Zelestra, a global renewable energy company with a strong focus on multi-technology solutions and customer-driven development, has secured a €130 million syndicated equity-bond facility from Santander, with additional support from ICO (Instituto de Crédito Oficial) and Cesce (Compañía Española de Seguros de Crédito a la Exportación).

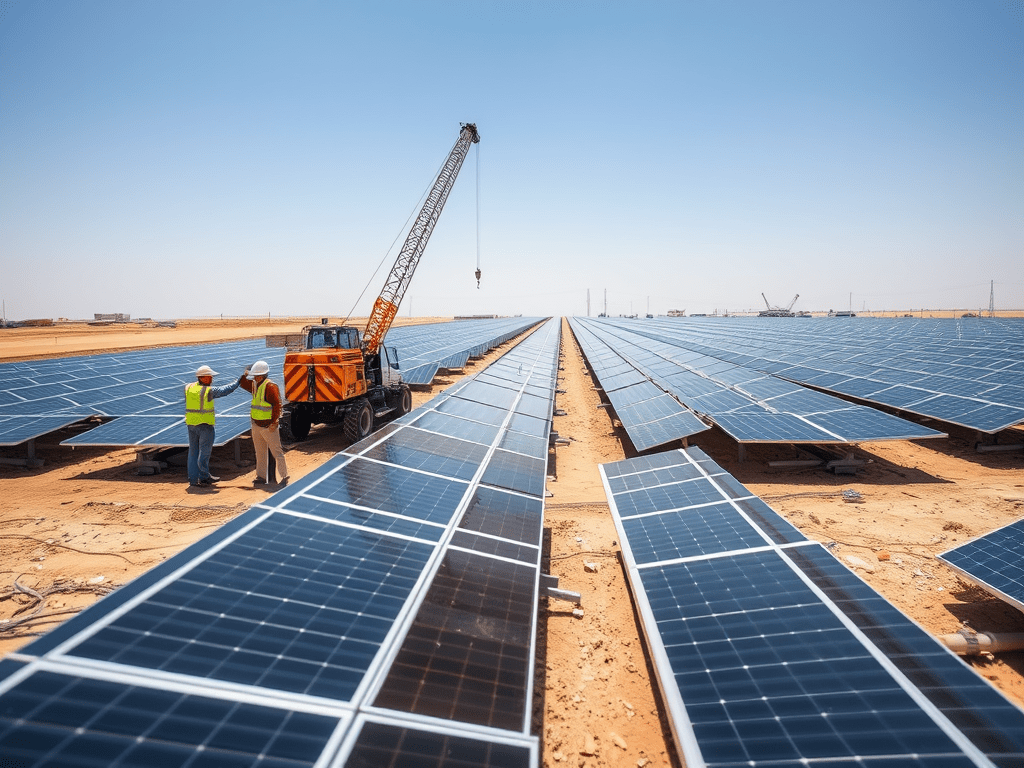

This financing will enable Zelestra to advance roughly 500 MW of contracted renewable energy projects across Italy, Germany, and the United States. The projects, which include new wind, solar, and battery energy storage developments, are scheduled to enter the construction phase in 2026 and 2027. Beyond providing capital for these upcoming projects, the facility also helps diversify Zelestra’s financing structure and reflects the strong confidence that major financial institutions have in the company’s long-term global strategy.

According to Xavier Puig, Chief Financial Officer of Zelestra, the facility represents an important milestone for the company. He noted that Zelestra continues to expand its global presence through a customer-centric approach and welcomed the support of leading international lenders and credit agencies. He added that this funding will play a key role in driving Zelestra’s growth and in delivering large-scale clean energy projects for its customers and the communities they serve worldwide.

Cesce, acting as Spain’s Export Credit Agency, is responsible for managing credit and investment insurance on behalf of the Spanish State. The agency oversees political, commercial, and extraordinary risks that arise as Spanish companies expand internationally, offering protection and support to facilitate their global operations.

Subscribe to get the latest posts sent to your email.