Industry growing uneasy about falling crude prices and tariff uncertainty

President Donald Trump is set to meet with top oil executives at the White House this week as he charts plans to stoke domestic energy production, even as the industry grows uneasy about falling crude prices and tariff uncertainty.

The encounter is set to be Trump’s first sit-down with a large group of oil and gas leaders since his inauguration and his creation of a new National Energy Dominance Council to quarterback policy. The planned meeting was described by people familiar with the matter, who asked not to be named because it had not been formally announced.

Invited participants include executives leading some of the nation’s largest oil companies, including members of the industry’s top trade group, the American Petroleum Institute. Interior Secretary Doug Burgum, the head of Trump’s energy dominance council, and Chris Wright, the energy secretary who is the panel’s vice chair, are also expected to attend.

The session, like Trump’s meetings with executives from other industries, is seen as an opportunity to discuss policy priorities at the opening of his second term. Trump held similar meetings during his first term, including to discuss an oil price collapse fed by the pandemic and a battle for market share between Russia and Saudi Arabia.

The president has an affinity for America’s oil and gas bounty — he frequently calls it “liquid gold” — and industry leaders, including billionaires Harold Hamm of Continental Resources Inc. and Kelcy Warren of Energy Transfer LP, backed his 2024 campaign.

Trump has already launched a series of policy changes intended to boost demand for oil and gas, while making it easier and less costly to produce those fossil fuels. It’s part of his broader campaign to “unleash American energy dominance.”

Yet the president’s efforts to juice U.S. oil and gas output — while also slashing energy prices — may be on a collision course, a warning increasingly sounded by oil leaders.

Hamm has said that higher prices — around US$80 per barrel — are needed to unlock some production.

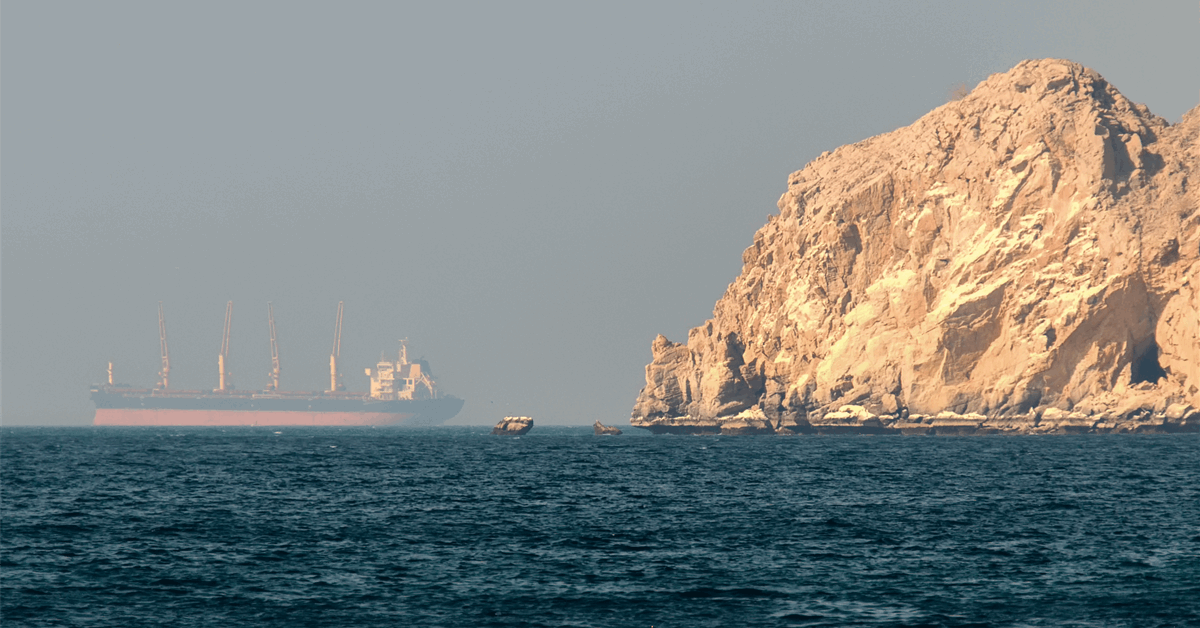

West Texas Intermediate crude, the U.S. benchmark, is hovering around US$67, a price decline tied to increased output from OPEC+ and concerns about weak Chinese demand.

“There are a lot of fields that are getting to the point that’s real tough to keep that cost of supply down,” Hamm told Bloomberg Television on Thursday. Once oil prices are below US$50 — a level touted by the administration — “you’re below the point where you’re going to ‘drill, baby, drill,’” Hamm added.

Trump has cheered the drop in oil prices and said that lowering energy costs will release pressure on U.S. consumers. On the campaign trail, he pledged to cut energy prices in half — an ambitious goal that analysts say could mean that many U.S. producers couldn’t afford to keep drilling.

“President Trump’s energy agenda has set our nation on a path toward energy dominance,” said Bethany Williams, spokesperson for the American Petroleum Institute.

“We appreciate the opportunity to discuss how American oil and natural gas are driving economic growth, strengthening our national security and supporting consumers with the president and his team.”

Some oil industry leaders are also uneasy about Trump’s trade policy, marked by threats to impose widespread tariffs, including levies on automobiles, semiconductors and pharmaceuticals.

Duties on steel and aluminum, which went into effect earlier this week, are a particular challenge for domestic drillers, who rely on specialty metals for pipes and production equipment.

During Trump’s first term, oil companies won tariff exemptions on some products, but the president has declined those waivers this time.

Some industry leaders have also cautioned administration officials that the boldest bids to undo climate policy could expose oil companies to more litigation and limit their opportunity to sell natural gas in Europe, which has clamped down on methane emissions.

Bloomberg.com

Share This:

More News Articles