The U.S.-Africa Energy Forum (USAEF) has announced a strategic partnership with Welligence, a leading provider of energy research and advisory services, to help U.S. investors access Africa’s most promising energy opportunities. This collaboration aims to bridge the gap between American investors and Africa’s evolving energy sector, particularly in oil, gas, and LNG markets.

Welligence, with its deep expertise in African energy markets, will support U.S. companies in navigating the continent’s dynamic energy landscape. Known for its comprehensive insights into Africa’s oil, gas, and LNG sectors, Welligence provides critical data on reserves and infrastructure developments across key African markets, enabling investors to assess risks, identify opportunities, and optimize investment strategies.

As a trusted advisor, Welligence’s data-driven approach will enhance USAEF’s mission to facilitate high-value engagements between American stakeholders and African energy leaders. This partnership also reinforces USAEF’s position as a data-driven event, focusing on the latest trends in energy exploration and investment.

The collaboration will feature key energy developments, including data-driven exploration in Africa. Advanced seismic data and predictive modeling are improving the ability to identify untapped reserves in leading African exploration markets. Notable upcoming events include Angola’s 2025 offshore block tender, Libya’s 2025 bid round, and new exploration opportunities in the Republic of Congo’s coastal basin. These developments will be central to USAEF’s efforts to showcase Africa’s growing energy sector and foster strategic partnerships.

In its 2024 exploration roundup, Welligence highlighted significant upstream discoveries, including Namibia’s Mopane discovery, Ivory Coast’s Calao discovery, and other notable finds in Angola, Congo, and Guinea-Bissau. These developments are expected to drive future exploration and investment in Africa’s energy markets.

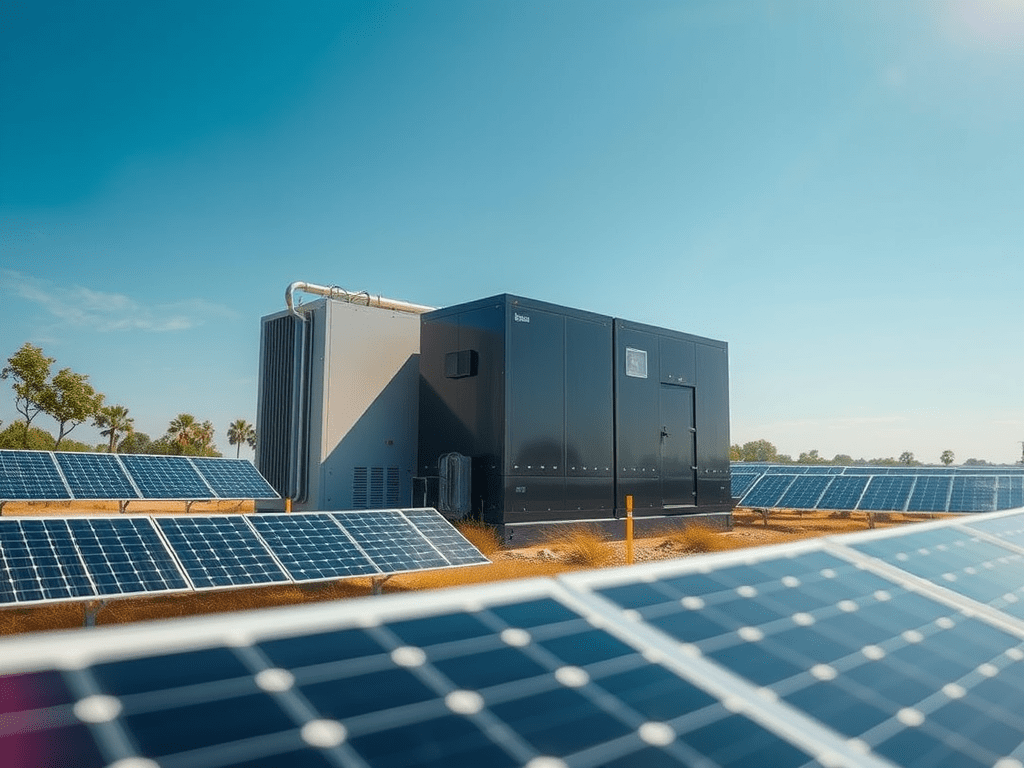

USAEF continues to serve as a key platform for driving U.S.-Africa energy investment, connecting American investors with high-growth opportunities across the continent. Through its partnership with Welligence, USAEF will offer unparalleled access to critical energy projects, spanning oil and gas exploration as well as large-scale renewable initiatives.

James Chester, CEO of Energy Capital & Power, emphasized the strategic importance of the partnership, stating, “Welligence’s extensive knowledge of Africa’s energy markets and its role in providing strategic insights aligns perfectly with USAEF’s goal to bridge the gap between U.S. investors and Africa’s growing energy opportunities. This partnership ensures that American stakeholders are well-positioned to tap into Africa’s energy potential and contribute to the continent’s ongoing energy transformation.”