In its first monetary policy decision of 2026, the Federal Reserve elected to hold the federal funds rate steady at 3.50%–3.75%, pausing further cuts after three reductions late last year. The decision, made at the January 27–28 Federal Open Market Committee meeting, reflects a cautious stance amid mixed economic signals and persistent inflation above target.

The FOMC statement shows that while economic activity “has been expanding at a solid moderate pace,” job gains have slowed and the unemployment rate has only “shown some signs of stabilization,” leading policymakers to resist further easing for now. The committee reiterated its dual mandate of maximum employment and returning inflation to its 2% goal, signaling that future moves will depend on incoming data.

The decision came as markets braced for a hold—CME FedWatch data showed a near-total chance of unchanged rates entering the meeting—and the Fed’s language underscored caution rather than conviction on additional cuts in the near term.

The backdrop to the decision includes rising energy prices and dollar weakness, which add complexity to the inflation outlook. U.S. crude (WTI) has climbed above the $63 per barrel mark in Wednesday afternoon trading, supported by winter weather supply disruptions, a softer dollar, and elevated geopolitical risk, making energy costs a continuing inflationary risk for policymakers.

Analysts say this dynamic complicates the Fed’s task: higher crude prices can feed through to consumer inflation, while a weaker dollar boosts commodity prices globally and supports risk assets. At the same time, the labor market shows signs of cooling, keeping pressure on policymakers to balance inflation control with economic growth considerations.

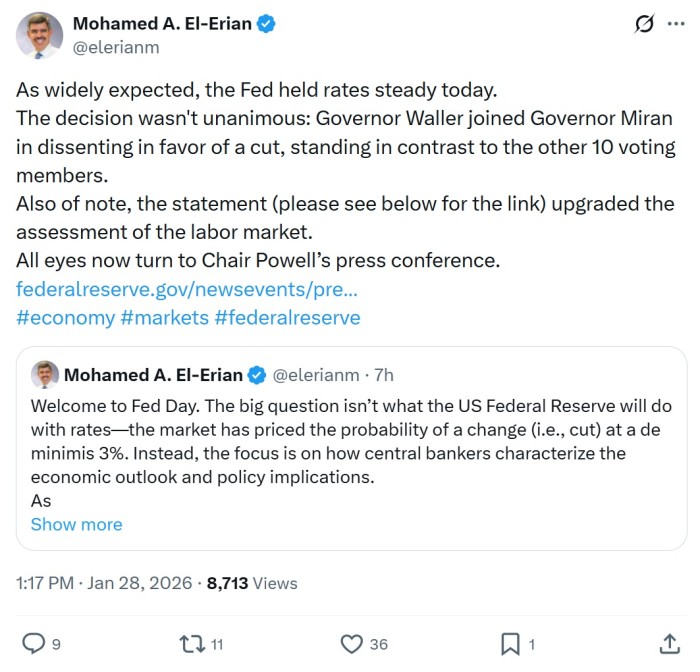

The Fed’s cautious pause comes amid political tensions around monetary policy, including pressure from the White House for deeper cuts and ongoing scrutiny of Fed Chair Jerome Powell’s leadership. The decision was not unanimous, with Governors Waller and Miran backing an immediate cut. The Fed held its line for now, but dissent signals that the easing cycle isn’t over yet.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com

- U.S. Considers Sanctions Relief to Revive Venezuela’s Oil Output

- Crude Rallies on Weather Disruptions and Fresh Geopolitical Nerves

- Indian Refiners Boost Middle East Supply To Offset Lost Russian Oil