The European Bank for Reconstruction and Development (EBRD) delivered more than €800 million in new investments in Serbia in 2025, marking the third consecutive year in which it crossed this level. This consistent performance reinforces its position as the leading international financial institution operating in the country. In 2025, the Bank supported a record 42 projects across Serbia.

A significant 84 per cent of its investment was directed toward the private sector, reflecting its focus on strengthening the resilience, productivity and competitiveness of small and medium-sized enterprises (SMEs). The year was also notable because the EBRD’s total cumulative investment in Serbia surpassed €10 billion for the first time, marking a major milestone in its long-standing partnership with the country.

Commenting on these achievements, Matteo Colangeli, the EBRD’s Regional Director for the Western Balkans, said that 2025 represented another year of exceptional results. He noted that the Bank maintained very high investment levels and increased the share allocated to private-sector development, particularly SMEs.

With more than €800 million invested last year, the total capital deployed in Serbia has now exceeded €10 billion, which he described as a reflection of strong and long-term partnerships within the country. He also highlighted the EBRD’s growing presence in Belgrade and reaffirmed the Bank’s commitment to expanding its work to support Serbia’s economic resilience and long-term competitiveness.

Nearly half of the Bank’s annual investment was channelled through its network of partner financial institutions, including local banks and leasing companies. Much of this financing ultimately supported SMEs through specialised financial products. These products targeted key areas such as green and digital transformation, improved access to finance for youth-led and women-led enterprises, and enhanced support for trade.

Along with funding, the EBRD continued to offer advisory services tailored to helping SMEs adopt international standards, improve operations and integrate more smoothly into global value chains. The innovation ecosystem also remained an important priority, demonstrated by the Star Venture Programme, which supported 31 high-potential startups and trained more than 200 early-stage entrepreneurs in 2025.

In the wider corporate sector, the EBRD extended growth finance as well as sustainability-linked loans to a range of Serbian companies involved in manufacturing, pharmaceuticals, agribusiness and technology. It also partnered with foreign investors by providing co-financing, particularly in real estate development projects.

Environmental and infrastructure projects remained an essential focus. The Bank launched a comprehensive air quality improvement programme aimed at replacing polluting boiler houses and introducing cleaner and more sustainable heating solutions in several municipalities. It continued to support Serbia’s transport sector as well, including financing for Serbia Voz to purchase new sleeping cars for international rail routes.

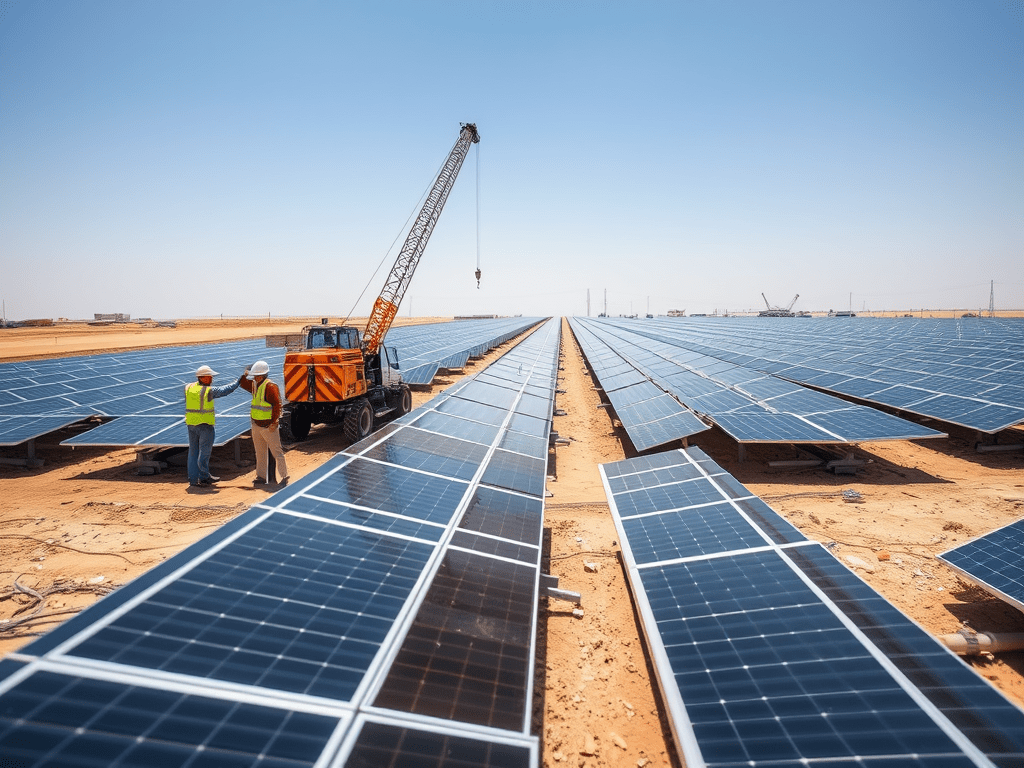

The EBRD also played a major role in strengthening Serbia’s energy sector. It provided extensive technical assistance for the country’s second renewable energy auction, which successfully allocated 645 MW across 10 wind and solar projects. These projects will contribute to cleaner, more affordable and more reliable energy supplies for the Serbian economy.

Today, the EBRD remains Serbia’s largest institutional investor. To date, it has invested more than €10.6 billion across 404 projects. Its work in Serbia continues to focus on enhancing private-sector competitiveness, advancing the green transition and supporting the development of sustainable infrastructure.

Subscribe to get the latest posts sent to your email.