U.S. President Donald Trump will speak to Russia’s Vladimir Putin on Tuesday about ending the Ukraine war, with territorial concessions in Ukraine as well as control of the Zaporizhzhia nuclear power plant likely to feature in the talks.

“We want to see if we can bring that war to an end,” Trump told reporters on Air Force One. “Maybe we can, maybe we can’t, but I think we have a very good chance.’’

‘;

document.write(write_html);

}

Earlier, Ukrainian President Volodymyr Zelenskyy declined a proposal by Trump to acquire approximately 50% of Ukraine’s rare earth mineral rights. Valued at several trillion dollars, Ukraine’s mineral reserves include lithium, titanium and graphite which are essential for high-tech industries. The proposal was delivered by U.S. Treasury Secretary Scott Bessent as part of a bid to compensate Washington for assistance to Kyiv. Trump had suggested that Ukraine owed the United States $500 billion worth of resources for its past military support. However, Zelenskyy sought better terms, including U.S. and European security guarantees. Trump’s proposal did not include provisions for future assistance, which Zelenskyy deems necessary. Zelenskyy’s team has developed an offer for a mineral partnership in exchange for security guarantees, which was announced earlier this month.

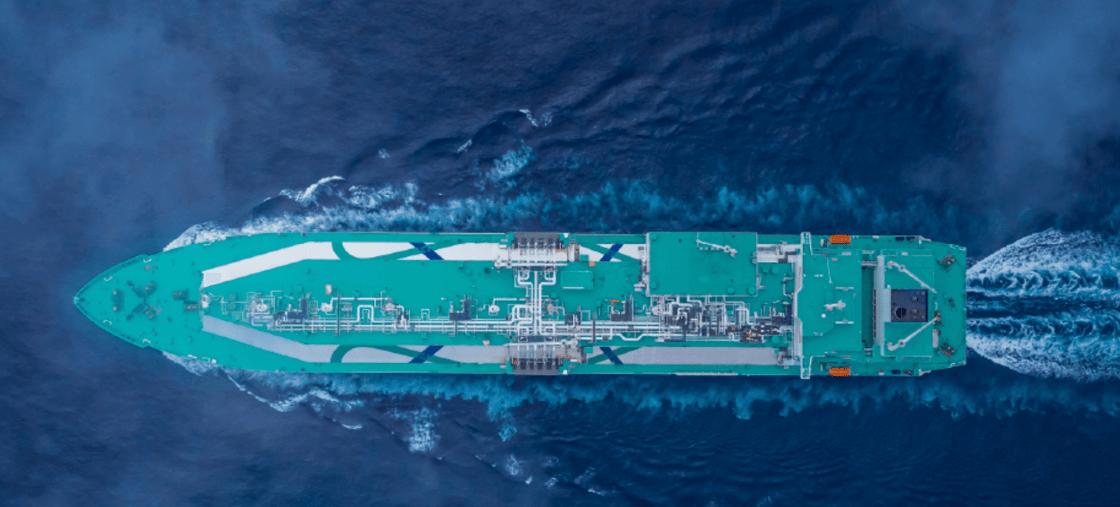

A ceasefire to the Russia-Ukraine war could be bearish for oil prices if Trump pushes for the removal of sanctions on the Russian energy industry, Tyler Richey, co-editor at Sevens Report Research, told MarketWatch. Geopolitical stability may also “largely extinguish the still simmering ‘fear bid’ in the oil market.” Sanctions by the Biden administration roughly tripled the number of directly sanctioned Russian crude oil tankers, enough to affect around 900,000 barrels per day (bpd). Whereas it’s highly likely that Russia will try to circumvent the sanctions by employing even more shadow fleet tankers and ship-to-ship transfers, StanChart sees 500,000 bpd of displacements over the next six months.

The EU has floated the idea of resuming purchases of Russian pipeline gas as part of a potential settlement of the Russia-Ukraine war. Backed by Hungarian and German officials, the proposal argues that the move could give both Russia and Europe incentives to maintain a peace deal while stabilizing the continent’s energy market.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com

- German Energy Minister: Europe Shouldn’t Revive Nord Stream Gas Pipelines

- Qatar Cuts Prices for Its Oil

- Goldman Sachs Cuts Oil Price Outlook Amid Oversupply Fears