The AES Corporation has announced its financial results for the year ended December 31, 2024, highlighting significant strategic accomplishments and solid financial performance.

2024 Strategic Achievements

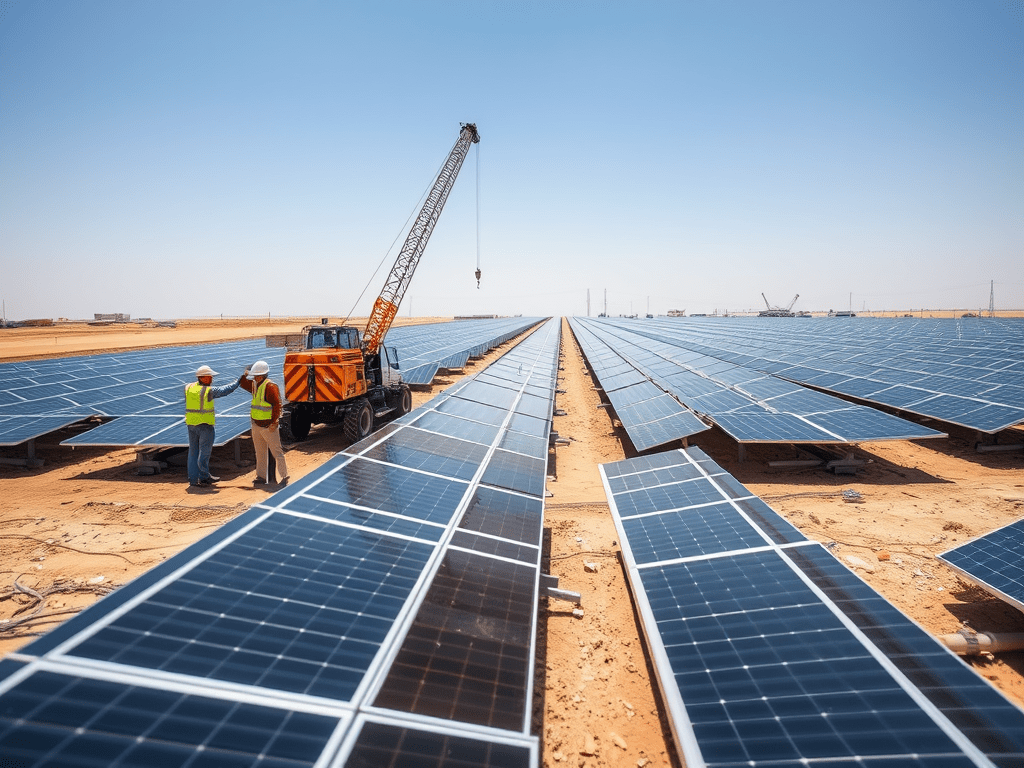

In 2024, AES signed or awarded 6.8 GW of new contracts, including renewable power purchase agreements (PPAs), data center load growth at US utilities, and retail supply for data centers. Notably, 4.4 GW of renewables were secured under long-term PPAs, while AES Ohio experienced a 2.1 GW data center growth. AES also provided 310 MW of retail supply to support data centers across Ohio. The company maintained its position as the top provider of clean energy globally to corporations for the third consecutive year, according to BloombergNEF.

AES also completed the construction or acquisition of 3.0 GW of renewable energy projects, mainly in the United States and Chile, alongside a 670 MW combined cycle gas plant in Panama. Additionally, AES Indiana received approval from the Indiana Utility Regulatory Commission (IURC) to implement new base rates and an ROE of 9.9%.

In terms of asset sales, AES has already announced or closed $2.8 billion of its $3.5 billion asset sale proceeds target through 2027.

2024 Financial Highlights

- GAAP Financial Metrics

- Net Income of $698 million, compared to Net Loss of $182 million in 2023

- Net Income Attributable to The AES Corporation of $1,686 million, compared to $242 million in 2023

- Diluted EPS of $2.37, compared to $0.34 in 2023

- Non-GAAP Adjusted Financial Metrics

- Adjusted EBITDA of $2,639 million, compared to $2,828 million in 2023 and 2024 guidance of $2,600 to $2,900 million

- Adjusted EBITDA with Tax Attributes of $3,952 million, compared to $3,439 million in 2023 and 2024 expectation of $3,550 to $3,950 million

- Adjusted EPS of $2.14, compared to $1.76 in 2023 and 2024 guidance of $1.87 to $1.97

Financial Position and 2025 Outlook

AES is on track to meet its target of signing 14 to 17 GW of PPAs between 2023 and 2025, with 10.0 GW of PPAs signed in 2023 and 2024. The company expects to complete construction of 3.2 GW of new renewable energy projects in 2025. AES has initiated guidance for 2025, forecasting:

- Adjusted EBITDA: $2,650 to $2,850 million.

- Adjusted EBITDA with Tax Attributes: $3,950 to $4,350 million.

- Adjusted EPS: $2.10 to $2.26.

The company is reaffirming its annualized growth target of 7% to 9% through 2025, based on 2020 results, and maintaining the same 7% to 9% growth target through 2027, based on its 2023 guidance.

AES remains committed to long-term growth, driven by its robust renewable energy pipeline and operational efficiencies. The company continues to focus on its strategic priorities, positioning itself for continued success in the global clean energy market.