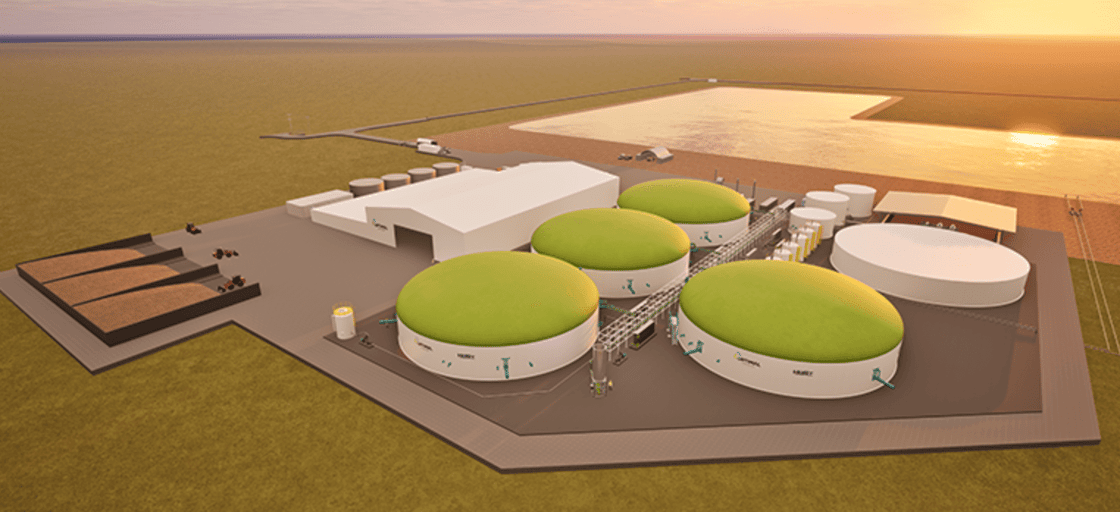

Bulgaria’s Lukoil Neftohim Burgas refinery has saved $8 million in just two months after dropping its Swiss-based trading intermediary Litasco SA, with Special Commercial Administrator Rumen Spetsov telling Russia’s parliamentary committee that the savings came mainly from scrapping commission fees previously paid to the middleman between the refinery and Lukoil’s oil reserves, Novinite reported on Thursday.

Spetsov said the refinery’s financial position has further stabilized through deferred payments and barter deals (exchanging fuel for crude oil), leading to a positive financial result in the current year. Lukoil Neftohim Burgas refinery is the largest oil refinery in the Balkans, and primarily processes heavy crude oil, favoring Russian Urals. The refinery has a processing capacity of ~9.5 million tonnes of crude oil per year, equating to roughly 190,000–196,000 barrels per day.

The Swiss trading arm has been significantly dismantled due to U.S. and UK sanctions, leading to mass layoffs at its Geneva headquarters and the expected closure of its Swiss offices in the current month. The Bulgarian government seized operational control of the refinery in late 2025 to safeguard national energy security and mitigate the risk of secondary sanctions.

Set OilPrice.com as a preferred source in Google .

While the Trump administration issued a license in 2025 allowing transactions with Lukoil’s Bulgarian entities until April 29, 2026, the refinery remains on the market. The deadline for Lukoil to divest these assets has been set for February 28, 2026.

Reports emerged in January that the Carlyle Group had reached an agreement to acquire Lukoil’s international assets, including the Burgas refinery, pending U.S. regulatory approval. The deal involves LUKOIL International GmbH, which includes refineries in Bulgaria and Romania, a stake in the West Qurna 2 oilfield in Iraq and various other assets across Europe, the Middle East and Africa. However, assets in Kazakhstan, including the Caspian Pipeline Consortium (CPC) and the Tengiz oilfield, are not part of the deal.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com

- Brent Oil Price Tops $71 as Fears of U.S.-Iran Conflict Grow

- Hungary Weighs Cutting Power and Gas Shipments to Ukraine

- Cenovus Energy Q4 Earnings Skyrocket on Record Production