(Reuters) – U.S. natural gas futures jumped about 8% on Tuesday to a three-week high, as extreme cold in some parts of the country cut output by freezing oil and gas wells, while gas flows to liquefied natural gas (LNG) export plants reached records and forecasters predicted more cold weather and higher heating demand over the next two weeks.

Front-month gas futures for March delivery on the New York Mercantile Exchange rose 28.2 cents, or 7.6%, to settle at $4.007 per million British thermal units (mmBtu), their highest close since January 24 for a second day in a row.

That was the biggest daily percentage increase since Feb. 3 when prices soared by about 10%.

SUPPLY AND DEMAND

Financial firm LSEG said average gas output in the Lower 48 U.S. states rose to 105.2 billion cubic feet per day (bcfd) so far in February from 102.7 bcfd in January when freezing oil and gas wells and pipes, known as freeze-offs, cut production. That compares with a monthly record of 104.6 bcfd in December 2023.

With the return of extreme cold that is again freezing wells in some parts of the country, daily output was on track to drop by around 3.5 bcfd over the last 12 days to a preliminary three-week low of 103.2 bcfd on Monday.

That compares with a daily record high of 106.7 bcfd on February 6. Analysts noted that preliminary data is often revised later in the day.

Meteorologists projected weather in the Lower 48 states would remain mostly colder than normal through February 22 before switching to near normal levels from February 23-March 5.

With milder weather coming, LSEG forecast average gas demand in the Lower 48 states, including exports, will fall from 146.4 bcfd this week to 129.9 bcfd next week. Those forecasts were lower than LSEG’s outlook on Friday.

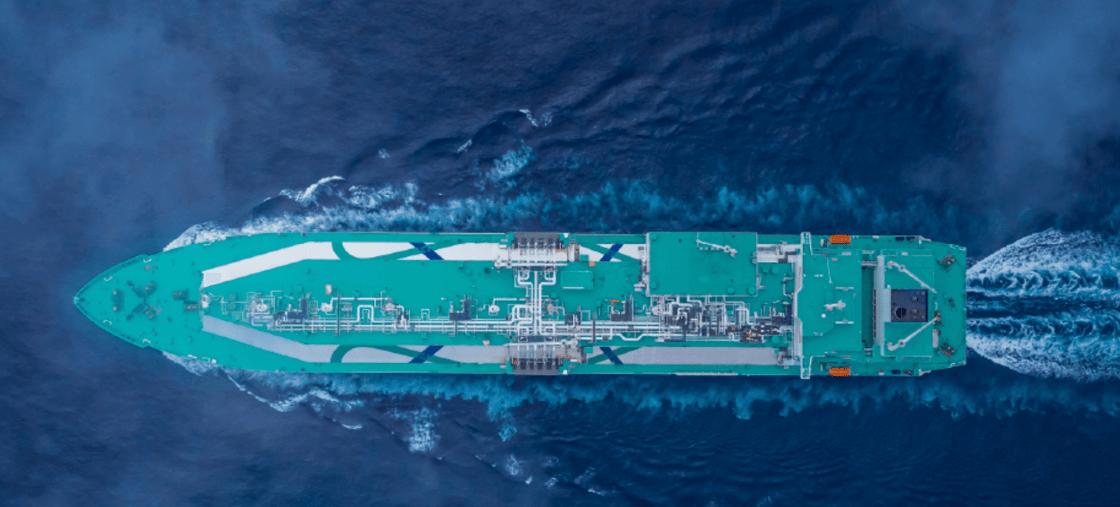

The amount of gas flowing to the eight big U.S. LNG export plants rose to an average of 15.4 bcfd so far in February, up from 14.6 bcfd in January. That compares with a monthly record high of 14.7 bcfd in December 2023.

On a daily basis, LNG feedgas hit a record 16.0 bcfd on Monday, topping the prior all-time daily high of 15.8 bcfd on January 18.

That LNG daily feedgas record came as flows to Venture Global’s 2.6-bcfd Plaquemines LNG export plant under construction in Louisiana hit a fresh high of 1.4 bcfd on Sunday.

The U.S. became the world’s biggest LNG supplier in 2023, surpassing Australia and Qatar, as surging global prices fed demand for more exports, due partly to supply disruptions and sanctions linked to Russia’s 2022 invasion of Ukraine.

Gas was trading at around $15 per mmBtu at both the Dutch Title Transfer Facility (TTF) benchmark in Europe and the Japan Korea Marker (JKM) benchmark in Asia.

Week ended Week ended Year ago Five-year

Feb 14 Feb 7 Feb 14 average

Forecast Actual Feb 14 U.S. weekly natgas storage change (bcf): -168 -100 -58 -145 U.S. total natgas in storage (bcf): 2,129 2,297 2,487 2,219 U.S. total storage versus 5-year average -4.1% -2.8%

Global Gas Benchmark Futures ($ per mmBtu) Current Day Prior Day This Month Prior Year Five-Year

Last Year Average Average

2024 (2019-2023) Henry Hub 3.61 3.73 1.80 2.41 3.52 Title Transfer Facility (TTF) 14.44 14.66 8.12 10.95 15.47 Japan Korea Marker (JKM) 14.95 14.94 8.93 11.89 15.23

LSEG Heating (HDD), Cooling (CDD) and Total (TDD) Degree Days Two-Week Total Forecast Current Day Prior Day Prior Year 10-Year 30-Year

Norm Norm U.S. GFS HDDs 419 453 301 368 366 U.S. GFS CDDs 6 5 8 8 7 U.S. GFS TDDs 425 458 309 376 373

LSEG U.S. Weekly GFS Supply and Demand Forecasts

Prior Week Current Next Week This Week Five-Year

Week Last Year (2020-2024)

Average For

Month U.S. Supply (bcfd) U.S. Lower 48 Dry Production 105.3 103.9 103.9 104.8 95.8 U.S. Imports from Canada 10.2 10.6 9.0 N/A 8.0 U.S. LNG Imports 0.0 0.0 0.0 0.0 0.2 Total U.S. Supply 115.6 114.5 112.9 N/A 104.0

U.S. Demand (bcfd) U.S. Exports to Canada 3.4 3.0 3.0 N/A 2.9 U.S. Exports to Mexico 5.8 5.5 5.9 N/A 5.0 U.S. LNG Exports 14.2 14.3 14.6 13.6 11.3 U.S. Commercial 17.7 20.7 16.2 14.2 15.9 U.S. Residential 29.8 35.2 26.4 22.9 26.4 U.S. Power Plant 33.6 32.2 30.2 33.2 30.0 U.S. Industrial 25.9 26.9 25.5 24.7 25.1 U.S. Plant Fuel 5.2 5.1 5.1 5.2 5.1 U.S. Pipe Distribution 3.1 3.3 2.8 3.1 4.0 U.S. Vehicle Fuel 0.1 0.1 0.1 0.1 0.2 Total U.S. Consumption 115.4 123.6 106.4 103.4 106.7 Total U.S. Demand 138.8 146.4 129.9 N/A 125.9

N/A is Not Available

U.S. Northwest River Forecast Center (NWRFC) at The Dalles Dam 2025 2025 2024 2023 2022 (Fiscal year ending Sep 30) Current Day Prior Day % of Normal % of Normal % of Normal

% of Normal % of Normal Actual Actual Actual

Forecast Forecast Apr-Sep 86 84 74 83 107 Jan-Jul 84 81 76 77 102 Oct-Sep 86 82 77 76 103

U.S. weekly power generation percent by fuel – EIA

Week ended Week ended 2024 2023 2022

Feb 21 Feb 14 Wind 13 11 11 10 11 Solar 4 3 5 4 3 Hydro 6 6 6 6 6 Other 1 1 1 2 2 Petroleum 0 0 0 0 0 Natural Gas 35 40 42 41 38 Coal 21 20 16 17 21 Nuclear 20 19 19 19 19

SNL U.S. Natural Gas Next-Day Prices ($ per mmBtu) Hub Current Day Prior Day Henry Hub 4.60 4.43 Transco Z6 New York 6.99 4.39 PG&E Citygate 4.06 3.95 Eastern Gas (old Dominion South) 4.70 3.84 Chicago Citygate 5.73 4.02 Algonquin Citygate 20.21 18.55 SoCal Citygate 4.49 4.15 Waha Hub 2.90 3.18 AECO 1.88 1.65

ICE U.S. Power Next-Day Prices ($ per megawatt-hour) Hub Current Day Prior Day New England 179.42 150.37 PJM West 72.71 50.60 Mid C 46.97 52.83 Palo Verde 33.39 31.21 SP-15 22.58 18.94

Reporting by Scott DiSavino; Editing by Chizu Nomiyama and David Gregorio

Share This:

More News Articles