(Reuters) – U.S. President Donald Trump issued a flurry of orders within hours of his inauguration on Monday intended to boost the nation’s already record-high oil and gas production and unwind former President Joe Biden’s climate agenda.

Here are some of the actions Trump took on his first day:

ENERGY EMERGENCY

Trump declared a national energy emergency, intended to provide him with the authority to reduce environmental restrictions on energy infrastructure and projects and ease permitting for new transmission and pipeline infrastructure.

“It allows you to do whatever you’ve got to do to get ahead of that problem,” Trump told reporters while signing the order. “And we do have that kind of an emergency.”

Earlier in the day, he explained the reason for the declaration: “The inflation crisis was caused by massive overspending and escalating energy prices, and that is why today I will also declare a national energy emergency. We will drill baby, drill.”

He has previously said that surging electricity demand from the technology industry, mainly to fuel artificial intelligence, required a big grid overhaul.

Trump issued an order for the U.S. to resume processing export permit applications from new liquefied natural gas projects supplying Asia and Europe, effectively reversing a pause Biden put in place in early 2024 to study the environmental and economic effects of the booming exports.

U.S. exports of the super-chilled fuel set a record in 2023 and the country is the world’s largest exporter of the product. But the pause in new export permits created uncertainty for a slew of projects in the works.

Plants in Louisiana awaiting approvals include Commonwealth LNG, Venture Global’s CP2, Cheniere Energy’s expansion to its Sabine Pass facility and Energy Transfer’s Lake Charles terminal. In Texas, a second phase of Sempra’s project Port Arthur LNG, awaits approval.

GOODBYE PARIS

Trump ordered the U.S. withdrawal from the Paris climate deal, an international agreement to fight climate change, repeating a move he made in his first term.

Trump has called climate change a hoax, and says the accord puts the United States at a competitive disadvantage to geopolitical rivals like China.

“I’m immediately withdrawing from the unfair, one-sided Paris climate accord rip off,” he said. “The United States will not sabotage our own industries while China pollutes with impunity.”

OFFSHORE WIND

Trump suspended new federal offshore wind leasing pending an environmental and economic review, saying wind mills are ugly, expensive and harm wildlife.

“We’re not going to do the wind thing,” he said.

A White House press release said Trump issued an executive action suspending offshore wind leasing from all areas of the U.S. outer continental shelf pending an environmental and economic review.

The order is not expected to impact existing U.S. offshore wind projects being advanced by companies including Orsted, Avangrid, Copenhagen Infrastructure Partners, and Dominion.

Biden saw wind power as a vital part of his strategy to decarbonize the power sector.

EV TARGETS

Trump took aim at electric vehicles, revoking a 2021 executive order signed by Biden that sought to ensure half of all new vehicles sold in the United States by 2030 were electric.

Biden’s 50% target, which was not legally binding, had won the support of U.S. and foreign automakers.

Trump said in an executive order he was halting distribution of unspent government funds for vehicle charging stations from a $5 billion fund, called for ending a waiver for states to adopt zero-emission vehicle rules by 2035 and said his administration would consider ending EV tax credits.

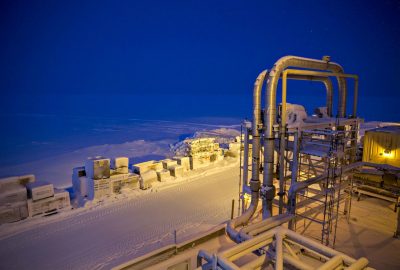

DRILL, BABY, DRILL

Trump signed an executive order repealing Biden’s efforts to block oil drilling in the Arctic and along large areas of the U.S. coasts, according to the White House.

Trump also repealed a 2023 memo that barred oil drilling in some 16 million acres (6.5 million hectares) in the Arctic, the White House announced.

It’s unclear if the moves would be sufficient to attract big drillers, who have shied away from the region in recent years due to relatively high costs of development.

Biden this month banned new offshore oil and gas development along most U.S. coastlines ahead of Trump taking office.

REFILL THE STOCKPILE

Trump said he intends to fill strategic reserves “right to the top”.

That’s likely a reference to the U.S. Strategic Petroleum Reserve, the nation’s stockpile of crude oil, designed as a buffer against supply shocks.

After the invasion of Ukraine, Biden had sold more than 180 million barrels of crude oil from the reserve, a record amount.

The sales helped keep gasoline prices in check, but sank the reserve to the lowest level in 40 years.

“We will bring prices down, fill our strategic reserves up again, right to the top, and export American energy all over the world,” Trump said.

He will likely look to Republican lawmakers to give him the money for the oil purchases in the coming weeks.

Share This:

More News Articles