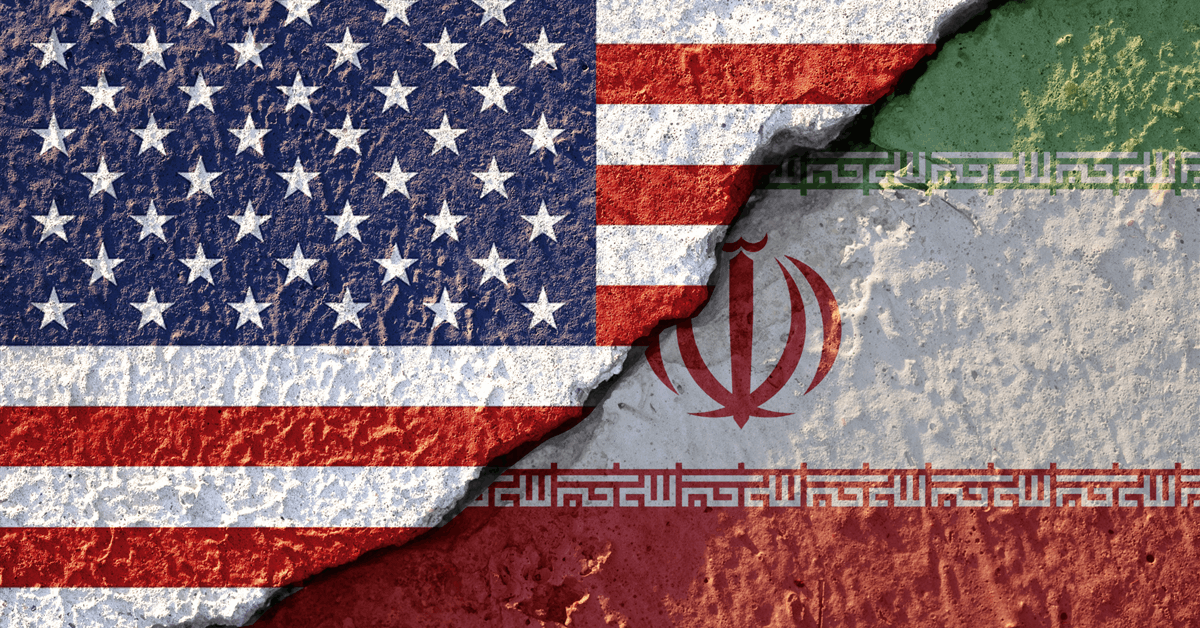

A limited U.S. strike on Iranian military or nuclear targets is the likeliest outcome.

That’s what Morningstar thinks, according to the company’s equity director Joshua Aguilar, who outlined in a note sent to Rigzone late Thursday that this scenario “would mean no impact on global physical flows, so the global surplus would remain intact”.

“Any price action would be due to the geopolitical premium,” he added.

In the note, Aguilar highlighted that Morningstar thinks a limited strike event is a base case for several reasons.

“First, we’d flag U.S. domestic political incentives,” he said.

“U.S. midterm elections take place later this year, and Trump has made keeping inflation down a cornerstone of his platform, which includes prices at the pump,” he added.

“Second, we think the U.S. hand is stronger following the capture of Maduro, both from the standpoint of a successful military operation, and because Venezuelan output … gives the U.S. somewhat of a physical, heavy-sour crude buffer that can substitute for Iranian crude exports in the event of a limited strike with some supply disruption,” he continued.

“Third, any severe strike would potentially strengthen OPEC+’s hand,” he went on to state.

While Aguilar said in the note that a severe strike seems possible, he added that it is much less likely. Aguilar also noted that Morningstar thinks the odds of a Strait of Hormuz closure are remote. He conceded, however, that this “would be the most severe case for global oil prices”.

In the note, Aguilar pointed out that global oil benchmarks “have risen significantly since the start of the year”.

“Brent futures now trade at nearly $72 per barrel, rising nearly 20 percent since early January,” he said.

“This contradicts nearly universal bearish prognostications for crude prices earlier in the year related to supply glut fears,” he added.

Aguilar revealed in the note that Morningstar is maintaining its midcycle estimate of $65 per barrel Brent.

In a J.P. Morgan report sent to Rigzone late Thursday by Natasha Kaneva, the company’s head of global commodities strategy, analysts at J.P. Morgan, including Kaneva, said they “continue to assign a low geopolitical risk premium to the Middle East”.

“With affordability and broader economic conditions central to U.S. electoral dynamics, the president must ultimately weigh the economic costs of any strike on Iran ahead of the November mid-term elections,” the analysts said.

“Our baseline scenario assumes some form of agreement with Iran and a ceasefire in Ukraine this year. While the probability of military action against Iran has increased, we expect any such action to be surgical and designed to avoid Iran’s oil production and export infrastructure,” they added.

“Given the region’s proximity to major energy chokepoints, geopolitically driven crude price rallies may persist, but these should eventually fade as global fundamentals remain relatively soft,” they continued.

In the report, the J.P. Morgan analysts said their balances “continue to project sizable surpluses later this year, suggesting that production cuts of two million barrels per day will be needed to prevent excessive inventory accumulation in 2027, which would help stabilize prices at around $60 per barrel Brent”.

In a comment sent to Rigzone this morning, Aaron Hill Chief Market Analyst at FP Markets, noted that WTI oil prices “continued to clear out offers, refreshing year to date highs of $67.01 in recent trading”.

“The bid came on the heels of U.S. President Donald Trump’s warning to Iran that it has 10 to 15 days to reach a nuclear deal, or ‘really bad things’ will happen. The U.S. is assembling two aircraft carriers, fighter jets, and refueling tankers in the region,” he added.

Rigzone has contacted the White House and the Iranian Ministry of Foreign Affairs for comment on the Morningstar and J.P. Morgan reports, and Hill’s statement. At the time of writing, neither have responded to Rigzone.

To contact the author, email