TotalEnergies has officially completed its acquisitions of VSB Group, a prominent European wind and solar developer, and SN Power, a leading hydropower developer in Africa, particularly in Uganda. The company has also forged new agreements with RES, a renewables developer, to acquire projects in Alberta, Canada, alongside the closure of its first project acquisition in the region.

TotalEnergies has closed its acquisition of VSB Group, further enhancing its integrated electricity business in Germany. VSB’s portfolio, which includes over 15 GW of renewable energy projects, significantly contributes to TotalEnergies’ renewables pipeline, increasing its capacity in Europe to more than 40 GW. This acquisition also adds to TotalEnergies’ previous strategic purchases of battery storage developer Kyon Energy, energy manager Quadra Energy, and its offshore wind projects in the region.

The deal aligns with TotalEnergies’ focused strategy for key European markets. The company has decided to initiate the divestment process for VSB’s Puutionsaari project in Finland (440 MW of wind and solar), in line with its evolving market priorities.

TotalEnergies has successfully acquired SN Power, strengthening its multi-energy strategy in Africa. The acquisition is particularly important in Uganda, where TotalEnergies already operates in exploration and production. The purchase includes a 28.3% stake in the Bujagali hydropower plant, which meets over 25% of Uganda’s peak electricity demand. The deal also includes a stake in two other hydropower projects under development in Rwanda (206 MW) and Malawi (360 MW). This acquisition bolsters TotalEnergies’ expertise in hydropower development with the addition of a skilled team.

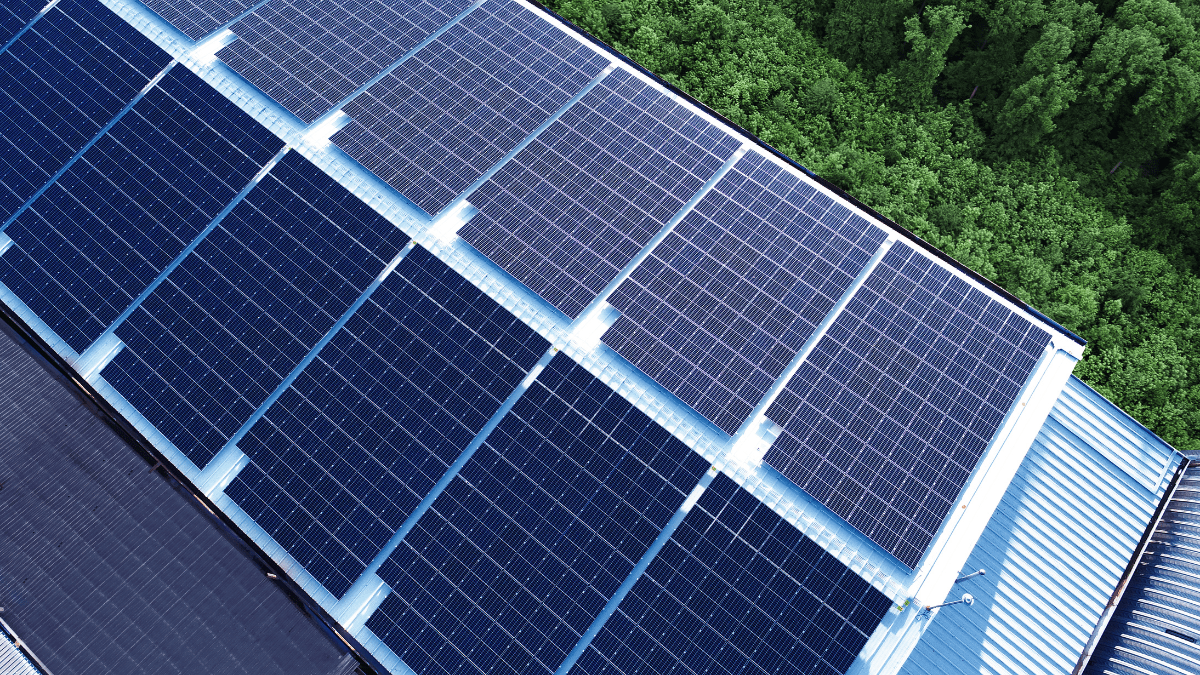

In Canada, TotalEnergies has signed agreements with RES to acquire several wind and solar projects in Alberta, totaling over 800 MW of renewable energy capacity. The company has also completed the acquisition of Big Sky Solar (184 MW), a solar facility in Alberta that commenced operations in late February 2024. A significant portion of the electricity generated by Big Sky Solar will be sold through a long-term power purchase agreement (PPA), with the remainder sold on the electricity market. Additionally, TotalEnergies will market the carbon credits produced by the facility under Alberta’s regulated carbon emissions program.

These acquisitions in Europe, Africa, and Canada further TotalEnergies’ commitment to accelerating the transition to renewable energy, enhancing its global portfolio while supporting sustainable, multi-energy solutions in diverse regions.