Chevron has bought a stake of 4.99% in Hess Corp since the start of the year, according to a regulatory filing from this week. The company said it is confident its merger with Exxon’s partner in Guyana will proceed as planned, Reuters reported.

The stake Chevron bought over the last two months cost about $3.2 billion, the report noted, representing a total of 15.38 million common shares in Hess Corp.

‘;

document.write(write_html);

}

Chevron announced plans to acquire Hess for some $53 billion in one of a series of so-called megadeals in the oil space that began in 2023 amid the war-driven rally in oil and gas prices. The announcement, made in October of that year, followed closely the news that Exxon had agreed to take over Pioneer Natural Resources in a deal worth $59.5 billion to become the leader in the Permian.

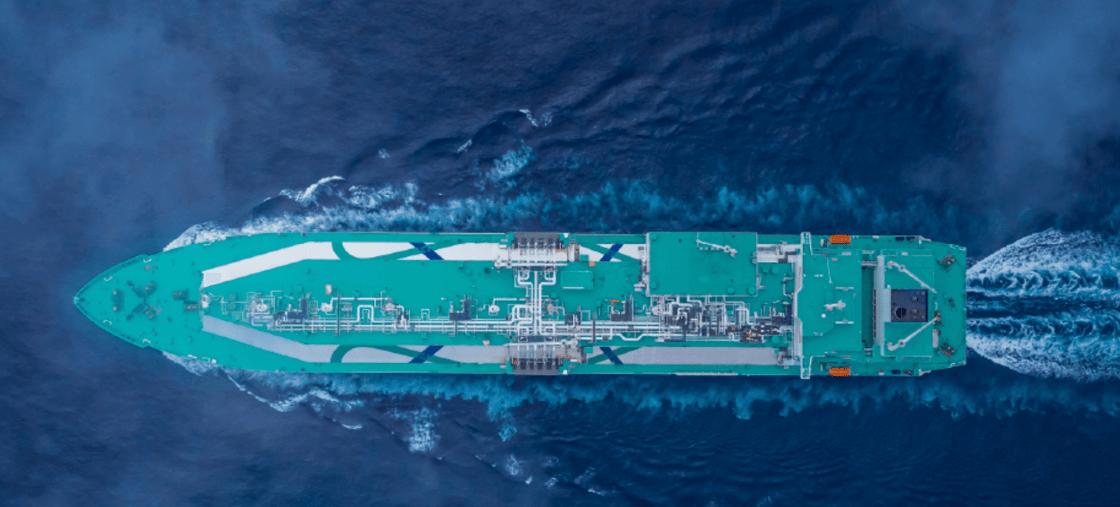

For Chevron, the appeal of Hess Corp lay in its Guyana assets, where along with partner Exxon, the company tapped as much as 11 billion barrels of oil equivalent, with production ramping up fast. Currently, the South American nation pumps some 660,000 bpd all from the Exxon-Hess operated Stabroek Block. Output is projected to hit 1.3 million barrels daily by 2030.

It is also Exxon that is making the completion of the Chevron-Hess merger difficult as it seeks the right of first refusal for Hess’ Guyana assets, turning to an arbitration court. Chevron and Hess insist that this is not an asset acquisition deal, so the right of first refusal clause in the partnership deal between Exxon and Hess does not apply. Exxon begs to differ and it has the third partner in the Stabroek Block on its side—China’s CNOOC.

Hess Corp. has a 30% stake in the Stabroek Block and Chevron has made no secret of the fact that this stake is the main reason it wants to acquire the company. Yet Exxon is also eyeing that stake, to add to its 45% in the project. If Exxon wins, the Hess acquisition would become pointless for Chevron.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com

- German Energy Minister: Europe Shouldn’t Revive Nord Stream Gas Pipelines

- Qatar Cuts Prices for Its Oil

- Goldman Sachs Cuts Oil Price Outlook Amid Oversupply Fears