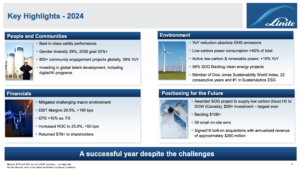

Linde overcame a challenging trading environment and pointed to the ‘resilency of its model’ after posting a full-year operating profit of $9.7bn in 2024, up 7% on 2023.

It rounded off the year strongly with Q4 operating profit of $2.5bn, up 9% annually, boosted by high prices and productivity initiatives across all segments. Operating cashflow for the year totalled $9.4bn although full year sales were flat however, at $33bn.

Sanjiv Lamba, CEO, said it made “significant progress” in its clean energy strategy – sourcing more than 40% of global electricity from low-carbon sources – and signed its largest ever product agreement, supporting the $10bn project backlog which will contribute to earnings “for years to come”.

… to continue reading this article and more, please login, register for free, or consider subscribing to gasworld