By and

Venture Global Inc. slashed the marketed range for its initial public offering, bringing the potential valuation well below its $110 billion target.

The liquefied natural gas exporter is marketing 70 million shares in the offering for $23 to $27 each, a more than 40% drop from the $40 to $46 per share it had targeted earlier, according to an earlier filing with the US Securities and Exchange Commission.

At the top of the new range, the company would raise $1.9 billion in the listing, and would have a market value of about $65 billion, based on the outstanding shares.

Investors approached during the marketing of the deal wanted a lower valuation range, according to people familiar with the matter, who asked not to be identified as the information isn’t public. A representative for Venture Global didn’t immediately respond to requests for comment.

The lower pricing would come as a setback for potential IPO candidates in the US energy sector, which have been looking to Venture Global’s offering to help revive sentiment around first-time share sales in the sector. Just six energy IPOs priced on US exchanges in 2024, raising $667 million to mark the lowest volume for energy IPOs in 21 years, data compiled by Bloomberg show.

Still, Venture Global is targeting a lofty valuation relative to competitors. Cheniere Energy Inc., the largest LNG exporter in the US, has a market value of $54 billion after jumping 48% over the past year.

Read More:

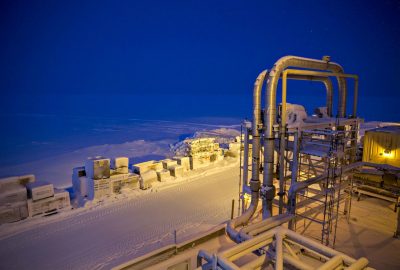

Venture Global, founded outside of Washington, DC, was viewed as a startup compared to the established energy companies and climbed to quickly build two export facilities in Louisiana.

The company is locked in arbitration battles with some of the world’s biggest energy players, which are also its customers. BP Plc and Shell Plc are in a with Venture Global over its first plant, Calcasieu Pass, due to a prolonged start to their contracts almost three years since the facility first began loading cargoes.

Venture Global had net income of $756 million in the nine months ended Sept. 30 on revenue of $3.4 billion, versus net income of $3.6 billion on revenue of $6.3 billion in the same period in 2023, according to the filing.

LNG is expected to play an increasingly central role in global energy markets in the years ahead, as nations seek a cleaner-burning alternative to oil and coal. The US’s position as the world’s largest supplier of the fuel is poised to grow even stronger, as Donald Trump’s return to the White House was accompanied by a sweeping overhaul of US energy policy to return the emphasis to fossil-fuel production.

Read More:

— With assistance from Bre Bradham

Share This:

More News Articles