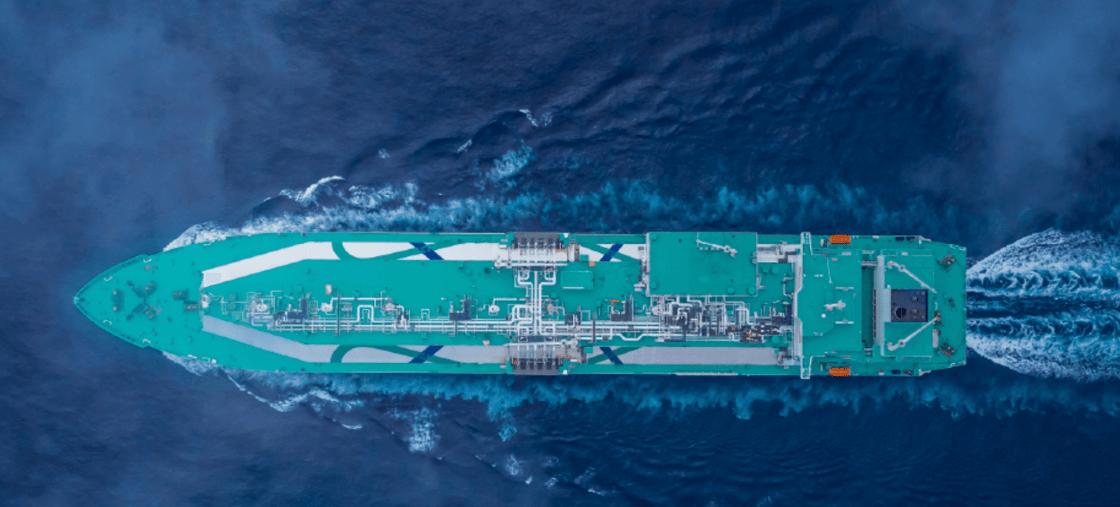

China has not received a single cargo of U.S. liquefied natural gas in 40 days and there are currently no LNG tankers en route to the country, Bloomberg has reported, citing data it compiled from ship-tracking information providers and energy analytics provider Kpler.

The purchase freeze was the result of the tariff exchange that President Donald Trump started as soon as he took office, by slapping an additional 10% tariff on all Chinese imports. In response, China imposed 15% tariffs on U.S. LNG imports and a lower tariff of crude oil imports.

‘;

document.write(write_html);

}

Following the tariffs, Chinese LNG buyers with long-term supply contracts with U.S. producers have started reselling the cargos to Europe, Bloomberg reported, citing sources from the trading world. What’s more, Chinese traders have grown cold towards new long-term commitments for future supply from the United States, instead seeking long-term deals with gas producers in the Middle East and the Asia Pacific.

The publication mentioned one new deal, between China Resources Gas International and Woodside Energy, which has a term of 15 years and is the first long-term deal between a Chinese company and an Australian company to be signed in years.

The moment is rather opportune for Europe, which is nearing the end of its leak gas demand season as spring comes. Yet demand is going to remain elevated for a while as it restocks its depleted gas storage. Indeed, Kpler predicted European gas demand will tick higher in the coming weeks because it is coming out of winter with lower levels of gas in storage.

Kpler also revised South Korea’s 2025 LNG demand higher—but it revised Chinese LNG demand for this year down, based on weaker LNG imports in February, part of the reason for which is quite likely the tariff exchange with the United States.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com

- Trump Talks to End Ukraine War Involve Power Plants

- German Energy Minister: Europe Shouldn’t Revive Nord Stream Gas Pipelines

- Goldman Sachs Cuts Oil Price Outlook Amid Oversupply Fears