By , , and

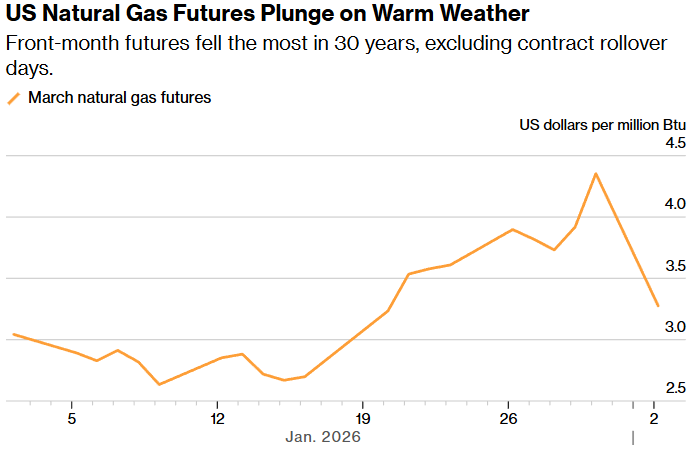

US natural gas futures plummeted on Monday as weather forecasts for mid-February shifted significantly warmer, marking the largest daily loss for the front-month contract on a percentage basis since 1995, excluding contract rollover days.

The March contract settled down 25.7% to $3.237 per million British thermal units, more than erasing steep gains on Friday that pushed up prices ahead of record-breaking cold weather.

Get the Latest US Focused Energy News Delivered to You! It’s FREE:

While frigid temperatures are gripping the southern US and prompting power-saving efforts, the outlook through the middle of the month is warmer. The private forecaster Commodity Weather Group on Monday showed a loss of 26.3 heating degree days, a measure of demand for furnace fuels. That is likely to decrease demand for natural gas, which is used for heating and power generation, and reduce the likelihood of cold weather-related supply disruptions. Midday weather forecasts adding back about 6.3 heating degree days did nothing to stem the losses.

Source: NYMEX

Crude oil and other commodities, particularly metals, also plunged Monday as President Donald Trump said the US was entering talks with Iran, cutting the risk premium driven by the possibility of conflict between the countries.

Trend-following algorithmic commodity trading advisors closed out of some bullish bets, moving to an 18% net-short position from 9% net short as the plummeting gas price passed key price thresholds, according to analytics firm Kpler Ltd.

US gas production was up to 111.6 billion cubic feet per day, the highest since Jan. 20 as production comes back online after freezing temperatures disrupted supplies in gas-producing basins across the US. This has been “a far faster recovery than historic freeze-offs,” particularly in the prolific oil- and gas-bearing Permian Basin, Eli Rubin, senior energy analyst at EBW Analytics Group, wrote in a note to clients Monday.

Top US gas producers Expand Energy and EQT Corp. fell as much as 4.8% and 5.5%, respectively.

US gas futures have whipsawed over the past few weeks, with the February futures contract surging to a three-year high last week, driven by a winter storm that boosted heating demand. The contract more than doubled in seven final trading days before expiring.

Share This:

More News Articles