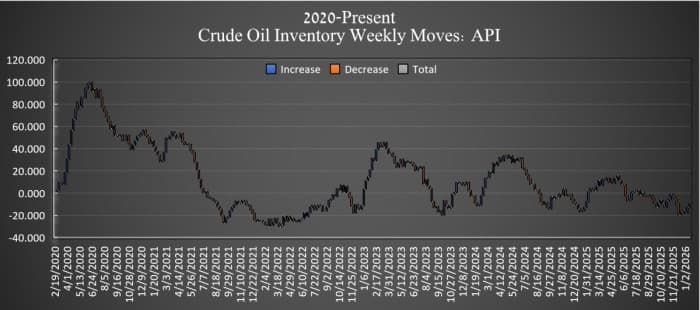

The American Petroleum Institute (API) estimated that crude oil inventories in the United States saw a build of 3.04 million barrels in the week ending January 16. Crude oil inventories increased by 5.27 million barrels in the week prior.

Inventories in the US Strategic Petroleum Reserve (SPR) keep climbing week after week. The Department of Energy (DoE) reported that crude oil inventories in the SPR rose by 800,000 barrels to 414.5 million barrels in the week ending January 16. This is 311 million barrels shy of maximum capacity.

US production fell during the week of January 9 to 13.753 million bpd, down from 13.811 million bpd in the week prior, according to the latest EIA data. This is 272,000 bpd more than this same time last year.

At 4:27 pm ET, Brent crude was trading up on the day at $65.23 (+0.48%). Brent is now roughly $0.10 down from this time last week amid geopolitical turmoil and worry of soft demand. WTI was also trading up on the day, by $0.27 (+0.45%) at $60.63.

Gasoline inventories saw another large increase this week as well, gaining 6.2 million barrels in the week ending January 16. In the week prior, gasoline inventories grew by 8.23 million barrels. As of last week, gasoline inventories were 4% above the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell slightly in the reporting period, falling by 33,000 barrels, after gaining 4.34 million barrels in the week prior. Distillate inventories were still 4% below the five-year average as of the week ending January 9, the latest EIA data shows.

Cushing inventory—the inventory kept at the delivery hub for the WTI Crude futures contract—rose by 1.2 million barrels, after increasing by 945,000 barrels in the prior week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com

- India Deepens Energy Ties With the Gulf While Balancing Russian Oil Risk

- Indian Refiners Boost Middle East Supply To Offset Lost Russian Oil

- Germany’s Coal Plants Return to Profit