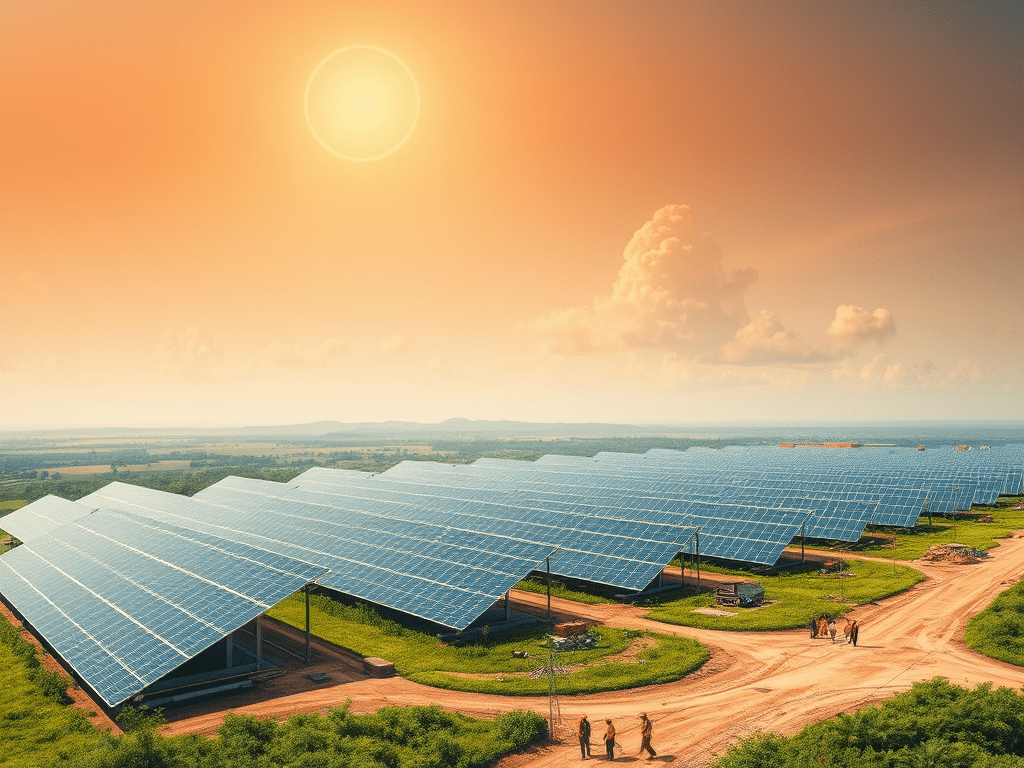

A cross-border team of lawyers from Norton Rose Fulbright advised Ecofin US Renewable Infrastructure Trust PLC on the sale of a U.S. distributed solar generation project portfolio to True Green Capital Fund IV. The deal had a headline enterprise value of $54.5 million, which included a cash payment of around $37.1 million at closing and the assumption of about $15.7 million in debt. The portfolio consists of 62 solar PV facilities spread across five different power markets in six states, with a total net capacity of 63.68 MWdc. The projects are fully contracted through power purchase agreements, averaging 16 years remaining on each contract.

This sale represents about 36% of Ecofin’s total portfolio, which has a generating capacity of 176.9 MW. It’s also the first transaction under the company’s managed wind-down strategy announced in September 2024. The deal was signed on December 12, 2024, and closed on March 10, 2025. Norton Rose Fulbright’s legal team was led by Becky Diffen (Austin), Richard Sheen, and Matthew O’Shea (London), with support from David Burton (New York), Quay Strozier, Andrew O’Shaughnessy (Washington, DC), Jared Kaplan, John F. Young (Chicago), Bob Greenslade (Denver), Caileen Kateri Gamache, Ibrahim Basit (Houston), and Ian Fox, Julia Lloyd, Mark Craggs, Elisabeth Trotter, and Jessica Liu (London).