By Andrew Darnton

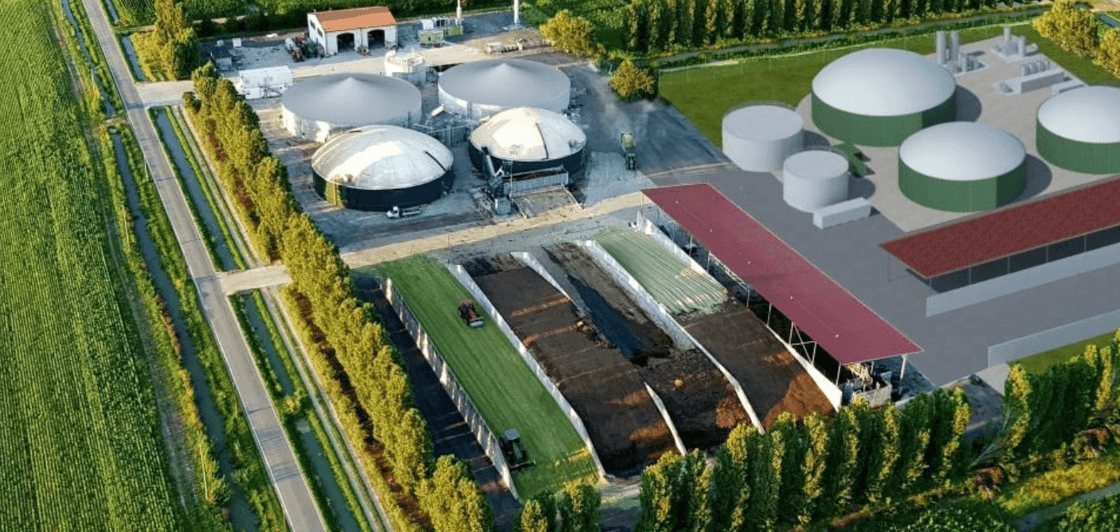

A recent joint-venture announcement between TotalEnergies and CMA CGM signals that LNG bunkering — supplying LNG as a marine fuel — is becoming more concretely integrated into shipping strategy. In July 2025, the two firms agreed to form a 50/50 LNG bunkering logistics company based in Rotterdam, with a target launch of services in 2028 and development of a 20,000 m³ LNG bunker vessel. As part of the deal, TotalEnergies will supply up to 360,000 metric tons of LNG annually through 2040.

Why this matters: shipping is under increasing regulatory and market pressure to reduce greenhouse gas emissions. The International Maritime Organization’s (IMO) upcoming Net-Zero Framework, expected to be adopted in the exceptional 2025 session, may introduce carbon pricing and emissions compliance mechanisms that favor lower-carbon or transitional fuels. LNG, while not a zero-emissions solution, offers lower CO₂ and SOₓ emissions relative to traditional heavy fuel oil or marine diesel.

From the perspective of ports and logistics hubs, Rotterdam is positioning itself as a pivot point for transitioning shipping fuels. The joint venture underscores the importance of creating reliable LNG bunkering infrastructure so vessels can refuel seamlessly. Without such infrastructure, LNG-fuelled ships face range or refueling constraints, undermining adoption.

Yet significant challenges persist. The capital cost of LNG bunker vessels and infrastructure is high. Demand density matters: unless there is enough LNG-fuelled shipping traffic in a region, the economics are hard to justify. In addition, the environmental benefit of LNG is contested given methane slip (unburned methane emissions) and lifecycle emissions. Some stakeholders argue that more advanced fuels (e.g. ammonia, hydrogen, bio-LNG) must eventually displace LNG for full decarbonization.

The Rotterdam JV also reflects a broader strategic alignment: shipping companies increasingly seek to control not only vessel operations but also fuel supply chains. By investing into the logistics and bunkering side, CMA CGM and TotalEnergies can internalize some margins and manage supply continuity risk.

For shipowners and charterers, the announcement suggests that LNG bunkering is becoming a more credible pathway rather than a niche concept. That said, the lead time (launch in 2028) suggests that transition will be gradual. Until then, traditional marine fuels and hybrid/dual-fuel solutions will coexist.

In the run-up to IMO’s 2025 vote on emissions reforms, alternatives will also be under scrutiny: is investment in LNG bunkering future-proof, or might operators risk stranded bunker infrastructure if the regulatory focus shifts harder toward zero-carbon fuels? The Rotterdam JV is a bet that LNG will maintain a transitional role. But its success will hinge on demand, regulation, and technological advances in emissions mitigation.