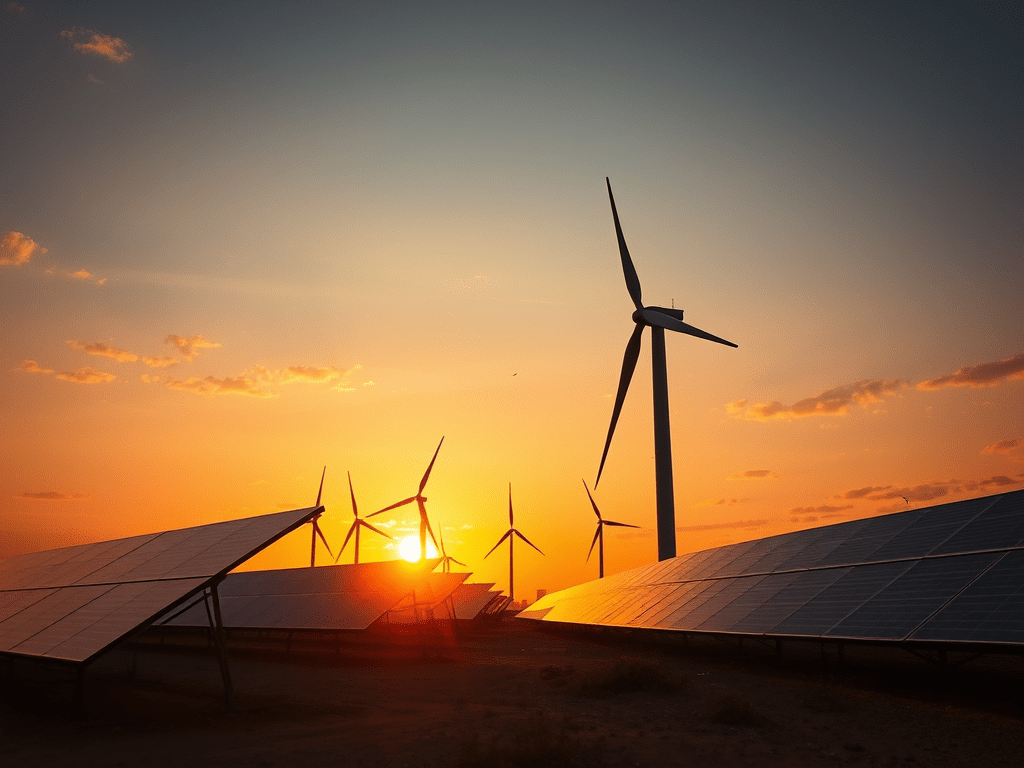

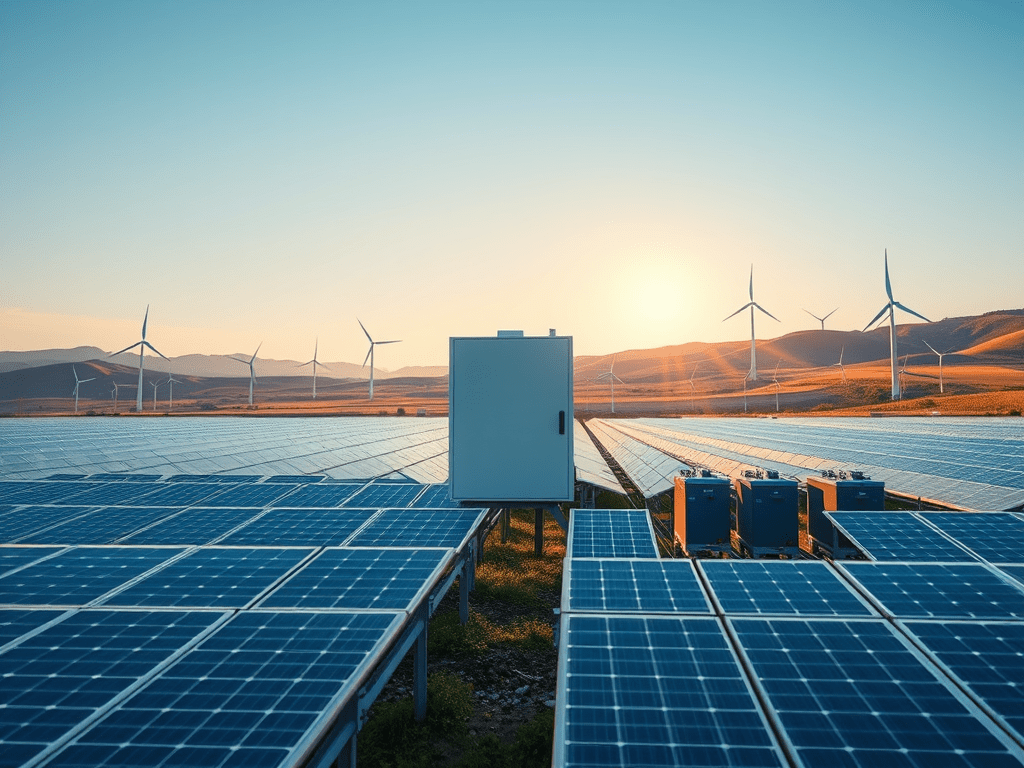

For years, decarbonization efforts have focused on highly visible technologies such as solar farms, wind installations, and green hydrogen hubs. However, behind the scenes, two transformative forces, Artificial Intelligence (AI) and ESG frameworks, are driving fundamental change in how businesses plan, execute, and measure their transition strategies. These tools aren’t merely influencing sustainability practices; they’re reshaping the operational logic behind energy decarbonization.

Decarbonization is no longer a choice

Climate goals are no longer distant aspirations. They are shaping how countries legislate, how businesses report, and how investors allocate capital. India, for instance, has committed to reducing the emissions intensity of its GDP by 45 percent by 2030 and aims to source half of its electricity capacity from non-fossil fuels. This shift, announced by the Ministry of Environment and Forests and reported on, carries far-reaching implications across various industries.

As regulatory requirements tighten, companies must treat decarbonization as a core business necessity essential for securing investments, market access, and long-term operational viability.

The rise of AI as a decarbonization enabler

At the same time, artificial intelligence is becoming the invisible infrastructure of clean energy systems. From managing demand on smart grids to optimizing renewable power generation, AI is helping energy providers make faster, cleaner, and more efficient decisions.

Its applications stretch well beyond utilities. Manufacturers are using AI to monitor equipment efficiency in real time. Logistics companies are cutting fuel use by mapping more efficient transport routes. Even carbon emissions are being tracked across supply chains through machine learning models that quantify Scope 3 footprints with a level of detail previously out of reach. In India, sectors like cement, steel, and automotive are already piloting AI-driven systems to reduce thermal losses and identify low-carbon production routes.

Supply chains will decide the pace of transition

While energy generation gets the spotlight, it’s the supply chain that will determine how quickly and effectively decarbonization takes root. Hard-to-abate emissions often lie buried in procurement choices, vendor networks, and material flows. This is where AI and ESG intersect most powerfully. AI can map emissions across complex, multi-tier supply chains, while ESG frameworks bring these insights into boardroom discussions and investor reports. In India’s manufacturing-heavy economy, decarbonizing supply chains isn’t just about carbon; it’s about competitiveness, compliance, and continuity.

The road ahead will be measured in quiet wins

The energy transition will not be shaped by bold promises alone; it demands disciplined execution backed by robust governance and intelligent systems. ESG provides the framework for transparency and accountability, while AI delivers the analytical depth needed for strategic decision-making. Companies that effectively combine these two forces won’t merely comply, they’ll lead. In the evolving climate-conscious economy, true leadership will be measured not by volume but by readiness, consistency, and results.

Subscribe to get the latest posts sent to your email.