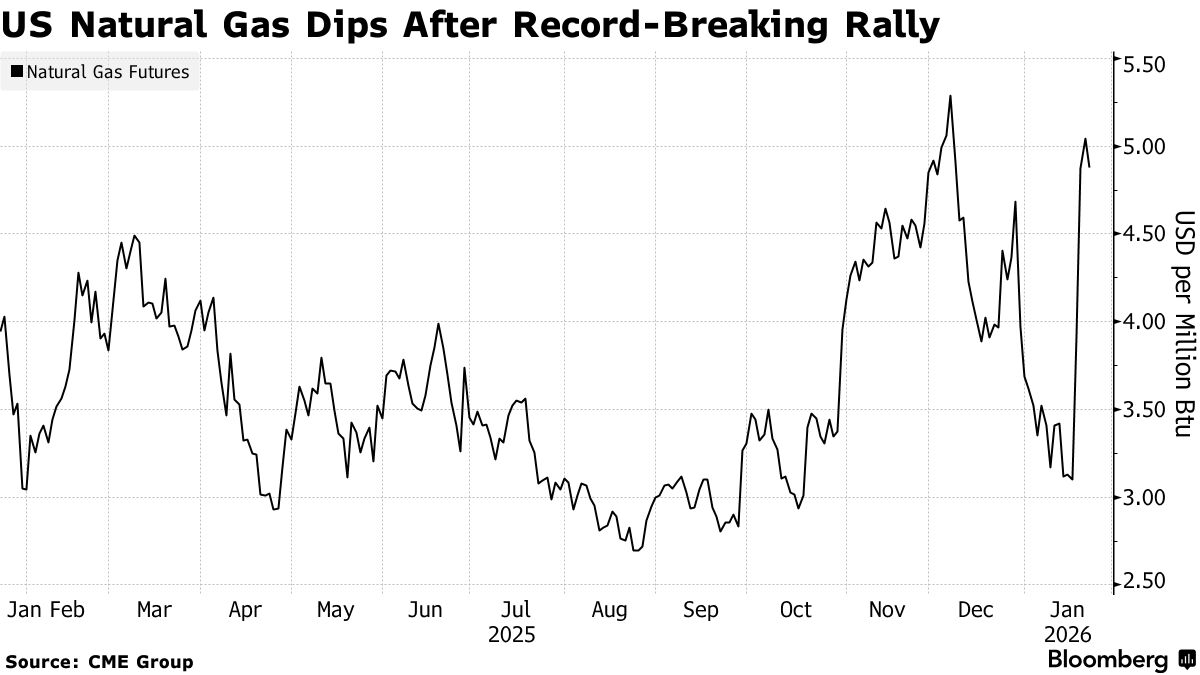

US natural gas futures pared a record breaking three-day rally, after traders finished exiting short positions and the market braced for a historic winter storm.

Front-month contracts dropped as much as 7.6% to $4.660 per million British thermal units on Friday, after surging 63% over the previous three sessions. Prices were still on track for their biggest weekly gain in records going back to 1990.

This week’s surge was driven by forecasts for below normal temperatures across most of the country, threatening to boost gas consumption and drain inventories. The freeze — particularly in the southern gas-producing states — has raised concerns about water icing in pipelines, potentially disrupting output from this weekend.

The shift in US weather forecasts came days after hedge funds turned more bearish on gas at the end of last week, leaving the market poised for a rally as traders rushed to close out those wagers. Gas prices briefly climbed above $5.50 per million Btu on Thursday, a level that a Citigroup analysis on Thursday showed would wipe out all shorts.

There are signs that the current price spike will be short lived. February futures are trading at a steep premium to the , signaling the market is focused on the near-term supply crunch. The February contract was down 3.9% to $4.847 per million Btu at 4:09 p.m. in Singapore.

Share This:

More News Articles