More than €22 billion in bonds have been issued under the European Green Bond Standard (EUGBS) just over a year after it came into effect, but new research from the Institute for Energy Economics and Financial Analysis (IEEFA) indicates that there is still room for improvement. Since the standard became legally effective in late 2024, it has played an important role in strengthening credibility and transparency across the green bond market. EUGBS-labelled bonds must follow strict requirements, including EU taxonomy-aligned use of proceeds, mandatory external reviews, and standardised reporting practices.

Kevin Leung, a sustainable finance analyst at IEEFA and author of the report, noted that early market momentum has been positive, with every EUGBS-labelled issuance attracting strong oversubscription. However, he also pointed out that the standard is currently capturing only a small share of taxonomy-aligned investments. IEEFA’s analysis highlights three areas where the standard has performed well. First, EUGBS issuance has been received positively by the market, with participation from a wide variety of issuers including sovereign governments, municipalities, development banks, commercial banks, and corporates.

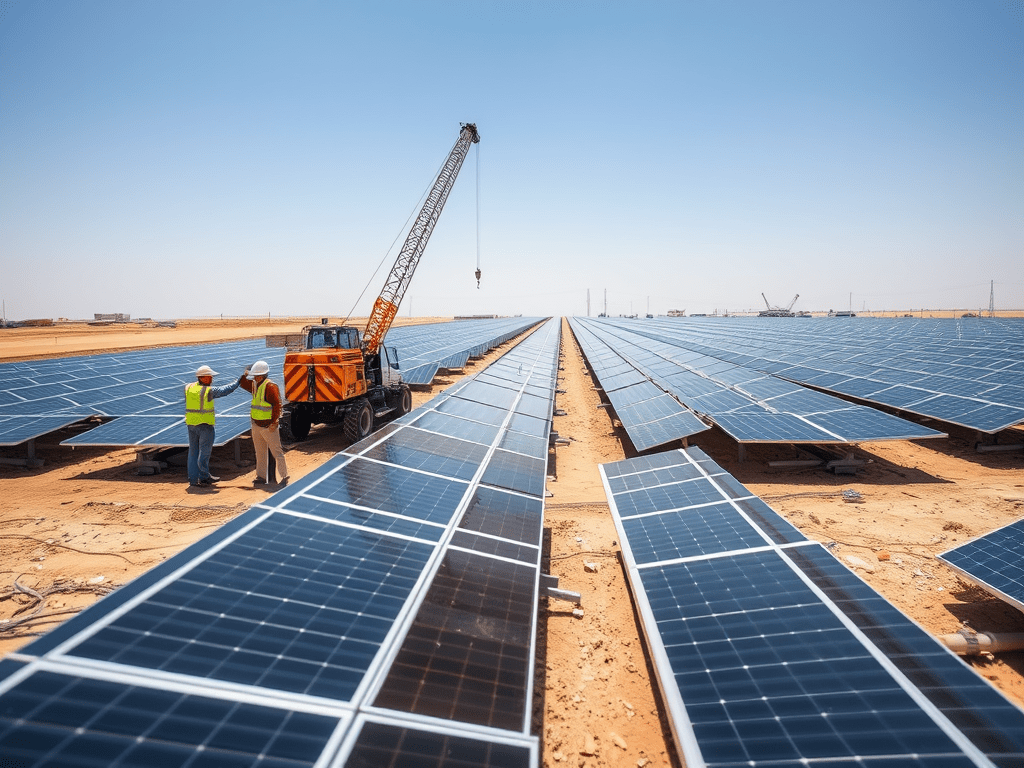

This diversity is important for investors building balanced sustainable bond portfolios. Second, European Green Bonds have played a useful role in supporting the EU’s energy security priorities. Much of the issuance has come from the energy and utilities sectors, showing how the standard can channel capital into activities aligned with EU environmental and competitiveness objectives. Third, public-sector issuers that adopted the standard early are providing valuable examples. Denmark’s DKK 7 billion (€940 million) issue in September 2025 is cited as a clear model for other sovereigns considering EUGBS adoption.

At the same time, the research identifies several areas where further progress is needed. The European Commission has not yet issued under the standard, and overall issuance represents only a limited portion of the EU’s taxonomy-aligned capital expenditure. Additionally, financial institutions have not yet used EUGBS bonds in a meaningful way to expand green lending or finance platforms.

According to the report, the standard has the potential to help issuers demonstrate their sustainability performance more clearly across four areas: long-term climate commitments, capital expenditure plans, delivery of green assets, and governance practices. To broaden uptake, the study highlights several opportunities, including converting existing bonds into EUGBS-labelled instruments, launching new structured or innovative products, and creating more taxonomy-aligned financial offerings that encourage wider issuer participation.

The analysis also recommends that policymakers explore ways to attract more international issuers to the standard. Expanding its global adoption would widen the universe of investable assets, support portfolio diversification, and direct more cross-border capital flows into green projects. Leung emphasised that one of the most important areas still needing development is impact reporting. Because the environmental impact of green bonds varies widely depending on the project, he noted that monitoring the quality of reporting and tracking issuers’ alignment over time will be essential to determining whether the EUGBS ultimately lives up to its ambition of being the market’s “gold standard.”

Subscribe to get the latest posts sent to your email.