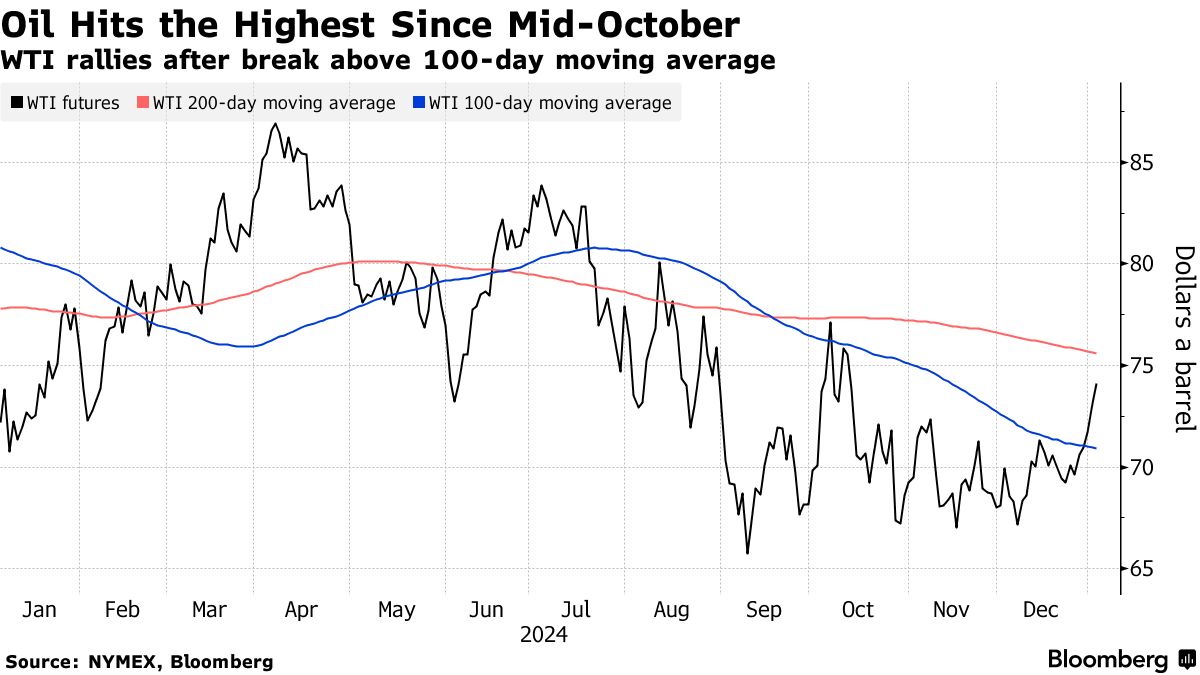

West Texas Intermediate climbed for the fifth straight session, approaching $74 a barrel and settling at the highest closing price since mid-October. A push above key technical levels earlier in the week spurred fresh buying from quantitative funds, while strength in equity markets and a slump in the dollar aided Friday’s gain.

WTI’s prompt spread firmed to about 75 cents a barrel in a sign of a tightening supply outlook.

Capping oil’s advance, the onshore yuan weakened past a level that China had been defending throughout December, fanning concerns over the nation’s economic struggles.

The outlook for 2025 remains uncertain, however, with expectations for oversupply, the possible revival of idled OPEC+ production and lackluster demand from top importer China. The return of Donald Trump to the White House later this month also adds unpredictability for global markets.

In a positive sign for prices, some Middle Eastern barrels have gained in value in recent days as a mix of robust refinery demand and disruption to flows from Iran and Russia by sanctions pushed regional values to a rare premium to the global Brent benchmark.

“Oil prices are a few dollars undervalued right now,” Daan Struyven, head of commodities research at Goldman Sachs Group Inc., said in a Bloomberg television interview. “Global energy demand will continue to rise very significantly.”

Share This:

More News Articles