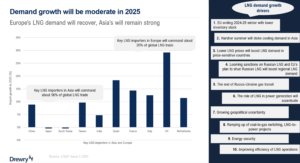

LNG prices are forecast to ease in 2025 – settling at $14-15 MMbtu – after recording new lows in 2024, according to Drewry Shipping Consultants’ research.

However the stabilising outlook comes amid warnings about tight supply, sporadic seasonal spikes, ongoing geopolitical uncertainty and disruptions. Rates will still be lower in 2025/26 but likely recover in 2027 and peaking in 2028.

LNG shipping rates plummeted 58% year-on-year in 2024 due to high vessel availability, limited new supply, subdued demand with ample gas storage in Europe, South Korea and Japan, and low industrial demand, as well as increased competition from renewables and nuclear.

… to continue reading this article and more, please login, register for free, or consider subscribing to gasworld