-

China hasn’t imported liquefied natural gas (LNG) from the US for 40 days, the longest time in almost two years, due to Beijing’s 15% tariff on US LNG shipments.

Summary by Bloomberg AI

-

Chinese gas buyers are diverting US LNG shipments to Europe and looking to procure supply from Asia-Pacific or the Middle East instead, while China is also boosting its energy security by producing more gas at home.

Summary by Bloomberg AI

-

The trade war is threatening to decouple the world’s biggest LNG seller and buyer, with China’s imports of American gas having risen dramatically since 2020, but now facing uncertainty.

Summary by Bloomberg AI

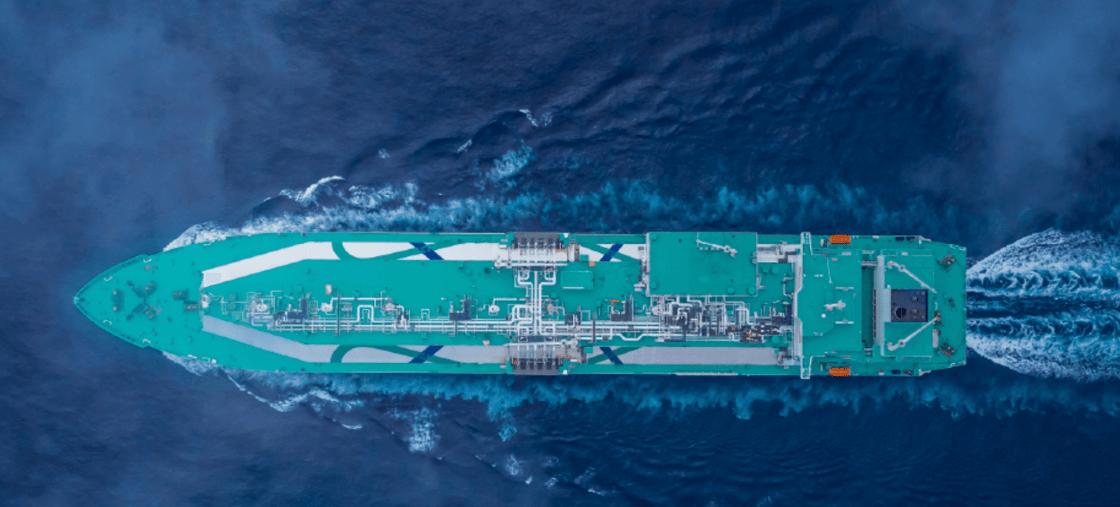

China hasn’t imported liquefied natural gas from the US for 40 days, the longest gap in almost two years, as traders are forced to divert shipments elsewhere to avoid Beijing’s tariffs on the super-chilled fuel.

The barren streak is the most extended since June 2023, according to ship-tracking data compiled by Bloomberg. There currently aren’t any US shipments en route to China either, according to ship-tracking data from Kpler, an analytics firm.

The trade war provoked by the Trump administration is threatening to decouple the world’s biggest LNG seller and buyer. Beijing a 15% tariff on US LNG shipments from Feb. 10 in retaliation for blanket American levies on Chinese exports.

US Gas Sales to China

LNG Imports have averaged over 400,000 tons a month

In response, Chinese gas buyers with long-term commitments to US projects are reselling those shipments to Europe, according to traders. Firms in China are also reluctant to sign new deals with US facilities, and are looking to procure supply from Asia-Pacific or the Middle East instead.

China Resources Gas International on Monday to buy LNG from Australia’s Woodside Energy Group Ltd. from 2027 for 15 years. It’s the first term-supply deal involving Chinese and Australian companies in years, and follows improved ties between Canberra and Beijing after trade relations hit a nadir at the start of the decade.

China is also boosting its energy security by focusing on producing more gas at home, which will help to curb import growth. Output has been , and notched a 3.7% year-on-year increase in the first two months of 2025. At the same time, , from coal to renewables to gas piped overland from Russia, are taking the edge off Chinese demand for seaborne gas.

The last trade war under the first Trump presidency brought US LNG sales to China to a halt. Since resuming in 2020, Chinese imports of American gas have risen dramatically to average over 400,000 tons a month.

In January, Secretary of State Marco Rubio said LNG should be used as leverage in a new round of trade negotiations. China isn’t among the countries playing ball, though, which bodes ill for US developers trying to secure contracts to kick-start new projects.

Share This:

More News Articles