Under the terms of the merger agreement, TAE and Trump Media & Technology Group (TMTG) shareholders will each own about 50% of the combined company – which will be one of the world’s first publicly traded fusion companies – at closing. As part of the transaction, TMTG has agreed to provide up to USD200 million of cash to TAE at signing and an additional USD100 million is available upon initial filing of the Form S-4 registration statement. The transaction, which was approved by the boards of directors of both companies, is expected to close in mid-2026, subject to customary closing conditions, including shareholder and regulatory approvals.

In 2026, the combined company plans to site and begin construction of the world’s first utility-scale fusion power plant (50 MWe), subject to required approvals. Additional fusion power plants are planned and expected to be 350–500 MWe.

TMTG Chairman and CEO Devin Nunes and TAE CEO and Director Michl Binderbauer plan to serve as co-CEOs of the combined company.

“Trump Media & Technology Group built uncancellable infrastructure to secure free expression online for Americans, and now we’re taking a big step forward toward a revolutionary technology that will cement America’s global energy dominance for generations,” Nunes said.

“Fusion power will be the most dramatic energy breakthrough since the onset of commercial nuclear energy in the 1950s – an innovation that will lower energy prices, boost supply, ensure America’s AI-supremacy, revive our manufacturing base and bolster national defence. TMTG brings the capital and public market access to quickly move TAE’s proven technology to commercial viability.”

Binderbauer said: “Our talented team, through its commitment and dedication to science, is poised to solve the immense global challenge of energy scarcity. At TAE, recent breakthroughs have prepared us to accelerate capital deployment to commercialise our fusion technology. We’re excited to identify our first site and begin deploying this revolutionary technology that we expect to fundamentally transform America’s energy supply.”

Michael Schwab, founder and managing director of venture capital firm Big Sky Partners, is expected to be named Chairman of a planned nine-member board of directors. “Through my involvement with TAE over the two decades, I’ve watched first-hand their commitment to science and the promise of applying fusion power to help solve the world’s demand for clean, abundant, affordable energy,” he said. “With the infusion of TMTG’s significant capital, TAE is on the precipice of scaling its leading technology to usher in a new era of energy abundance. The world needs energy, and fusion is the clear answer.”

After more than 25 years of research and development, TAE says it has significantly reduced fusion reactor size, cost and complexity. TAE has built and safely operated five fusion reactors and raised more than USD1.3 billion in private capital to date, including from Google, among others.

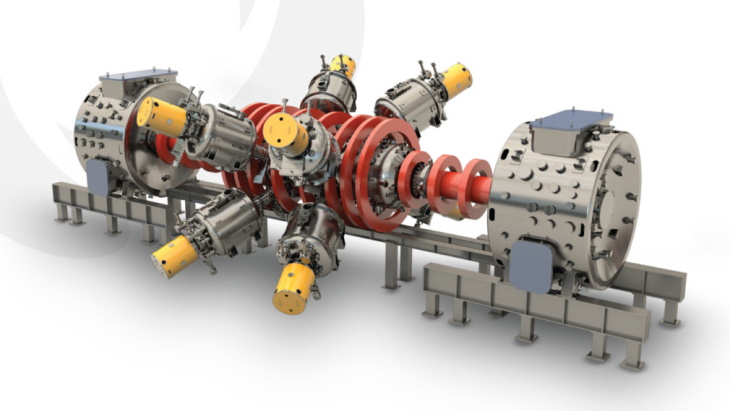

TAE’s approach to fusion combines advanced accelerator and plasma physics, and uses abundant, non-radioactive hydrogen-boron (p-B11) as a fuel source. The proprietary magnetic beam-driven field-reversed configuration (FRC) technology injects high-energy hydrogen atoms into the plasma to make the system more stable and better confined. This solution is compact and energy efficient, California-based TAE says.

For a fusion machine to produce electricity, it must keep plasma steadily confined at fusion-relevant conditions. On TAE’s current fusion machine, eight powerful neutral beams are placed at precise angles to meet those requirements. Inside each neutral beam canister, protons are accelerated and then combined with electrons to create a stream of neutral, high-energy hydrogen atoms (the ‘neutral beam’). Because the particles have no charge, they can bypass the fusion reactor’s magnetic field to provide heating, current drive and plasma stability. TAE is the first to use neutral beams for both FRC plasma formation and high-quality plasma sustainment – which it says results in a streamlined design that is smaller, more efficient and more cost-effective.

The same accelerator technology which produced TAE’s sophisticated neutral beam system for fusion has also been adapted for TAE’s medical technology subsidiary, TAE Life Sciences, to provide a non-invasive, targeted treatment for complex and often inoperable cancers. TAE also has a partially-owned power subsidiary – TAE Power Solutions – which has developed innovative energy storage and power delivery systems to serve multiple industries, including AI data centres, industrial users, and electric vehicles.