The Asian Development Bank (ADB) achieved a record milestone in 2024 by mobilizing $8.7 billion in nonsovereign cofinancing, significantly enhancing private sector participation in Asia and the Pacific’s development, particularly in the solar and renewable energy sectors. The total cofinancing reached $14.9 billion, complementing ADB’s core investment of $24.3 billion for the year.

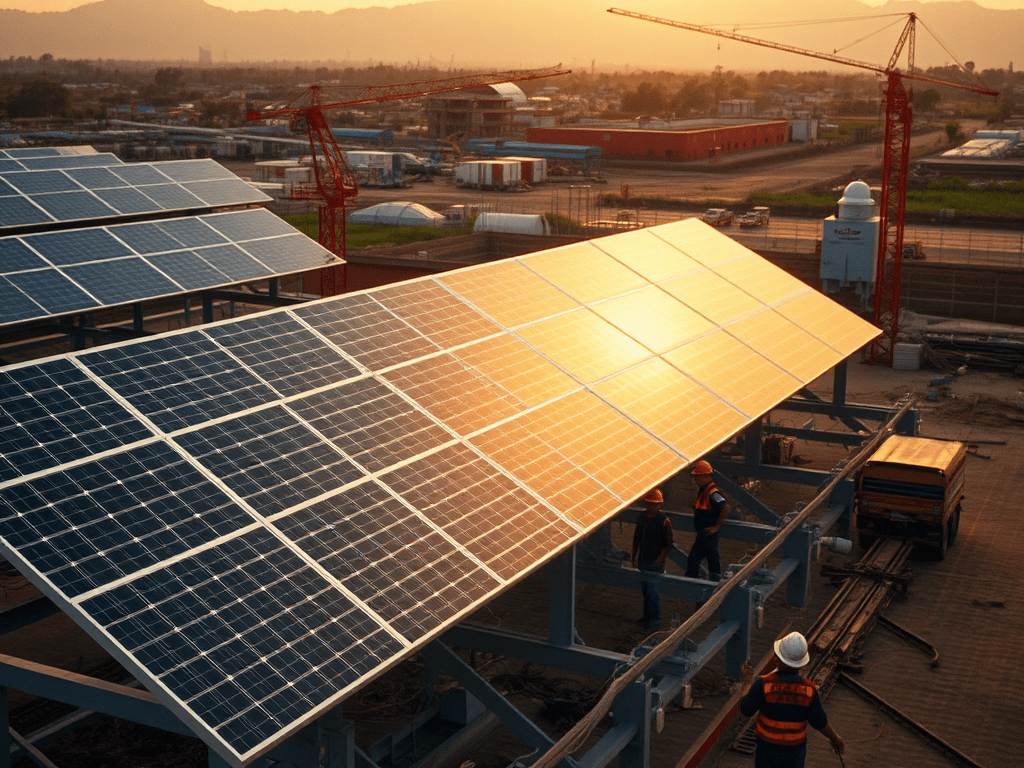

Among the standout energy initiatives was the Gulf Solar and Battery Energy Storage Project in Thailand, a flagship renewable energy effort backed by $260 million from ADB and an additional $529 million from partners. The project is positioned as a pivotal example of how blended finance is accelerating clean energy transitions in Southeast Asia.

Energy and infrastructure remained central to ADB’s sovereign cofinancing, which totaled $6.2 billion. Multilateral partners contributed $3.1 billion across 43 projects, focusing on infrastructure resilience and clean energy development, while bilateral partners added $2.9 billion over 35 projects.

ADB’s 2024 Partnership Report, unveiled during its 58th Annual Meeting in Milan, underscored the critical role of cofinancing in diverse sectors—from early childcare in India to power sector reforms in Uzbekistan, and disaster risk financing in Mongolia. Energy transformation remained a consistent theme across several initiatives.

“The record-breaking cofinancing figures reflect our commitment to innovation and climate resilience,” said Xinning Jia, Director General of ADB’s Strategy, Policy, and Partnerships Department. “We are strengthening ecosystems and supporting sustainable infrastructure that improves lives.”

Private sector engagement showed broad-based growth. Long-term project cofinancing rose 3.3% to $3.4 billion, while trade finance and supply chain support increased by 2.4%. Transaction volumes surged from 21,400 in 2023 to 27,600 in 2024, signaling growing confidence in ADB-facilitated programs.

ADB’s trust funds were instrumental in supporting energy innovation. The Japan Fund for Prosperous and Resilient Asia and the Pacific supported 33 projects, while ADB Ventures Investment Fund 1 and the Leading Asia’s Private Infrastructure Fund 2 delivered crucial financing to 15 private sector-led energy and green growth ventures.

Further extending its energy cooperation, ADB forged new ties with the South Asian Association for Regional Cooperation Development Fund to promote poverty alleviation and energy access in South Asia.

As a leading multilateral development bank since 1966, ADB continues to focus on inclusive, sustainable, and resilient growth, leveraging strategic partnerships and innovative financial instruments to tackle complex energy and climate challenges in the region.