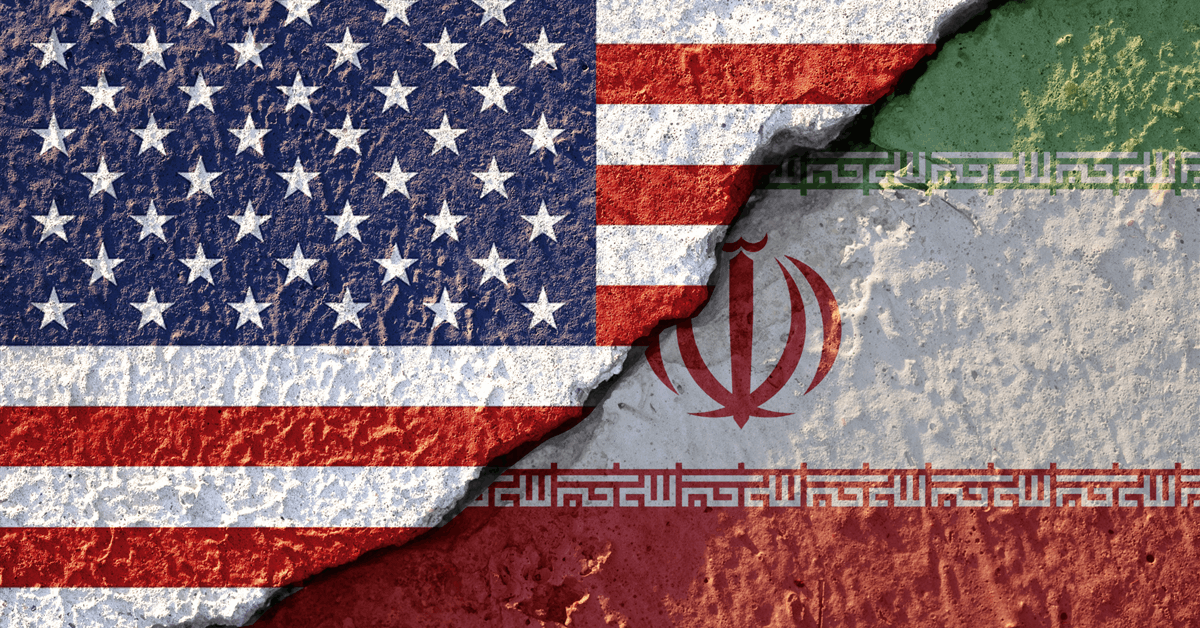

Crude oil prices were on course for their first weekly increase after three consecutive weekly losses, following President Trump’s latest threat to Iran that gave the country 10-15 days to make a deal or “really bad things” would happen.

At the time of writing, Brent crude was trading at $72.08 per barrel, with West Texas Intermediate at $66.89 per barrel, both up after hitting their highest levels in six months on Thursday after Trump’s threat.

“With a deal looking increasingly difficult to reach, it also means it will be more challenging to find a route to de-escalation, especially following the US military build-up we have seen in the region,” ING commodity strategists said in a note on Thursday. “And if de-escalation is not possible, the key question will then be what type of action the US takes and how Iran responds to this,” Warren Patterson and Ewa Mathey added.

The prospect of an oil supply disruption in Iran remains uncertain. “Market focus has clearly shifted to escalating Middle East tensions after the failure of multiple rounds of U.S.-Iran nuclear talks, even as investors debate whether any actual disruption will materialise,” Philip Nova analyst Priyanka Sachdeva said, as quoted by Reuters.

Bloomberg, meanwhile, noted that last year, President Trump had also indicated he wanted to go the diplomatic way but quickly reconsidered and ordered strikes on Iran, carried out by the United States and Israel together.

In further fuel for oil prices, the latest talks between Russia and Ukraine ended with no visible progress towards peace, making the prospect of sanction removal for Russia’s oil industry more distant.

Meanwhile, physical oil markets are suggesting that the oversupply assumptions may have been exaggerated. “The shape of the ICE Brent forward curve continues to suggest that the market is tighter than what many analysts have been expecting, including us,” ING’s Patterson and Manthey said in their note, adding that said market was in backwardation for both this year and next.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com

- U.S. Attacks Alleged Drug Boats as Venezuela Oil Crackdown Escalates

- Libya Awards Fuel Supply Deals To Western Firms, Aims To Cut Russian Imports

- U.S. to Redirect Venezuelan Oil Royalties Into a Treasury-Controlled Fund