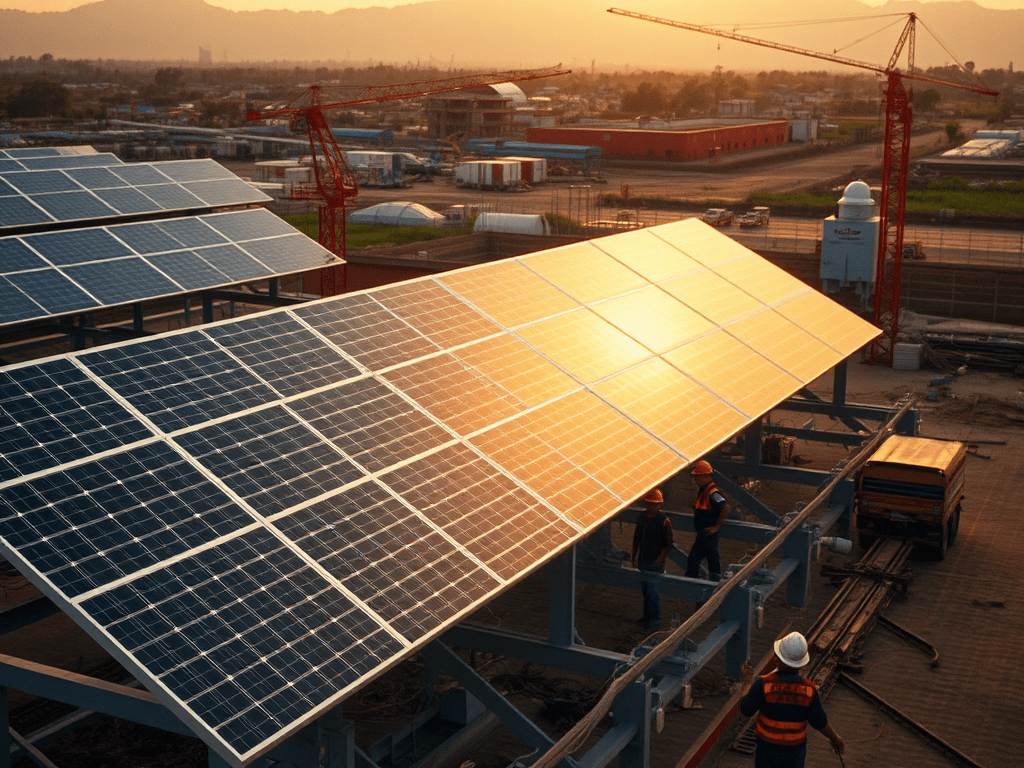

Doral Renewables LLC has successfully secured construction financing for three major solar projects in Pulaski County, Indiana—Mammoth South, Mammoth Central I, and Mammoth Central II. Each of these projects will have a capacity of 300 megawatts (MWac), forming a significant portion of the broader 1.3 gigawatt (GW) Mammoth Solar facility. Once fully operational, Mammoth Solar will produce enough clean energy to power approximately 275,000 households annually. The three projects will be built using ground-mounted single-axis photovoltaic (PV) systems and will incorporate around 20,000 tons of Indiana-sourced steel, contributing tens of millions of dollars in economic impact for the state.

Additionally, they will use more than 1 million solar modules manufactured in the United States. Doral Renewables also plans to incorporate agrivoltaic practices—combining solar power generation with agricultural activities—once construction is complete. This dual-use model will allow local farmers to reintroduce traditional farming methods such as livestock grazing and crop production within the solar project areas. Doral’s agrivoltaics initiative for the Mammoth Solar facility was recognized as the “Dual-Use Plan of the Year” at the North American Agrivoltaics Awards.

Evan Speece, Chief Financial Officer of Doral Renewables LLC, said in a statement, “We are thrilled to close these landmark financings in support of the construction of the remaining three phases of our Mammoth Solar project. Each of the three banks leading the debt financing is a repeat partner for Doral and we could not be happier to broaden our relationships with them. Notably, we are also proud to be extending our long-standing relationship with Truist by executing our first tax equity transaction together.”

Nadav Hazan, Vice President, KeyBanc Capital Markets, Utilities, Power & Renewable Energy Group, mentioned, “We are proud to serve as coordinating lead arranger for Doral Renewables as they build out the remaining phases of the Mammoth Solar Complex. Our longstanding relationship with Doral’s management team has created a foundation of trust that enables transformative projects like this. We are excited to see this collaborative effort pay off, and we look forward to the impact Mammoth will have on Indiana’s economy going forward.”

“We are proud to have supported Doral throughout the financing of these milestone projects, from development through to construction. We value our strong relationship and congratulate Doral and their partners on this important achievement,” commented Nuno Andrade, Head of Structured Finance & Advisory US, Santander Corporate & Investment Banking.

Paul Snow, Head of Renewables, Americas at HSBC, also added, “We are extremely proud to support Doral in the completion of the construction financing for their Mammoth Solar project. Building on our role in the initial bridge construction financing, this milestone reflects our ongoing commitment to Doral’s vision for large-scale renewable energy in the United States. As we deepen our partnership with Doral, we remain focused on financing leading renewable energy projects.”

Chris Nygren, Head of Tax Equity for Truist Bank, stated, “Truist is excited to close on this meaningful and important tax equity commitment with Doral for their impressive Mammoth South utility solar project. Broadening our relationship with Doral through this transaction is a win for both parties, and we look forward to partnering with them again in the future to help deliver renewable energy to local communities.”

All three projects are backed by long-term Power Purchase Agreements (PPAs) with leading utility companies and are expected to begin commercial operations in the fourth quarter of 2026. To finance the development, a $1.3 billion construction debt package was secured. KeyBanc Capital Markets, Banco Santander, and HSBC Bank USA acted as Coordinated Lead Arrangers.

The financing includes $412 million in construction-to-term loans, $614 million in tax equity bridge loans, and a $259 million letter of credit facility. At the same time, Doral signed a tax equity commitment exceeding $200 million for the Mammoth South project with Truist Bank. Marathon Capital Markets served as the tax equity advisor, and McDermott Will & Emery acted as Doral’s legal counsel. CCA Group and Milbank LLP represented Truist as tax equity advisor and legal counsel, respectively, while Norton Rose Fulbright served as legal counsel to the lenders.