Actis, a leading investor in sustainable infrastructure across growth markets, has announced the successful final close of its second Actis Long Life Infrastructure Fund (ALLIF2), securing US$1.7 billion in commitments. The fund is designed to invest in operating infrastructure assets across regions such as the Middle East, Africa, Asia, Latin America, and Central and Eastern Europe.

ALLIF2 follows the blueprint of its predecessor, ALLIF1, which raised US$1.3 billion and closed in 2019. Rather than pursuing capital-intensive projects, the fund focuses on brownfield assets and operational enhancements to generate predictable, long-term returns using moderate leverage. Target sectors include renewable energy, electricity transmission and distribution, district cooling, toll roads, and digital infrastructure.

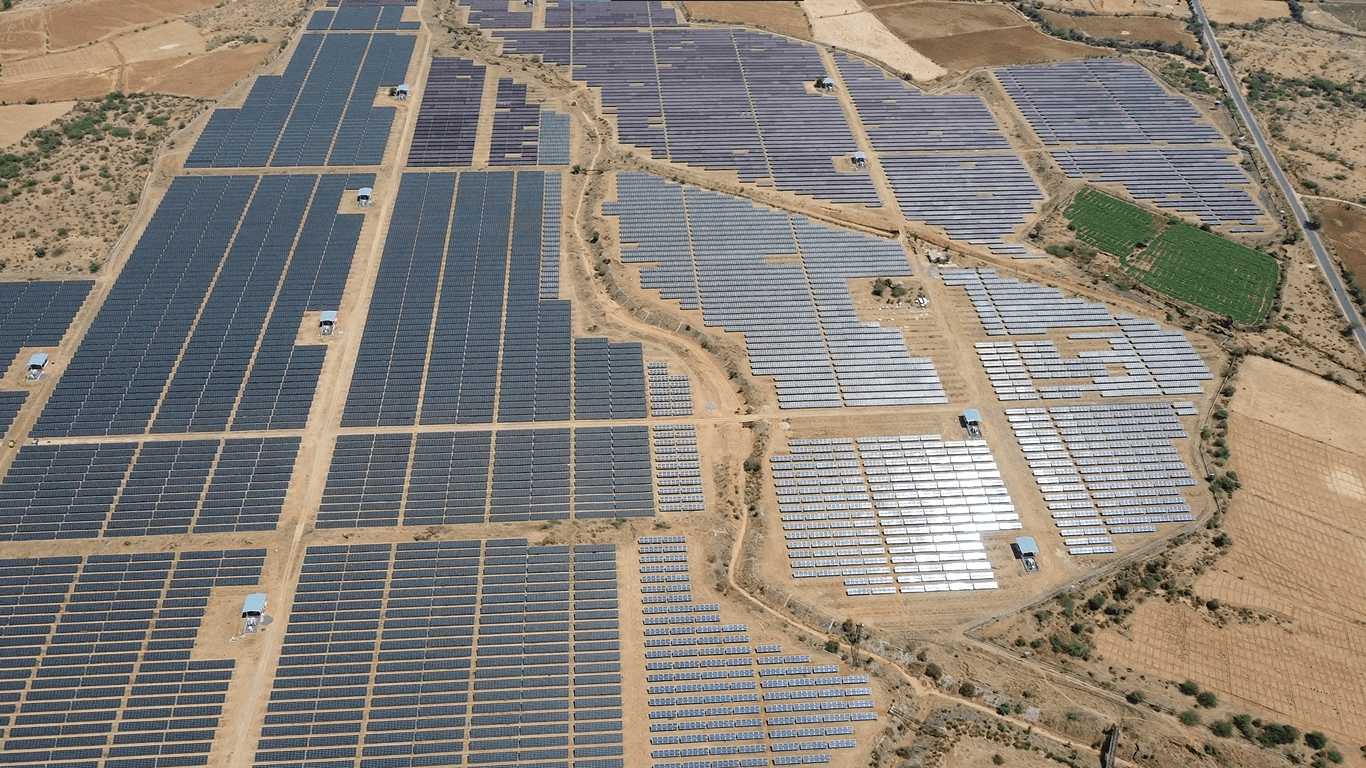

The fund has already deployed nearly 50% of its capital and is progressing a near-term investment pipeline exceeding US$2 billion. In March 2025, it acquired a 100% stake in Stride Climate Investments, a portfolio of 21 solar generation assets in India, contributing to the country’s clean energy targets while offering long-term contracted revenue streams. It also expanded its Brazilian electricity transmission platform with two acquisitions signed in December 2024, reinforcing the nation’s push to integrate its 89% renewables-based electricity supply.

Investor confidence in the strategy was underscored by strong backing from existing and new investors, including pension funds, insurance firms, funds of funds, and sovereign wealth funds across Europe, North America, Asia, and the Middle East.

Torbjorn Caesar, Chairman and Senior Partner at Actis, said the strategy has resonated with investors seeking “resilience, scale, and relevance,” adding that “we’re building real-world assets that are essential to national development, and pairing that with disciplined, long-term investment capital.”

Adrian Mucalov, Partner and Head of Long Life Infrastructure, noted that the fund reflects “investor appetite for infrastructure businesses in high-growth markets that have a solid operating track record with stable, downside protected cash flows,” and said the fund’s early deployment shows Actis’ ability to “originate at scale and invest with conviction in some of the world’s most dynamic economies.”

Neda Vakilian, Partner in the Investor Solutions Group, said the raise “reflects growing investor recognition of Actis’ deep understanding of growth markets and our differentiated approach to delivering stable returns.” She added that “at a time of macroeconomic uncertainty across western economies, we are seeing investors increasingly turn to globally diversified strategies.”

The ALLIF strategy is underpinned by long-term contracted revenues, availability-based agreements, inflation-indexed income, and other downside protections, including currency and interest rate hedging. Actis has invested over US$1.2 billion in the MENA region since 2019, including controlling stakes in Yellow Door Energy, a major solar player in the UAE, and Emicool, one of the country’s leading district cooling providers with 19 facilities.

Since inception, Actis has raised more than US$26 billion, predominantly directed toward low-carbon energy, digital infrastructure, and real estate. The firm’s October 2024 merger with General Atlantic brought its total assets under management to US$108 billion.