An unusually reticent president hasn’t had much to say about sanctions on Russia and Iran’s crude exports since returning to the White House.

The detained Eagle S tanker, part of the fleet carrying Russian oil, off Finland this month.Photographer: Roni Rekomaa/Bloomberg

By

Welcome to our guide to the energy and commodities powering the global economy. Today, reporter Weilun Soon says former US President Joe Biden’s efforts to crimp Russian and Iranian oil revenues risk going to waste. is a look at the fugitive banker who may be helping Russian firms beat American sanctions.

Donald Trump returned to power this week with a blitz of energy- and climate-related executive actions, but he’s been uncharacteristically quiet on measures to curb Russian and Iranian oil exports.

The US president’s reticence comes after Joe Biden’s administration aggressively targeted the two countries’ combined $220 billion in oil revenues during the final months of his term.

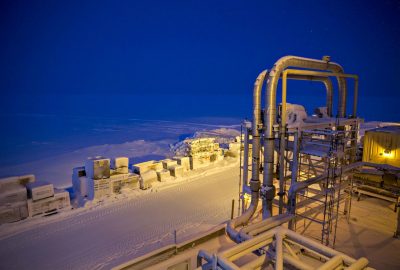

Three rounds of sanctions on Iran’s oil industry since October have squeezed flows, while unprecedented action against Russia earlier this month caused a on some routes and sent buyers of the country’s crude searching for alternatives.

Market chatter in the run-up to Monday’s inauguration was rife with speculation that Trump may double down on Biden’s efforts, further complicating the global energy trade.

Sources: US Treasury Department, UK Treasury, European Union

Note: 68 tankers have been sanctioned by more than one entity

In remarks at the White House, Trump did say he’s likely to impose more measures on Russia if President Vladimir Putin doesn’t come to the negotiating table to end the war in Ukraine. He hasn’t had much to say on Iran, though, despite the fact that his advisers are reportedly working on a targeting its oil industry.

But even as the market clambers to cope with Biden’s measures, the so-called dark fleet of tankers is regrouping to ensure that penalized oil exports continue moving.

At least one newly called at the Russian Pacific port of Kozmino in an attempt to show that it’s business as usual, while , which hasn’t handled Russian crude since before the invasion of Ukraine, is heading toward the same terminal.

In Europe, meanwhile, Moscow is swapping tankers between ports in the Arctic and Baltic seas in an attempt to avoid the restrictions.

The workarounds show how quickly the market can rebuild disrupted supply lines, and they serve as a warning about the dangers of inaction. Unless Trump acts quickly to keep up the pressure, Biden’s efforts to destabilize Moscow and Tehran’s oil industries may have been for naught.

–Weilun Soon, Bloomberg News

Share This:

More News Articles