Power Finance Corporation Ltd. (PFC) has officially acquired a 52.63% stake in REC Limited, following approval from the Cabinet Committee on Economic Affairs (CCEA). With this transaction, REC now becomes a subsidiary of PFC, creating a holding–subsidiary structure between two of India’s most influential power-sector financing institutions.

The decision was approved by PFC’s Board of Directors in its meeting held on February 6, 2026, and disclosed under Regulation 30 of SEBI’s Listing Obligations and Disclosure Requirements. This move marks a significant step in the government’s broader plan to restructure and strengthen Public Sector Non-Banking Financial Companies (NBFCs).

The acquisition follows the Union Budget 2026–27 announcement, in which the Finance Minister outlined a strategic vision to scale up public sector NBFCs, improve credit delivery, enhance technology adoption, and increase operational efficiency. As part of this strategy, the government proposed the restructuring and potential merger of PFC and REC.

Taking note of this policy direction, PFC’s Board has granted in-principle approval for a merger with REC, subject to regulatory and statutory clearances. The Board emphasized that the merged entity must continue to operate as a Government Company under the Companies Act, 2013.

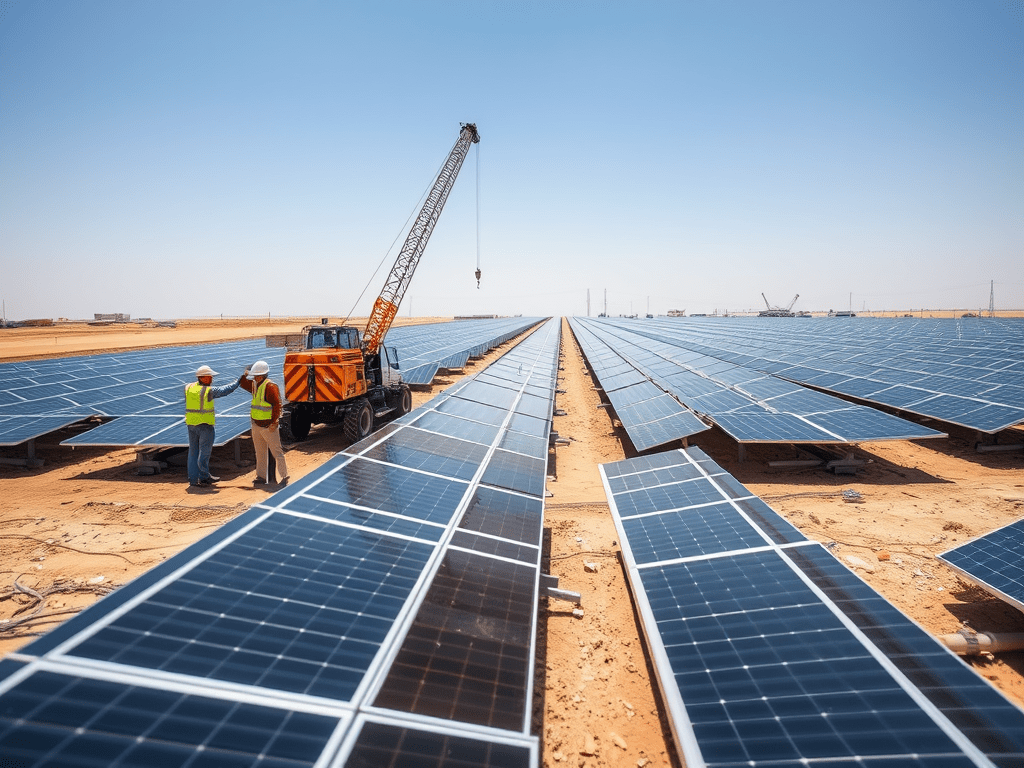

If finalized, the merger could create a larger, more financially robust lending institution capable of accelerating investments in power infrastructure, renewable energy, grid modernization, and clean energy transition projects. Industry experts believe this consolidation could enhance lending capacity, reduce funding costs, and improve execution efficiency in India’s evolving energy landscape.

A detailed merger plan is expected to be developed and shared once finalized, marking the next phase in the transformation of India’s power financing ecosystem.

Subscribe to get the latest posts sent to your email.