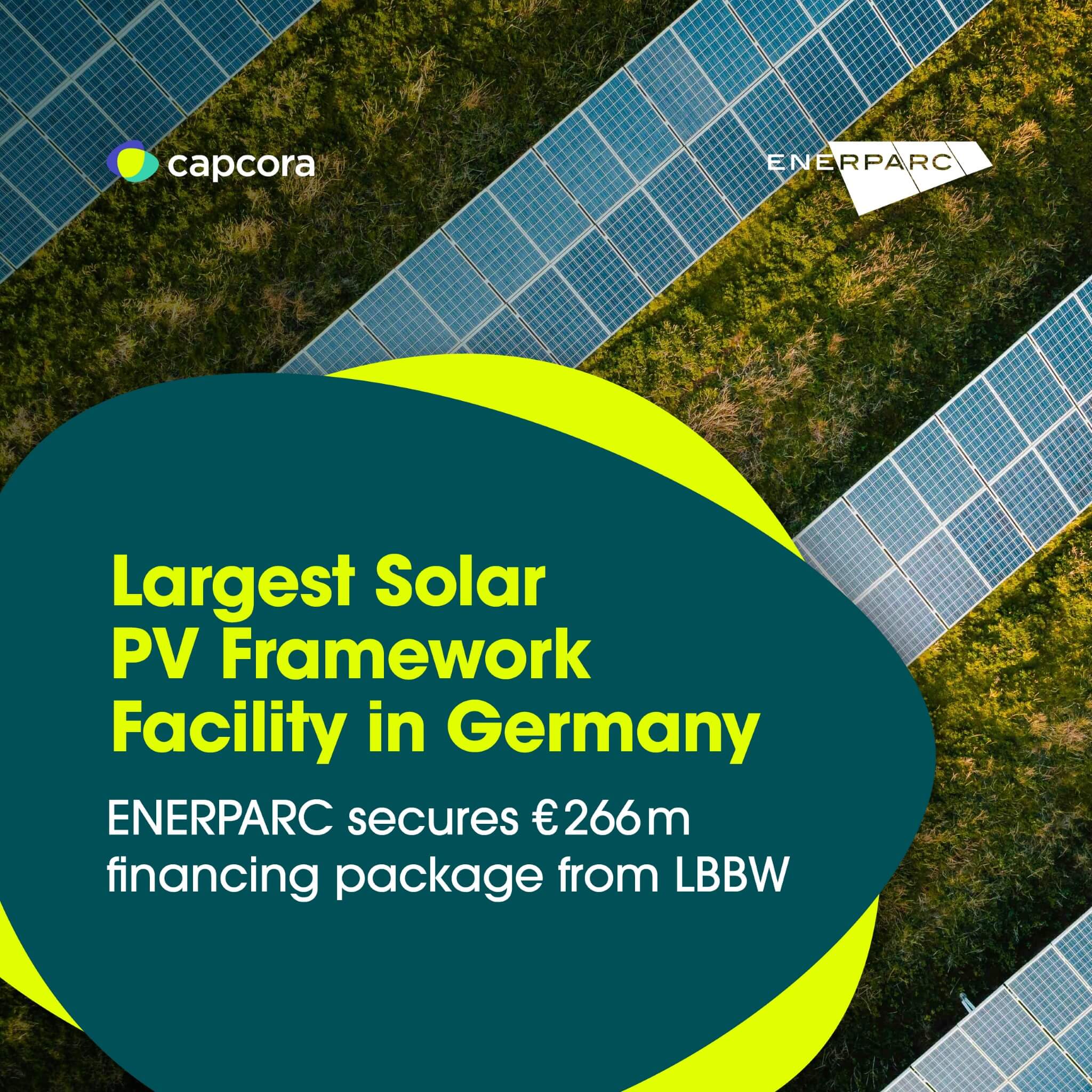

ENERPARC AG, a leading solar developer and independent power producer (IPP) in Europe, has secured funding to support the construction of a 400 MWp pipeline of ground-mounted solar PV projects in Germany. The financing package includes a €216 million senior secured project finance facility and a €50 million revolving credit facility (RCF). Capcora acted as the sole financial advisor for this transaction.

The project finance facility follows a portfolio approach, allowing ENERPARC to fund solar projects in clusters as they reach the ready-to-build stage over the next 24 months. This long-term facility, extending up to 24 years, covers both the construction and operational phases, ensuring financial stability and flexibility for ENERPARC’s growth. A key feature of this facility is its ability to support diverse revenue sources, such as Feed-in Tariffs (FIT) and Power Purchase Agreements (PPA), making the financing structure adaptable to different income streams.

Marco Langone, Head of Finance at ENERPARC, said in a statement, “This financing agreement is a key enabler for us to scale up our solar PV portfolio and contribute significantly to Germany’s energy transition. By securing flexible funding, we can construct projects with diverse revenue models, including EEG-backed assets, and unsubsidized PPA-backed solar projects.”

Jens Heil, Managing Director and Head of Project Finance Continental Europe at LBBW, stated, “We are pleased to support ENERPARC in expanding its renewable energy footprint in Germany. This transaction, tailored to the German market and ENERPARC’s specific needs in terms of the conditions to disbursement, underscores our commitment to financing the green transition and backing experienced developers driving the shift to clean energy. We are delighted to have added value to ENERPARC, an established player in the German market, through this innovative financing.”

“We are proud to have supported our long-standing client ENERPARC in securing this landmark financing, which is unique in the German PV market. The structure of this facility is customized to ENERPARC, allowing them to draw faster due to beneficial CPs and tailored provisions. It provides the flexibility needed to optimize different revenue models in a rapidly evolving energy market. We are grateful for their trust and appreciate the ENERPARC team’s exceptional teamwork and outstanding professionalism, which have been key to the success of this financing,” mentioned Alexander E. Kuhn, Managing Partner at Capcora.

In addition, the €50 million revolving credit facility (RCF) provides ENERPARC with early-stage access to funds at the corporate level, further enhancing its financial flexibility. This funding will help ENERPARC efficiently scale its solar PV pipeline in Germany. LBBW, one of Germany’s top project finance banks, highlighted the strategic importance of this deal in supporting the country’s renewable energy expansion. Simmons & Simmons LP acted as the legal advisor for the lenders, while Capcora advised ENERPARC on financial matters.