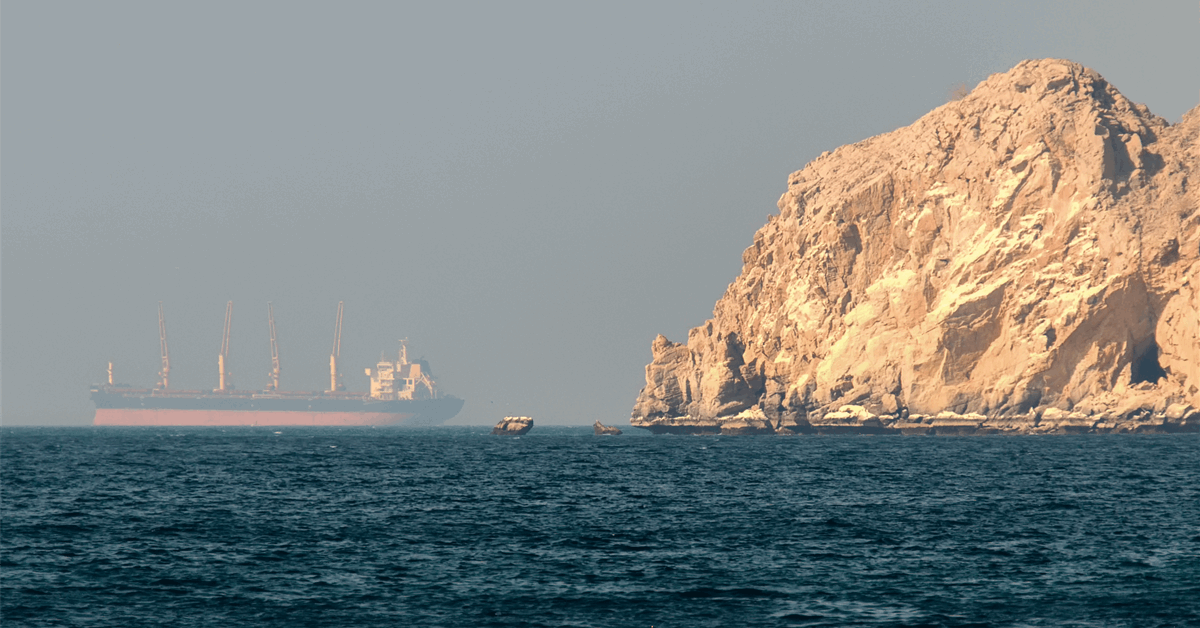

Saudi Arabia cut the official selling prices for its oil sharply ahead of a production boost set for next month. The sharpest cut was made for the price of oil sold in Asia, with flagship Arab Light set to be $2.30 per barrel cheaper in May, at a premium of $1.20 per barrel over the Dubai/Oman benchmark.

This is the sharpest price cut in over two years, Reuters reported. The move comes amid an oil price rout that followed President Trump’s announcement of a flurry of tariffs on all trade partners, notably China, which is the world’s largest oil importer. China retaliated promptly with its own tariffs on all U.S. imports, including oil and gas, adding pressure to prices.

‘;

document.write(write_html);

}

OPEC+, however, also made a solid contribution to this latest price slump. Last week, a day after the announcement of the tariffs, the group surprised markets by saying it would boost production by three times the originally planned amount of 135,000 bpd in May. Instead, it said, it would boost production by 411,000 barrels daily, thanks to “the continuing healthy market fundamentals and the positive market outlook”.

As a result of these developments, international oil prices plunged to the lowest since the pandemic and the Saudi decision to cut prices was not much of a surprise. The price cut was also higher than what analysts polled by Reuters expected: the consensus was that there would be a price cut of $1.80 per barrel for the flagship blend.

Meanwhile, the price cuts for other blends sold to markets other than Asia were much smaller, at some $0.50 per barrel for exports to Europe and $0.20 per barrel for exports to the United States. This is the second month in a row, for which Saudi Arabia cuts its official selling prices for its crude.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com

- Your Next iPhone Could Cost $2,300—But Oil Prices Might Stay Stuck

- Trump’s Tariffs Trigger Biggest Oil Price Drop Since 2021

- Russian Court Rules CPC Oil Export Capacity Should Stay Open