Iberdrola has become the first Spanish company—and the first globally—to issue a green bond that fully complies with both the new EU Green Bond Standard (EU GBS) and the Green Bond Principles of the International Capital Market Association (ICMA). The €750 million bond, issued over a 10-year term, marks a significant milestone in sustainable finance.

Investor interest in the transaction was exceptionally strong, with demand exceeding €3.7 billion—five times the amount offered. This represents the largest order book for an Iberdrola senior transaction since 2021, underscoring both market confidence in the company and growing appetite for green financial instruments that meet the highest international standards.

Key Highlights of the Offering:

- Amount Raised: €750 million

- Term: 10 years

- Coupon: 3.5%

- Credit Spread: 110 basis points over midswap

- Issue Premium: Negative, relative to theoretical value in the secondary market

- Investor Participation: Over 170 investors

- Geographic Distribution:

- United Kingdom: 32%

- France: 28%

- Germany: 11%

- Benelux: 10%

- Spain: 9%

- Other European countries: 10%

- Sustainable Investors: 93%

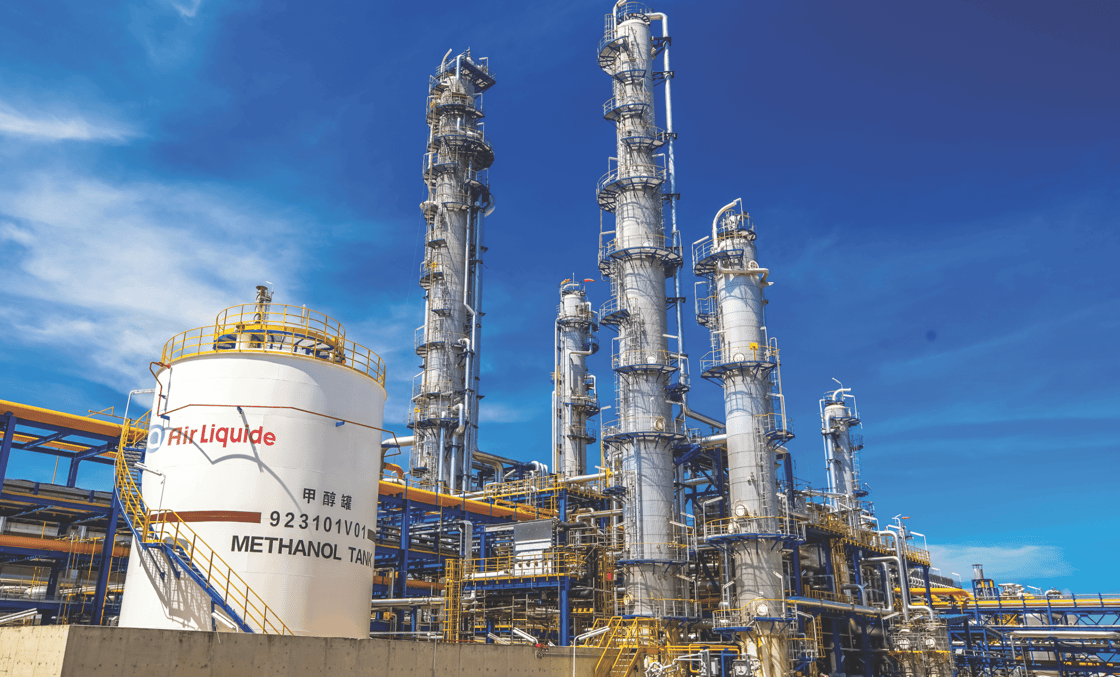

Proceeds from the bond will finance Iberdrola’s renewable energy projects—both operational and under construction—furthering the company’s commitment to clean energy development.

This is Iberdrola’s second public green bond offering in 2025, following a €400 million five-year equity-linked green bond issued in March, which carried a 1.5% coupon.

With this issuance, Iberdrola strengthens its already robust liquidity position, which stood at €20.9 billion at the end of March. The timing and pricing reflect favorable market conditions and strong investor confidence.