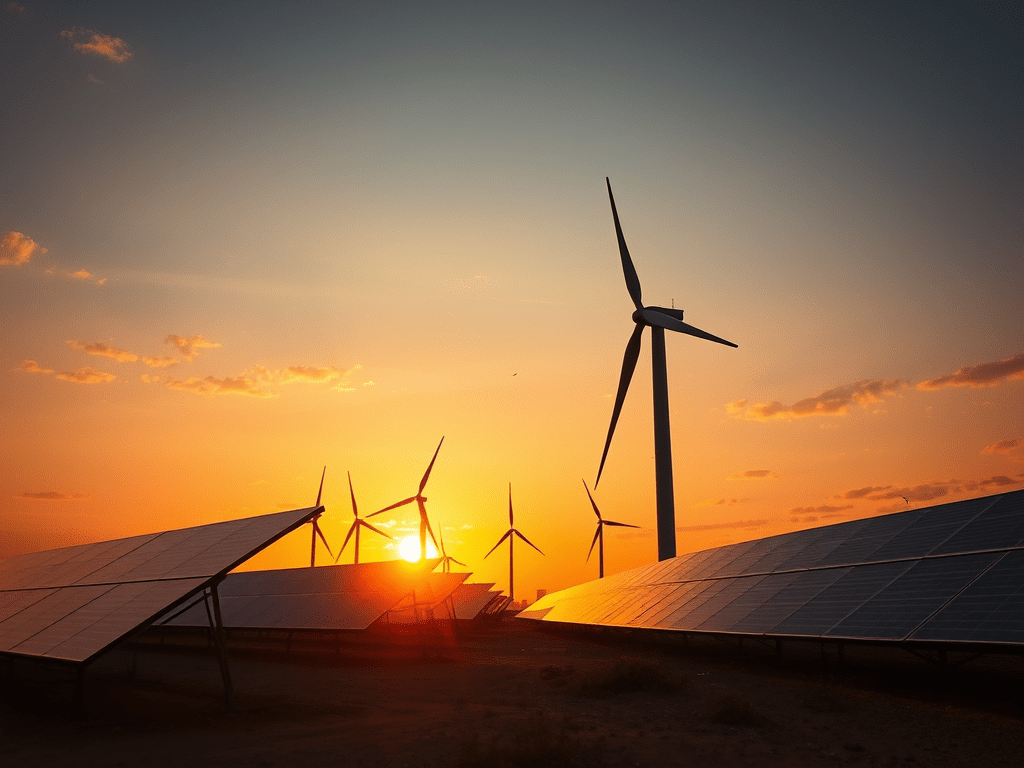

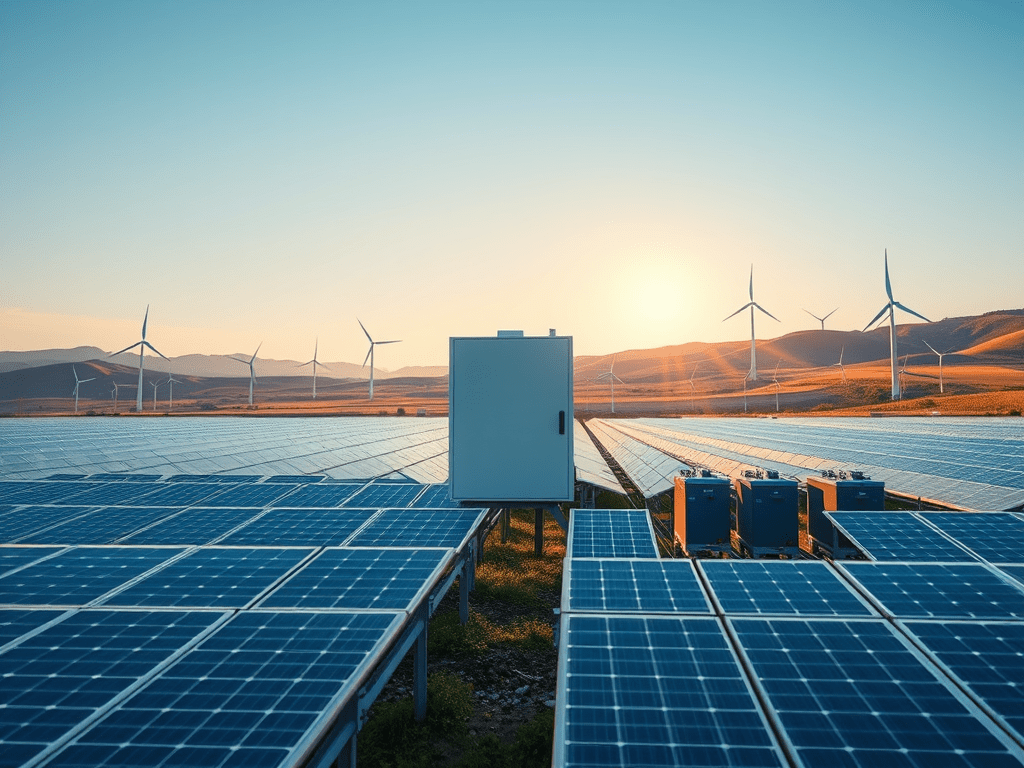

The Emerging Africa & Asia Infrastructure Fund (EAAIF), a Private Infrastructure Development Group (PIDG) company managed by Ninety One, has secured a USD 100 million debt facility from Export Finance Australia (EFA), marking a key step in its expansion into Asian markets and its mission to mobilise investment for strategic infrastructure in South and Southeast Asia.The new facility will enable EAAIF to target projects that advance energy access, commercial and industrial solar, digital communications, and sustainable transport, helping to create businesses, strengthen supply chains, and drive green growth.

Backed by USD 396 million in equity from the UK, Switzerland, the Netherlands, and Sweden through PIDG, the Fund has raised over USD 2 billion in debt since inception, proving the effectiveness of the blended finance model. Partnering with EFA further strengthens EAAIF’s capacity to help economies withstand climate shocks and accelerate a just, green transition.

Olivia Carballo, Managing Director & Martijn Proos, Co-Head of Emerging Market Alternative Credit, Ninety One, the fund manager of EAAIF, said: “Through our collaboration with the Australian government, Export Finance Australia is supporting the Fund to deliver sustainable infrastructure and clean energy projects across the Indo-Pacific. This partnership enables access to high-growth markets through a blended finance vehicle. By collaborating domestically, we are able to deliver resilient, climate-smart infrastructure to some of the fastest-growing yet underserved markets- bridging the financing gap and creating opportunities for people, communities and ambitious businesses across the region.”

Philippe Valahu, CEO, PIDG said: “The partnership with Export Finance Australia marks a powerful endorsement of PIDG’s mission to mobilise and multiply capital for infrastructure that has a deep and lasting impact on communities and economies. This commitment strengthens our capacity to deliver transformative projects in high-growth markets, reinforcing the shared ambition between PIDG and the Australian government to accelerate inclusive growth and the region’s green transition”.

John Hopkins, Managing Director & CEO of EFA, said: “Our investment in EAAIF enables us to support a diverse pipeline of renewable energy and infrastructure projects while partnering with a proven fund manager and a globally recognised development finance platform. It also demonstrates the value of working with like-minded partners to crowd in private capital and help close the infrastructure financing gap in the region.”

Subscribe to get the latest posts sent to your email.