Sembcorp Industries (Sembcorp) demonstrated a resilient performance for the full year of 2024 (FY2024). Group net profit, before exceptional items (EI) and discontinued operation, stood at S$1.02 billion, maintaining levels seen in FY2023 despite scheduled major maintenance in the first half of 2024 (1H2024). Group net profit after EI and discontinued operation reached S$1.01 billion, reflecting a 7% increase from S$942 million in FY2023. Net profit before EI and discontinued operation for 2H2024 was S$487 million, marking a 17% rise from 2H2023, driven by higher earnings in the Gas and Related Services and Integrated Urban Solutions segments.

In FY2024, the Gas and Related Services segment maintained a stable net profit before EI of S$727 million despite planned maintenance and a 34% drop in Singapore wholesale electricity prices. Sembcorp secured long-term contracts, with 98% of its gas-fired portfolio backed by offtake agreements and over 60% locked in for more than five years. The segment remains a key earnings driver, bolstered by the November 2024 acquisition of a 30% stake in Senoko Energy. Additionally, the 600MW hydrogen-ready power plant will enhance earnings upon completion in 2026.

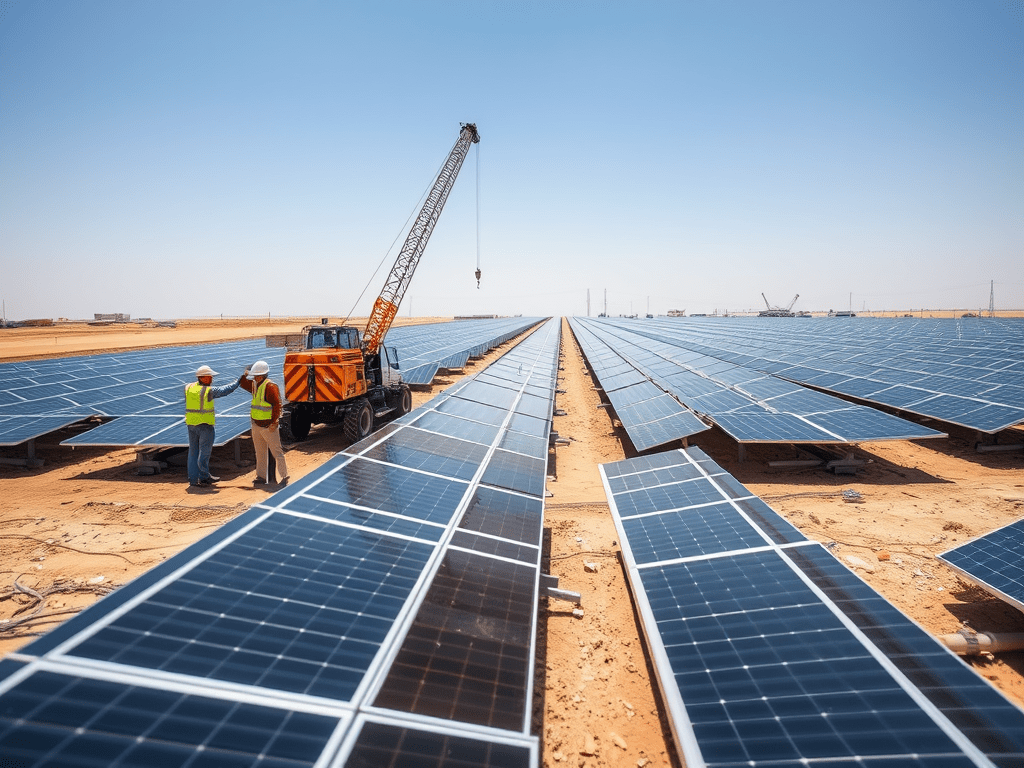

Since the end of 2023, Sembcorp has secured 4.1GW of renewables capacity across key markets, bringing the Group’s total renewables capacity to 17.0GW, including 13.1GW of installed capacity. In FY2024, the Renewables segment recorded a net profit before exceptional items (EI) of S$183 million. However, its performance was affected by curtailment in China and lower wind speeds in India during the second half of the year.

The Integrated Urban Solutions segment delivered a strong net profit before EI of S$169 million, driven by a turnaround in the Urban business. Higher land sales were achieved in Vietnam and Indonesia, while the Urban business expanded its portfolio with a gross land bank of 14,400 hectares for low-carbon industrial parks and over 508,000 square meters of industrial leasable space from ready-built warehouses and factories.

Reflecting the Group’s strong performance, the Board of Directors has proposed a final dividend of 17.0 cents per share, subject to shareholder approval. Combined with the interim dividend of 6.0 cents per share paid in August 2024, the total dividend for FY2024 will amount to 23.0 cents per share, representing a 3.9% dividend yield and an increased payout ratio of 40%, up from 23% in FY2023.

Looking ahead, Sembcorp is well-positioned to capitalize on transformative growth opportunities in energy transition, AI-driven advancements, and industrial realignment. The company’s three core growth engines—Gas and Related Services, Renewables, and Integrated Urban Solutions—will drive its strategic direction toward 2028 and beyond.

Wong Kim Yin, Group CEO of Sembcorp Industries, stated that the company delivered a strong financial performance in 2024, supported by resilient earnings and robust cash flow. He highlighted that the dividend increase reflects confidence in Sembcorp’s future performance and its ability to generate sustainable returns. He reaffirmed the company’s commitment to strengthening its growth engines, driving long-term expansion, and delivering increasing value to shareholders.

| S$ million | 2H2024 | 2H2023 | Δ% | FY2024 | FY2023 | Δ% |

|---|---|---|---|---|---|---|

| Turnover | 3,209 | 3,384 | (5) | 6,417 | 7,042 | (9) |

| Net Profit before Exceptional Items (EI) | ||||||

| Gas and Related Services | 388 | 374 | 4 | 727 | 809 | (10) |

| Renewables | 79 | 81 | (2) | 183 | 200 | (9) |

| Integrated Urban Solutions | 99 | 72 | 38 | 169 | 121 | 40 |

| Decarbonisation Solutions | (10) | (10) | – | (20) | (13) | (54) |

| Other Businesses | 19 | 16 | 19 | 38 | 31 | 23 |

| Corporate | (129) | (128) | (1) | (247) | (263) | 6 |

| Deferred Payment Note Income | 41 | 11 | 273 | 169 | 133 | 27 |

| Income | 77 | 95 | (19) | 159 | 179 | (11) |

| FX gain / (loss) | (36) | (84) | 57 | 10 | (46) | NM |

| Net Profit before EI | 487 | 416 | 17 | 1,019 | 1,018 | * |

| EI | (7) | (4) | (75) | 2 | 2 | (50) |

| Net Loss from Discontinued Operation | (9) | – | NM | (9) | (78) | 88 |

| Total Net Profit | 471 | 412 | 14 | 1,011 | 942 | 7 |