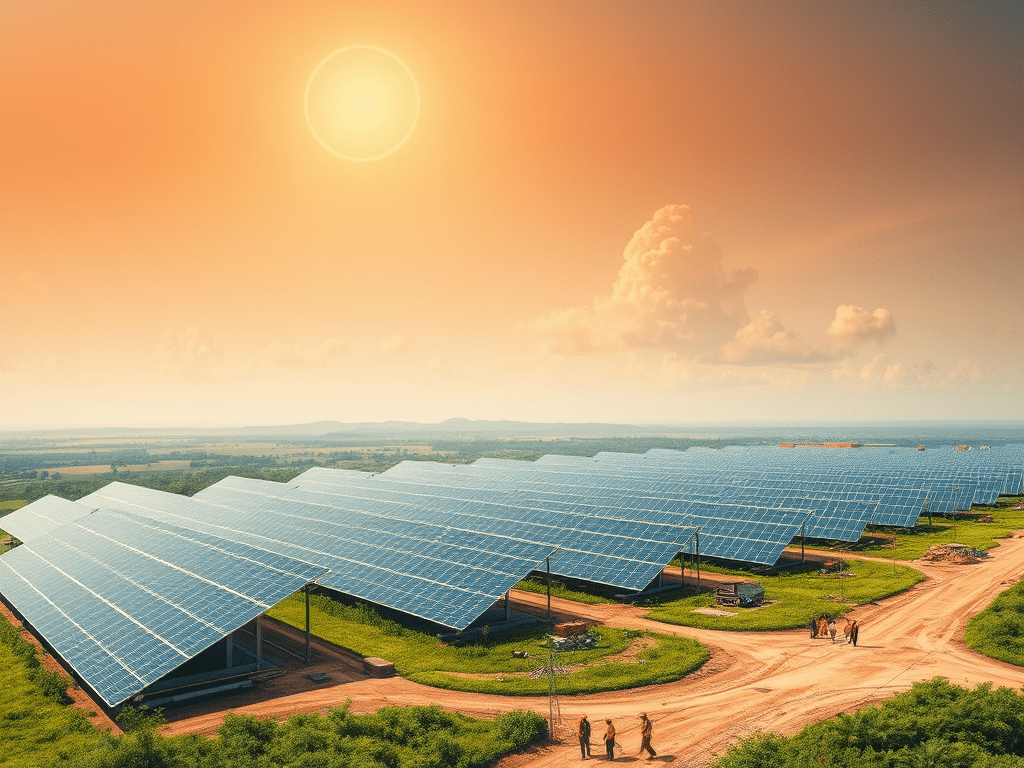

A recent industry analysis by the International Renewable Energy Agency (IRENA) has identified Vietnam and India as the leading global centers for solar photovoltaic (PV) manufacturing outside China. The report shows a clear shift in the global renewable energy supply chain, with both countries emerging as strong and cost-competitive production hubs.

According to the study, Vietnam currently produces the lowest-cost solar panels among major manufacturing nations outside China. This advantage is mainly due to structural factors that support large-scale production. One of the key reasons is the country’s low electricity tariffs. Solar manufacturing, especially the production of polysilicon and wafers, requires large amounts of energy. Lower power costs directly reduce overall manufacturing expenses. In addition, Vietnam offers competitive labor costs, including relatively affordable salaries for skilled engineers. These conditions have attracted international investors and helped the country expand its solar manufacturing base quickly.

Strong government support has also played an important role in Vietnam’s growth. Over the past few years, the country has built an increasingly integrated supply chain. By 2023, Vietnam’s solar manufacturing capacity had exceeded 18.4 GW. The country follows a flexible production model. Manufacturers can either produce solar components domestically or assemble modules using imported cells. This flexibility allows companies to manage costs efficiently and remain competitive in global markets.

has also made significant progress and is now ranked as the second most cost-effective solar manufacturing hub in Asia. By 2023, India’s installed solar capacity had reached 75 GW, reflecting rapid expansion in both deployment and manufacturing. India benefits from lower labor costs compared to Vietnam and has introduced strong policy measures to support domestic production. One of the key initiatives is the Production Linked Incentive (PLI) scheme, which encourages companies to invest in integrated solar manufacturing facilities. The scheme also aims to improve product quality and provide better financial support to manufacturers.

However, India still faces certain challenges. Electricity tariffs in the country are generally higher than in Vietnam, which increases the cost of upstream manufacturing processes. Despite this, India continues to close the cost gap through policy support and expansion of local supply chains.

As global solar panel prices decline, sometimes even falling below production costs, manufacturers face growing financial pressure. Even so, Vietnam and India remain the most promising alternatives to traditional solar manufacturing leaders. With strong policy backing and expanding capacities, both countries are expected to play a major role in shaping the future global solar market as demand for clean energy continues to rise.

Subscribe to get the latest posts sent to your email.