Oil majors have grown more efficient in the years since the shale bubble burst in 2014, pumping record production with a fraction of the workforce.

By and

An oilfield crew works a service rig during a state-funded oil well plugging operation in Midland. Photographer: Eli Hartman/Bloomberg

Get the Latest US Focused Energy News Delivered to You! It’s FREE:

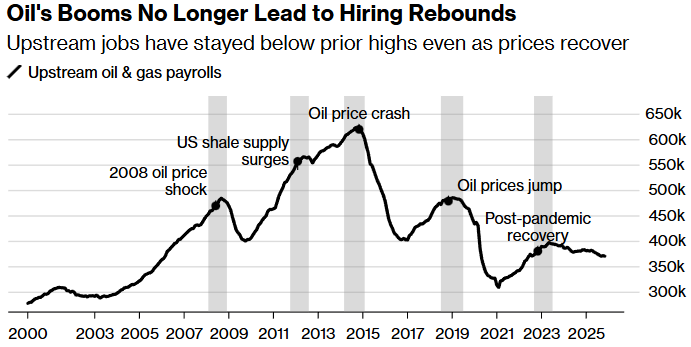

The US oil and gas industry slashed 40% of its workforce over the past decade of record-breaking production — and those jobs are unlikely to return.

In an industry known for its booms and busts, higher oil prices have historically spurred greater drilling activity, and therefore more hiring. But this link broke after years of poor returns to investors following the bursting of the shale bubble in the mid-2010s.

New technologies to drill faster for cheaper, corporate mergers and robots replacing humans on rigs resulted in the disappearance of some 250,000 jobs since the sector’s employment peaked in 2014. Production surged 50% during that time.

Source: Bureau of Labor Statistics, Energy Information Administration

Note: Upstream oil and gas employment is calculated as the combined employment of three BLS industries: Oil & Gas Extraction, Drilling Oil & Gas Wells, and Support Activities for Oil & Gas Operations.

In 2025, even as output reached new highs and a pro-drilling president returned to the White House, payrolls are hovering at the lowest level in three years.

“This industry has always been cyclical. You ride the wave when it’s good, and you brace for the downturn,” said Karr Ingham, president of the Texas Alliance of Energy Producers. “But what’s different now is, even when prices recover, we don’t see the same hiring bounce we used to.”

That means fewer career opportunities for people like Shaun Carter, a geologist who was laid off when the Oklahoma-based exploration and production company he was working for in 2019 unexpectedly shuttered.

Carter took up truck driving out of Houston — crisscrossing the Southeast and Midwest — assuming it would be temporary. More than six years later, he’s still driving, and his dreams of returning to the industry are fading.

“My hopes aren’t very high,” Carter said, calling from his truck while waiting at a loading dock.

In the years after the 2014 oil price crash, investors pushed companies to focus on profits instead of growth, triggering a wave of consolidation and job losses. Mergers and acquisitions activity in the sector has exceeded $500 billion since the start of 2023, according to Bloomberg calculations, more than a 20% increase compared with the prior three years. Major players continued to reduce headcount in the past year as crude prices fell, with Chevron Corp., ConocoPhillips and Exxon Mobil Corp. all announcing job cuts in 2025.

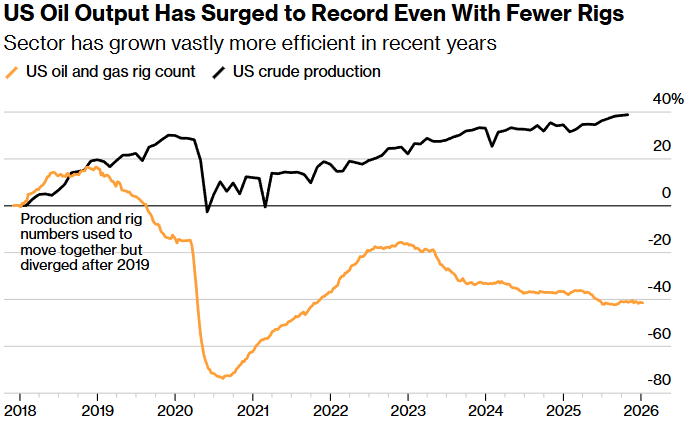

US oil producers are pumping a record 13.8 million barrels of crude a day, and they’re doing so with less than a third of the active drilling rigs than in 2014. That means each rig is now producing roughly four times as much oil as it did a decade ago — “brutally efficient,” as Ingham says — thanks to powerful equipment, refined techniques, automation as well as incentives to encourage workers to drill faster.

Source: Baker Hughes, Energy Information Administration

Note: Data represents percentage change since December 2017

While the Trump administration apprehended former Venezuela President Nicolás Maduro in part to access the nation’s vast oil reserves, major US oil executives have expressed caution about investing in the country. Analysts similarly doubt that the move will open up more jobs in the sector for Americans, as the domestic workforce is available and probably much cheaper, said Fernando Valle, managing director at Hedgeye Risk Management LLC.

Read More:

Since taking office last year, President Donald Trump has made it a priority to increase US oil and gas production by relaxing environmental regulations and pushing to open more federal land and waters to drilling. But some experts doubt that proposals to expand offshore drilling will result in new jobs. Those rigs will be unmanned in the future, said Ramanan Krishnamoorti, an energy professor at the University of Houston.

“They’ll be entirely run by robots and automation, with much of it handled onshore,” Krishnamoorti said. “We’re likely to see a very different oil and gas industry — far fewer jobs, and the remaining ones out of harm’s way.”

With oil currently priced around $60 a barrel, producers in some regions are right around that breakeven level that’s just high enough to keep wells running but too low to fatten profits. It’s a fine line for Trump too, who wants to advocate for the industry’s profitability but lower gas prices for everyday Americans.

Energy executives polled by the Federal Reserve Bank of Dallas said oil prices need to be around $65 a barrel to justify drilling a new well. Prices have remained below that level for the past three months, and even a spike would need to be sustained to persuade producers to ramp up spending.

“There’s this squeeze of trying to wring out as much cost as possible,” said Trey Cowan, an analyst with the Institute for Energy Economics and Financial Analysis. “Labor is the first place that really takes the punch.”

Read More:

Thanks in part to the efficiencies, some of the producers who have slashed jobs are performing better than expected. In the latest quarter, ConocoPhillips’ production exceeded its own highest estimate despite a decline in capital spending. Similarly, Chevron saw increased output in the Permian Basin even with fewer rigs.

Carter has come close to getting back into the industry multiple times. Most recently, Marathon Oil called him in May 2024: After he was a runner-up for an earlier position, the company wanted him to consider a different opening. He said he was interested, and was told to expect a call in the coming days.

Days later, driving his rig to a Costco in Tulsa, Oklahoma, he heard on the radio that ConocoPhillips had submitted a bid to buy Marathon.

“I was like, ‘Oh no, I know what that means,’” Carter said. He never heard about the position again.

— With assistance from David Wethe, Kevin Crowley, Alex Newman, Jade Khatib, Cecile Daurat, Marie Monteleone, and Reade Pickert

Share This:

More News Articles