U.S. oil and gas major Exxon Mobil Corp. (NYSE:XOM) is seeking environmental permits for its eighth project in Guyana, the first that will generate gas not linked to oil production. Exxon is also looking to explore another well at its massive offshore block, the head of the U.S. oil major in Guyana revealed on Wednesday. Exxon is getting ready for what promises to be a very active year for exploration and production in Guyana following upgrades that increased the capacity of two of its three floating facilities.

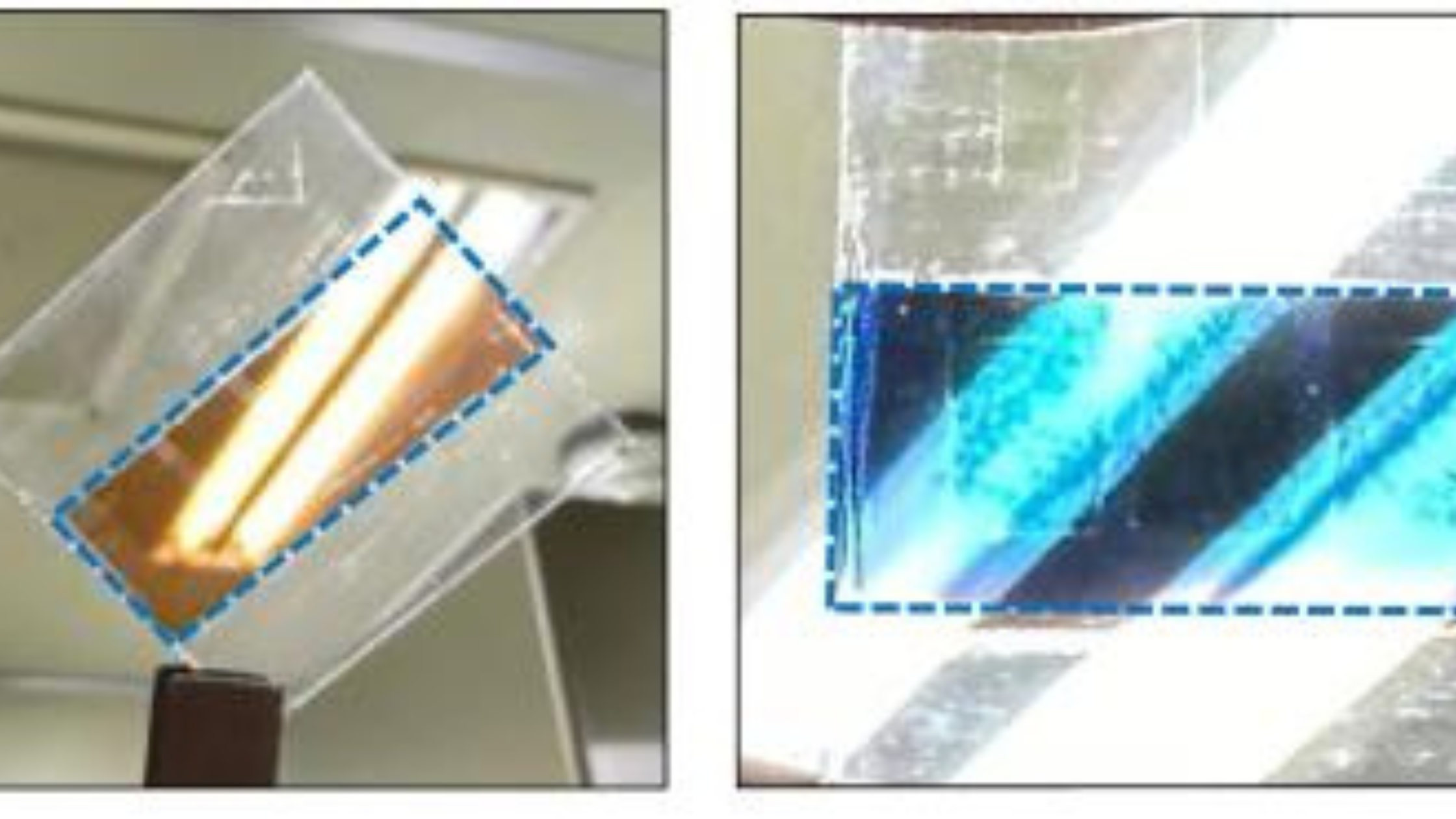

Last year, Netherlands-based SBM Offshore (OTCPK:SBFFF) (OTCPK:SBFFY) completed the $1.23B sale of its fifth floating production, storage, and offloading (FPSO) unit to Exxon for use in offshore Guyana. With a production capacity of 250,000 barrels of oil per day, the FPSO Jaguar has a daily associated gas treatment capacity of 540 million cubic feet and a water injection capacity of 300,000 barrels per day. According to Exxon, the project will significantly reduce the cost of electricity in Guyana. The proposed project would bring associated gas from ExxonMobil Guyana-operated projects offshore (Liza Phase 1 and 2) via pipeline to onshore gas processing facilities. The pipeline would transport up to ~50 million standard cubic feet per day of natural gas to the facilities.

‘;

document.write(write_html);

}

In November, Exxon announced that it has reached 500M barrels of oil produced from Guyana’s offshore Stabroek block, just five years after it kicked off production at the location. According to the company, the first three projects–Liza Phase 1, Liza Phase 2 and Payara–are already pumping more than 650K bbl/day. The Exxon-led consortium which includes Hess Corp. (NYSE:HES) and China’s Cnooc (OTCPK:CEOHF) have set a target to reach production of at least 1.3M bbl/day of oil by year-end 2027, a feat it hopes to achieve when six approved offshore projects come online. Data by the Guyana government has revealed that the consortium’s agreement generated $6.33B for the partners last year, with Exxon netting $2.9B, Hess earning $1.88B, while Cnooc amassed $1.52B from Stabroek. Exxon Mobil owns 45% of the Stabroek block; Hess 30% while Cnooc owns a 25% stake.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com

- BP Teases Fundamental Reset of Strategy to Boost Returns and Cash

- Tesla Sales Fell 59% In Germany In January

- Russia Claims to Be Fully Compliant with OPEC+ Output Quota