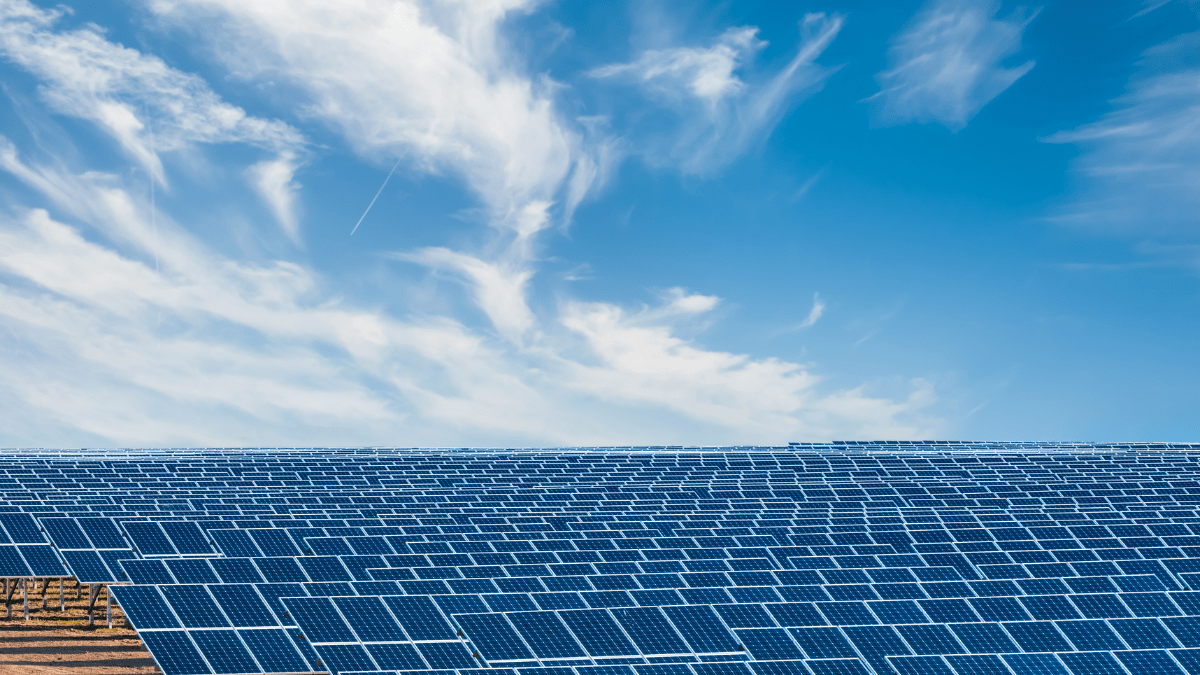

Brookfield Asset Management, a global alternative asset manager, has announced the sale of a 1.6 GW portfolio of solar and wind assets in India to Gentari Renewables India. The transaction is structured in two phases, with the first phase comprising the sale of 1 GW of operational assets now completed. This marks Brookfield’s first full-cycle portfolio monetization in India under its Renewable Power & Transition business.

Nawal Saini, Managing Director and Head of Renewable Power & Transition for South Asia and the Middle East at Brookfield, stated that the transaction highlights the company’s ability to create and realize value while contributing to India’s energy transition. He emphasized that the deal reinforces investor confidence and paves the way for further capital allocation in the country. Brookfield’s renewable portfolio in India includes approximately 40 GW of wind and solar assets at various stages of development.

Globally, Brookfield is one of the largest investors in renewable energy, with an installed capacity of approximately 46 GW and a development pipeline of 200 GW. Its renewable assets span North and South America, Europe, and Asia Pacific, covering hydroelectric, wind, utility-scale solar, and storage facilities.