Abu Dhabi National Energy Company PJSC (TAQA), a major integrated utilities company spanning Europe, the Middle East, and Africa, has announced its financial performance for the first quarter ending 31 March 2025.

TAQA recorded a 3.8% increase in revenue year-on-year, reaching AED 14.2 billion. This growth was mainly attributed to higher pass-through costs within its Transmission and Distribution (T&D) segment. However, despite the revenue uptick, the company experienced a 6.7% drop in EBITDA to AED 5.3 billion and a 1.5% decrease in net income to AED 2.1 billion. These declines were primarily driven by ongoing volatility in commodity markets and a reduced production profile in its Oil and Gas division. Nevertheless, the Group’s core utilities operations remained resilient and continued to support overall performance.

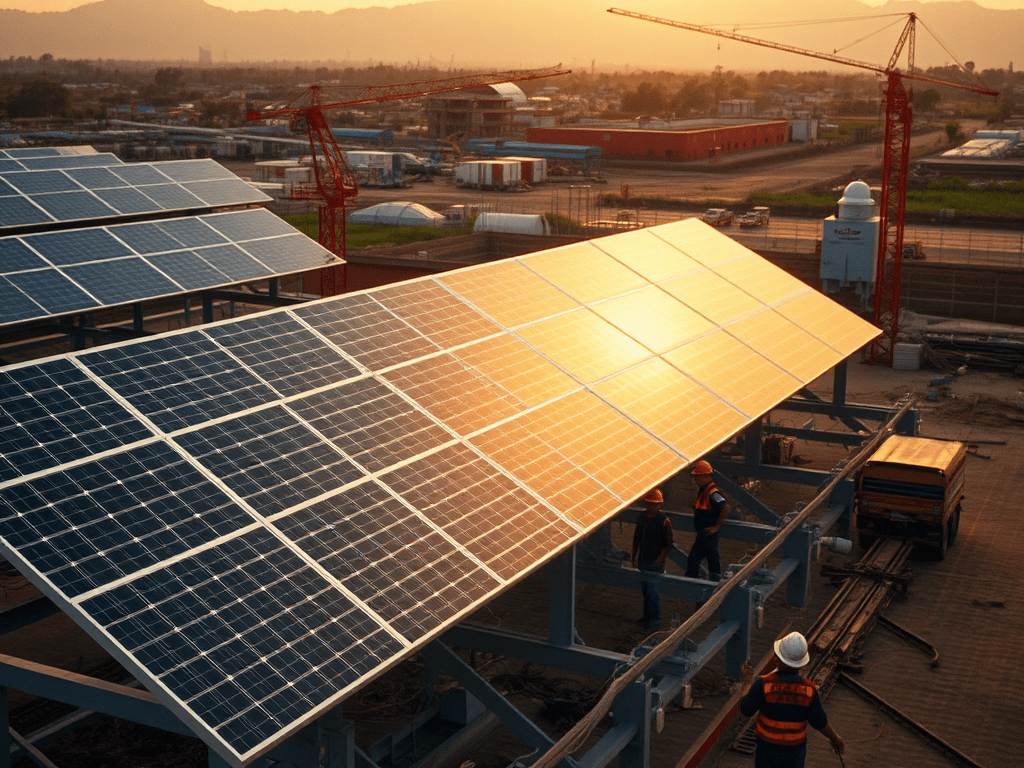

TAQA, through its significant shareholding in Masdar, made notable progress in expanding its global renewable energy footprint during the quarter. Masdar’s Saeta Yield platform acquired the 243 MW Valle Solar project in Spain. Additionally, Masdar agreed to purchase a 49.99% stake in four solar facilities owned by Endesa S.A. in Spain, totaling 446 MW, subject to regulatory clearance. Meanwhile, Masdar is also spearheading development of the world’s first giga-scale, 24/7 renewable energy project in Abu Dhabi. The initiative will integrate 5.2 GW of solar capacity with 19 GWh of battery storage to supply 1 GW of uninterrupted clean power.

After the quarter’s close, TAQA extended its growth trajectory with several strategic developments aimed at enhancing energy system integration. In April, TAQA and Emirates Water and Electricity Company (EWEC) signed a power purchase agreement for the 1 GW Al Dhafra Thermal power plant, in conjunction with substantial investments in grid modernization. These efforts are part of a broader vision to meet the energy demands of the UAE’s AI Strategy 2031.

The Al Dhafra Thermal project, fully owned and operated by TAQA, is designed to offer highly efficient, flexible, and dispatchable power. TAQA Transmission will play a pivotal role in incorporating the additional gas and renewable energy into the grid through advanced infrastructure, supporting the energy reliability needed for data-driven technologies and high-performance computing. The combined capital commitment for these initiatives is expected to reach AED 36 billion over the coming years.

TAQA further expanded its international presence with the acquisition of Transmission Investment (TI), a UK-based energy and utilities investment platform. TI is one of the UK’s largest operators of offshore transmission (OFTO) assets and a key player in subsea interconnector development. The deal marks a strategic move to enhance TAQA’s global position and contribute to energy transition goals with vital transmission infrastructure.

Jasim Husain Thabet, TAQA’s Group CEO and Managing Director, commented: “Our Q1 results reflect the strength and stability of our core utilities business, and underscore our continued success in executing our growth strategy. With solid revenue performance and meaningful progress in our renewable and infrastructure portfolio, we are positioned for a strong year ahead.

Our role in the global shift to low-carbon energy is reinforced through Masdar’s international growth and critical acquisitions like TI. With a solid financial base, strong cash flow, and alignment with both local and international energy objectives, TAQA is primed to deliver sustainable, long-term value.”

Q1 2025 Segment Highlights:

- Transmission & Distribution (T&D)

- Revenue: AED 9.1 billion

- EBITDA: AED 2.4 billion

- Net Profit: AED 1.4 billion

- Generation

- Revenue: AED 2.9 billion

- EBITDA: AED 1.7 billion

- Net Profit: AED 238 million

- Water Solutions

- Revenue: AED 636 million

- EBITDA: AED 397 million

- Net Profit: AED 167 million

- Oil & Gas

- Revenue: AED 1.5 billion

- EBITDA: AED 546 million

- Net Profit: AED 347 million

TAQA continues to pursue its strategic agenda focused on energy security, sustainability, and global infrastructure leadership.