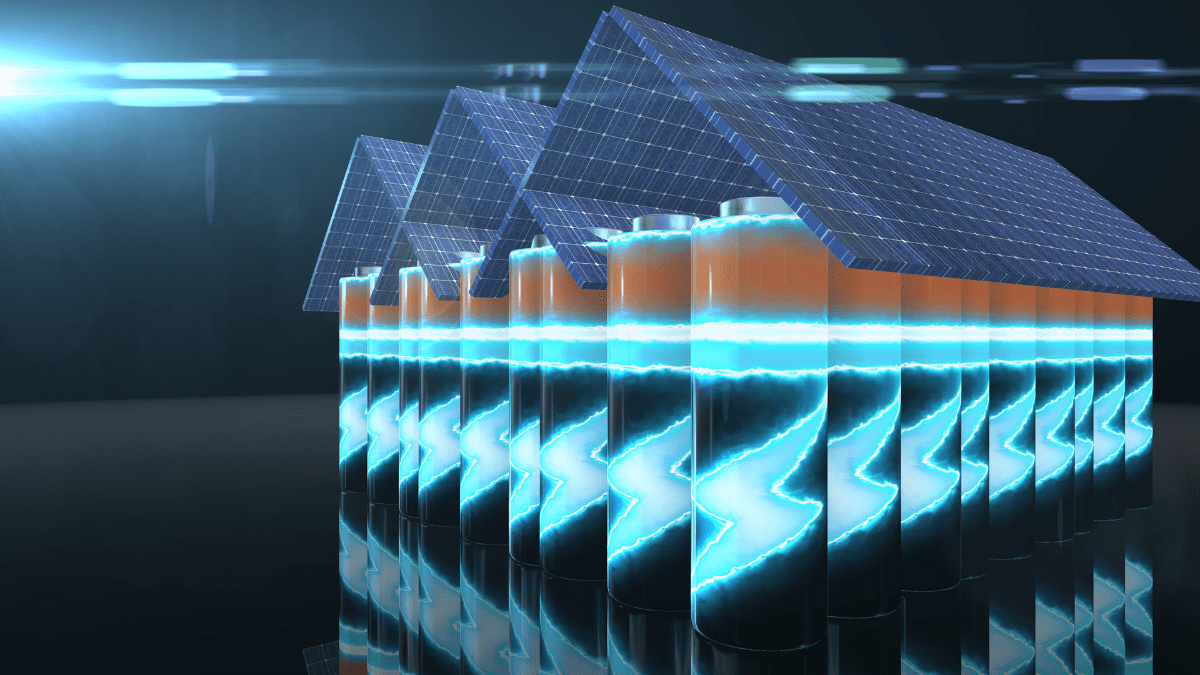

Watson Farley & Williams (WFW) has advised a consortium of leading banks on a £220 million green loan facility provided to Pulse Clean Energy. The lending group includes Banco Santander S.A., ABN Amro Bank N.V., Canadian Imperial Bank of Commerce, National Westminster Bank plc, Investec Bank plc, and Norddeutsche Landesbank Girozentrale. This green financing package will support the development of six new battery energy storage system (BESS) sites across the United Kingdom.

In addition to funding the construction of new projects, the financing will also be used to convert former diesel generation facilities into battery storage sites and provide ongoing capital for nine projects that are either nearing completion or already operational. The new sites will be located across Scotland, Devon, Greater Manchester, and Wales, and are expected to be fully operational by the end of 2027.

The combined storage capacity of these projects will exceed 700 megawatt-hours (MWh), contributing significantly to the UK’s renewable energy infrastructure. Over their operational life, these assets are expected to deliver more than £200 million in savings by reducing reliance on gas and lowering carbon emissions, while also supporting greater integration of renewable energy into the national grid.

Jennifer said in a statement, “We are delighted to have supported the lenders on this important green loan to Pulse Clean Energy, which will play a major role in helping it achieve its goal of a UK energy network run entirely on renewables. Successfully closing this milestone transaction highlights WFW’s expertise in advising on big-ticket financings in the fast-growing energy storage space”.

Nicola Johnson, Chief Financial Officer of Pulse Clean Energy, mentioned, “This landmark investment reflects strong global confidence in the growing UK battery storage market and in Pulse Clean Energy’s ability to deliver at scale. These six facilities will not only strengthen grid resilience but also unlock significant cost savings for consumers by allowing more renewable power onto the grid and reducing the need for expensive backup power during peak periods.”

He also added, “We’re proud to be at the heart of the UK’s energy networks – delivering critical infrastructure and turning former fossil fuel sites into energy assets which will enable a better energy system. With the backing of partners who share our long-term vision, we’re accelerating toward a future where energy is not only clean, but reliable and affordable for everyone”.

The financing aligns with the Loan Market Association’s Green Loan Principles, reinforcing its sustainability focus. Pulse Clean Energy has emerged as a key player in the UK’s energy transition, with a goal of achieving over 2 gigawatt-hours (GWh) of operational battery storage capacity by 2030.

The WFW legal team advising the lenders was led by London Projects Partner Jennifer Charles, with support from Senior Associate Abraham Knight and Associate Ellen Mackie. Due diligence support was provided by Projects Partner Emmanuel Ninos, Senior Associate James Ballantyne, and Associate Ben Harvey. Financial Markets & Products Partner Rob McBride, along with Associate Kristina Buckberry, advised on hedging matters.

Subscribe to get the latest posts sent to your email.