Nedbank Group and Norwegian investment firm Norfund have announced the acquisition of a “substantial minority” stake in Pele Energy Group, a renewable energy company co-founded by former JPMorgan Chase & Co banker, Gqi Raoleka.

The firms are investing $31 million (R573 million) in Pele Energy Group, according to the company’s Chief Financial Officer, Matt Wainwright. This investment follows a $135 million structured loan secured from Nedbank, Norfund, and South Africa’s Industrial Development Corporation (IDC). While the exact size of the stake remains undisclosed, Wainwright stated that the deal will strengthen Pele’s financial position and create a platform for further capital raising efforts.

“The company will target additional capital of R2 billion to R3 billion over the next two years,” Wainwright added.

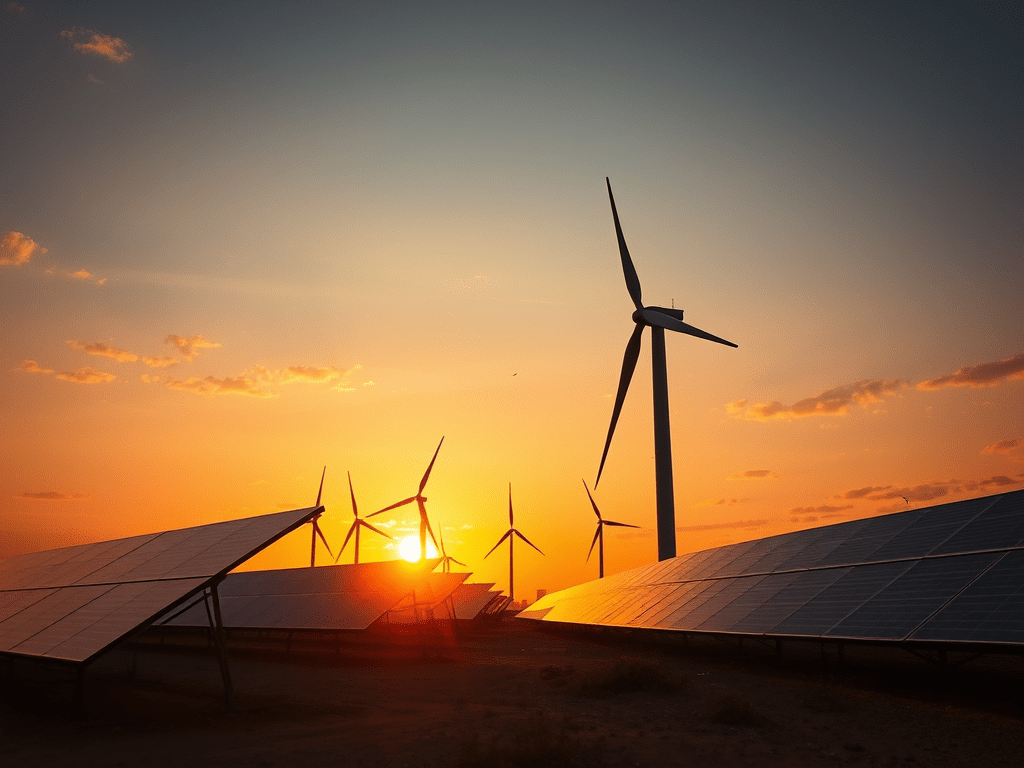

Pele Energy Group, along with other clean energy developers, is benefiting from a growing demand for self-sufficient power solutions in South Africa. While the country has achieved relative stability in its electricity supply, it previously faced frequent rolling blackouts. Renewable energy is seen as a crucial component in South Africa’s shift away from coal, which still accounts for over 80% of its electricity generation.

According to Wainwright, South Africa requires at least 30GW of renewable energy to support the grid’s evolving needs, including battery energy storage projects.

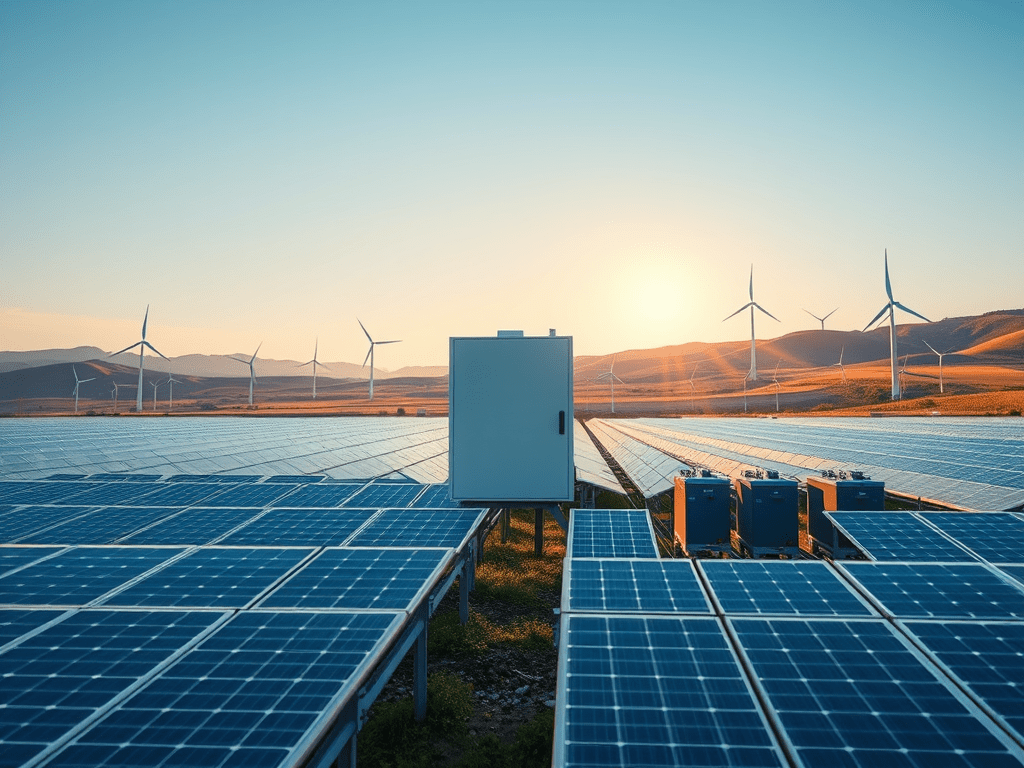

As part of the government’s renewable energy procurement programme, Pele and its partners successfully won bids in December for six out of eight approved projects. The company anticipates these projects to reach financial close between September 2024 and March 2026.